The Greenland Gambit: Trump’s New Tariff Wall on Europe

In a move that has sent shockwaves from the Arctic Circle to the financial hubs of London and Paris, President Donald J. Trump has announced a sweeping new trade offensive.

The Trade War's "Big Bazooka": EU Freezes Transatlantic Pact Over Greenland Tensions

The carefully stitched fabric of transatlantic trade is unraveling at record speed. In a move that signals a "downward spiral" in relations, the European Union has slammed the brakes on its landmark trade agreement with the United States.

The British Shopping Slump: A Secret Signal for Smart Traders?

The latest data from the Office for National Statistics (ONS) regarding Great Britain’s retail sales in November 2025 has left economists and market analysts scratching their heads.

US Jobless Claims Fall Slightly—But Is the Labor Market Quietly Weakening?

For Forex traders—especially those learning through GME Academy (Global Markets Eruditio)—employment data is one of the most important indicators affecting the US Dollar (USD).

UK Economy on a Knife-Edge: Growth Stalls as the Inflation Fire Cools

The latest S&P Global Flash UK PMI data for November 2025 presents a nuanced and challenging picture for the UK Economy and the Pound Sterling (GBP). While the headline figures confirm a sharp slowdown in private sector activity, a key bright spot emerged: the pace of output price inflation is easing, fueling speculation about the next move from the Bank of England (BoE).

Factories Slow Down but Future Looks Brighter: What November’s Manufacturing Survey Means for Forex Traders

Manufacturing in the region weakened again in November 2025, based on the latest Manufacturing Business Outlook Survey. While the current business activity remains negative — meaning more firms are reporting a slowdown — the good news is that expectations for the next six months improved sharply.

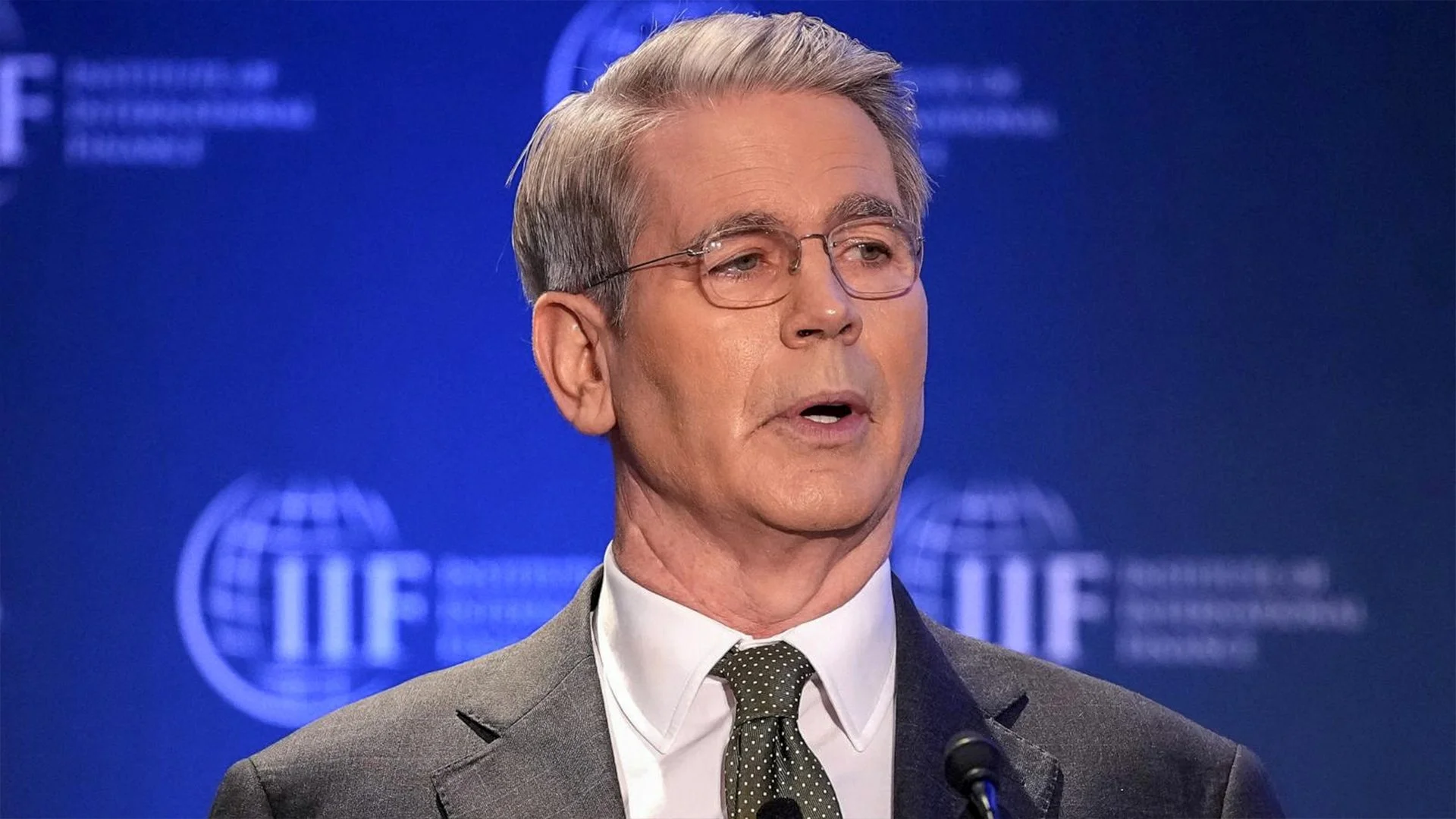

Fed’s Hammack: “Financial Conditions Are Quite Accommodative” — What This Means for Forex Traders

