The Silent Architect of Wealth: Building Trading Habits and Discipline

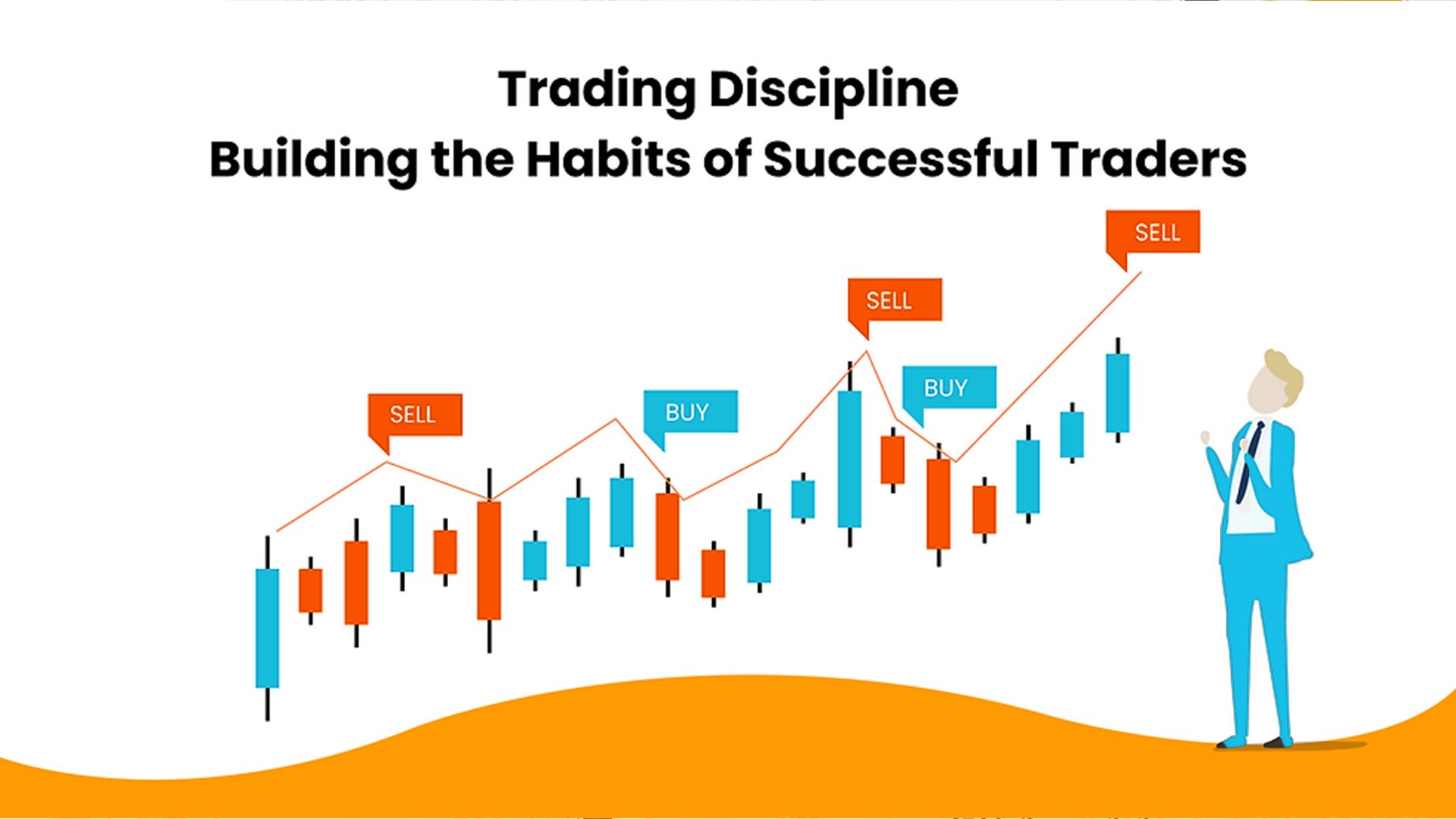

While high-speed fiber optics and advanced algorithms dominate the headlines, the most powerful tool in Forex trading remains the human brain—specifically, its ability to adhere to a routine. Most traders enter the market with dreams of overnight riches, but at Global Markets Eruditio, we teach a different reality: your trading account is a direct reflection of your daily habits.

Success in Forex trading for beginners isn't about finding a "magic" indicator; it's about building a psychological fortress that protects you from your own impulses. In a market where the US Dollar (USD) can swing on a single headline, discipline is the only thing that keeps you from becoming a statistic.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The Anatomy of a Professional Trading Routine

A professional trader doesn't just wake up and start clicking "buy" on the EUR/USD. They follow a sequence designed to ensure mental clarity. Discipline is like a muscle; it must be trained before the heavy lifting begins.

The Pre-Market Scan: Before touching a platform, a disciplined trader reviews the economic calendar. Is there a Canadian Dollar (CAD) employment report? Is a central bank official speaking? Knowledge of high-impact news prevents you from being blindsided by volatility.

The Rules of Engagement: Professionalism at the GME Academy means having written rules. If your strategy requires three indicators to align on the 4-hour chart, you do not enter if only two are present.

The "Post-Game" Analysis: The day doesn't end when the trade closes. Successful traders journal every move, noting not just the price, but their emotional state. Were you "revenge trading" a loss on GBP/JPY? Your journal will tell the truth your memory tries to hide.

Why Discipline is Your Best Risk Management Tool

We often talk about stop-losses and position sizing, but the ultimate risk management tool is your ability to walk away. The market is open 24/5, but your peak mental performance is not.

Consistency in your habits leads to consistency in your equity curve. Consider the "2% Rule." A disciplined trader religiously risks only 2% of their capital. An undisciplined trader might see a "perfect" setup on the US Dollar and risk 20%, thinking they can't lose. When the market inevitably zig-zags, the disciplined trader survives to trade tomorrow, while the "habit-free" trader is out of the game.

The Power of "Small Wins"

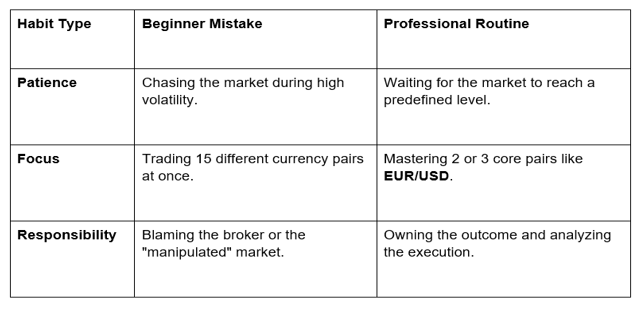

In the Forex world, habits are built through repetition. Every time you follow your plan—even if the trade results in a small loss—you have won. You have successfully reinforced the habit of discipline.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Building Your Foundation with GME

Discipline is rarely built in isolation. It requires a community and a proven framework. At Global Markets Eruditio, we don't just teach you how to read a chart; we teach you how to manage the person sitting in front of it. By focusing on the "boring" habits, you position yourself for extraordinary results.

Stop gambling and start trading. If you're ready to move past the cycle of impulsive decisions and build a professional mindset, we invite you to take the first step.

Join our FREE Forex Workshop and learn the exact habit-stacking techniques used by elite traders to navigate the global markets with composure and profit.