The Case for Strong, Effective Banking Supervision: Why It Matters for the Economy

At a time of increasing pressure on financial oversight, Federal Reserve Governor Michael S. Barr delivered a compelling argument for the importance of strong, effective banking supervision.

ECB’s de Guindos Signals Cautious Approach: What This Means for the Euro and Forex Traders

European Central Bank (ECB) Vice President Luis de Guindos recently highlighted that while economic growth in the Eurozone remains positive, it is still very low. This cautious assessment comes amid lingering uncertainty from global trade tensions, rising energy costs, and moderate domestic demand across EU member states.

Bank of Canada Faces Tariff Shock: Can Lower Rates Shield the Canadian Dollar from Structural Damage?

The Bank of Canada’s (BoC) latest address before the Senate Standing Committee on Banking, Commerce and the Economy painted a complex picture of the nation’s economic trajectory.

Powell Faces Final Fed Storm: Divisions Rise as His Term Nears End

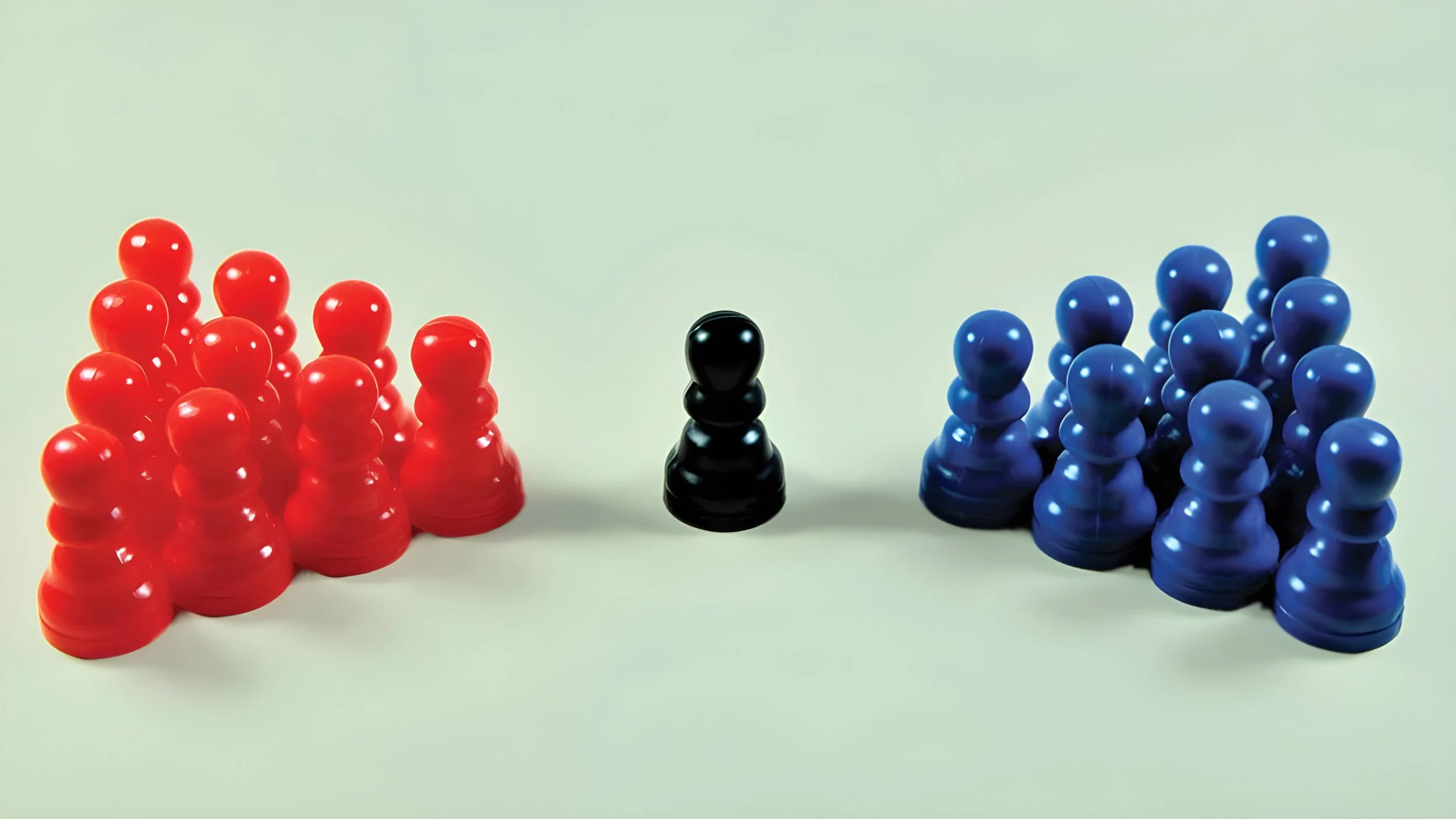

U.S. Federal Reserve Chair Jerome Powell is entering the final stretch of his term under heavy pressure — not just from markets, but from within the Fed itself. As his leadership ends in May 2026, Powell is dealing with internal disagreements, political tension, and confused market expectations.

Andrew Bailey’s Amsterdam Speech: Is the Global Financial System Ready for Its Next Big Test?

Bank of England (BOE) Governor Andrew Bailey recently took the stage in Amsterdam at the Klaas Knot Farewell Symposium—an event that marked both a farewell and a warning.

RBNZ Governor Hawkesby Set to Speak: Traders Brace for Clues on Policy Direction

On September 11, 2025, Reserve Bank of New Zealand (RBNZ) Governor Christian Hawkesby will participate in a fireside chat at the Financial Services Council’s annual conference in Auckland.

Understanding Neutral Policy: What Waller Means by Moving Interest Rates Toward Neutral

Federal Reserve Governor Christopher Waller recently signaled that U.S. monetary policy is moving toward a neutral stance. But what does that really mean, and why should Forex traders—even beginners—pay attention?