At the 2025 Cleveland Fed Financial Stability Conference, Beth M. Hammack, President and CEO of the Federal Reserve Bank of Cleveland, delivered key insights on the current financial system and the risks that lie ahead. Her remarks are particularly important for those involved in Forex Trading, especially Forex Trading for Beginners, as they highlight how monetary policy, inflation, and financial stability can move major currency pairs like EUR/USD, USD/JPY, and GBP/USD.

U.S. Labor Market Stalls: What the September 2025 Employment Report Means for the Dollar and Forex Traders

The latest Employment Situation Summary for September 2025 is finally out—six weeks late due to the U.S. federal government shutdown—and the data paints a picture of a U.S. economy that’s slowing, cooling, and showing signs of strain.

Federal Reserve Rate Cut: What It Means for Forex Traders and the US Dollar

The Federal Reserve made waves in financial markets with its October 28–29, 2025 FOMC meeting, lowering the federal funds rate by 25 basis points to 3.75–4 percent.

BOE’s Pill Signals Caution: UK Underlying Inflation Still Stronger Than It Appears

Bank of England (BOE) Governor Jonathan Pill has issued a note of caution to markets and policymakers, highlighting that underlying inflation dynamics in the UK remain higher than headline figures suggest.

US Jobless Claims Hold at 232K: What This Means for the Economy and Forex Traders

The latest data from the US Department of Labor shows that initial jobless claims for the week ending October 18th remained at 232,000. While this figure is in line with expectations, it continues to reflect a resilient labor market amid ongoing economic uncertainty.

U.S. Housing Market Distress: Are Rising Foreclosures a Red Flag for the Dollar?

The U.S. housing market is showing signs of stress, with foreclosure activity surging in October. For Forex traders, particularly beginners, these developments are more than just a housing story—they can signal potential shifts in the US Dollar (USD) and influence global currency markets.

U.S. Removes Tariffs on Latin American Imports: What Forex Traders Should Know

The United States has announced plans to remove tariffs on select products from Argentina, Ecuador, Guatemala, and El Salvador, a move that could influence global trade, commodity prices, and currency markets.

Fed’s Hammack Sounds Alarm: Is the Dollar Heading for Volatility?

Recent comments from Federal Reserve official Hammack have sparked attention in the Forex world. Traders are closely watching his signals, as they hint at the direction of inflation, interest rates, and the US Dollar (USD).

Boston Fed Highlights Economic Outlook, Monetary Policy, and Banking Innovation

In a recent address at the Boston Fed’s 24th Annual Regional and Community Bankers Conference, a Federal Reserve official shared key insights into the U.S. economy, monetary policy, and trends in regional banking. These perspectives are especially important for Forex traders, as shifts in interest rates, inflation, and banking dynamics directly influence currency movements and trading opportunities.

UK Leading Economic Index Shows Sluggish Growth — What This Means for the Pound and Forex Traders

The latest release from The Conference Board revealed that the Leading Economic Index® (LEI) for the United Kingdom declined by 0.3% in September 2025, falling to 74.2 (2016=100).

Bessent Dismisses “Tariffs as a Tax” Narrative — Says AI Could Drive U.S. Job Boom Amid Falling Mortgage Rates

In a recent MSNBC interview, U.S. Treasury Secretary Bessent struck an optimistic tone about the American economy, dismissing fears that tariffs automatically translate into higher consumer costs and highlighting what he called a “gigantic drop in mortgage rates.”

ADP’s Job Data Sends Mixed Signals — Is the U.S. Labor Market Losing Its Momentum?

The ADP employment data, long considered a preview of the official U.S. jobs report, is quickly becoming a market mover — and this week’s update left traders puzzled.

BoE’s Greene Warns: Inflation Persistence May Demand Tougher Monetary Policy — What It Means for the Pound

The Bank of England’s (BoE) Monetary Policy Committee (MPC) member Megan Greene issued a stark warning that the United Kingdom’s fight against inflation is far from over.

Bank of England Holds Rates at 4%: Is the Inflation Battle Nearing an End?

The Bank of England’s (BoE) latest Monetary Policy Committee (MPC) decision may mark a pivotal moment for both the UK economy and the Forex markets. In a close 5–4 vote during its meeting ending 5 November 2025, the MPC opted to maintain the Bank Rate at 4%, with four members advocating for a modest 0.25 percentage point cut to 3.75%.