Japan’s "Free Hand": Minister Katayama Issues Fierce Warning to Yen Speculators

The Japanese Yen is once again at the center of a geopolitical tug-of-war. In a series of bold statements that have set the Forex world on high alert, Japan's Finance Minister Satsuki Katayama recently declared that the government has a "free hand" to take decisive action to curb the currency’s slide.

Following a sharp depreciation that saw the US Dollar push towards the 158.00 level against the Yen, Katayama’s rhetoric marks the strongest verbal intervention of 2026. For those studying Forex Trading for Beginners, this is a classic example of "jawboning"—using high-level communication to influence market behavior without yet spending a single Yen.

The "Speculative" Surge vs. Economic Fundamentals

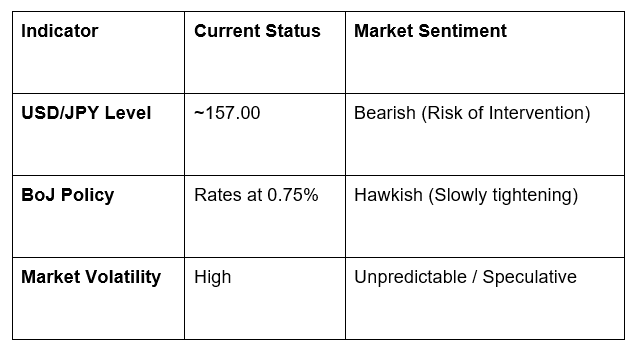

Katayama was unequivocal in her assessment: the Yen’s recent weakness is "clearly not based on fundamentals." Despite the Bank of Japan (BoJ) raising interest rates to a 30-year high of 0.75% in late 2025, the Yen has struggled to find its footing.

According to Katayama, these moves are driven by "speculative and excessive" activity rather than the reality of the Japanese economy. At GME Academy, we teach that while interest rate differentials—the gap between US and Japanese rates—are a primary driver of currency pairs like USD/JPY, trader sentiment and speculation can often overshoot the mark. Katayama is now signaling that Japan is "always absolutely ready" to correct that overshoot.

The US-Japan Accord: A "Green Light" for Intervention?

One of the most significant aspects of Katayama’s warning was her reference to the US-Japan Joint Accord. Signed by her predecessor and U.S. Treasury Secretary Scott Bessent, the agreement acknowledges that while exchange rates should be "market-determined," intervention is permissible to combat "excess volatility and disorderly movements."

By citing this accord, Katayama is subtly informing the markets that:

Washington is in the loop: Direct intervention likely has the tacit approval of the U.S. Treasury.

The "Free Hand" is real: Japan does not believe it needs further negotiations to step into the market.

The 160.00 "Danger Zone": History shows that the Ministry of Finance often views the 160.00 mark as a line in the sand. With the pair currently hovering near 157.00, the window for "bold action" is narrowing.

Forex Market Reaction: Trading the Yen in 2026

For Forex traders, Katayama's "free hand" comment has immediate implications for risk management. Direct intervention typically involves the Japanese government selling US Dollars and buying Yen in massive quantities—often $10 billion to $50 billion in a single day—which can cause a USD/JPY pair to drop by 300 to 500 pips in minutes.

If you are just starting Forex Trading for Beginners, being caught on the wrong side of an intervention is a common pitfall. This is why understanding the "fundamental" vs "speculative" divide mentioned by Katayama is essential for a sustainable Forex Trading career.

The Global Ripple Effect

The Yen isn't just a Japanese concern; it’s a global "safe-haven" and a major component of the Forex market. A sudden surge in the Yen's value could trigger a "carry trade unwind," where investors who borrowed cheap Yen to buy higher-yielding assets (like the US Dollar or AUD) are forced to close their positions, leading to volatility across all major currency pairs.

At Global Markets Eruditio, our mission is to help you decode these high-level political signals and translate them into a coherent trading strategy. Whether it's the "Free Hand" of Japan or the "Neutral Rate" of the Fed, the keys to the market are hidden in plain sight.

Don't get blindsided by "bold action" from central banks. Learn to read the signs before the move happens.

Join our FREE Forex workshop today and master the fundamentals of currency trading with GME Academy!