The "Genius" Trap: Why Consistency Beats Intelligence in Forex Trading

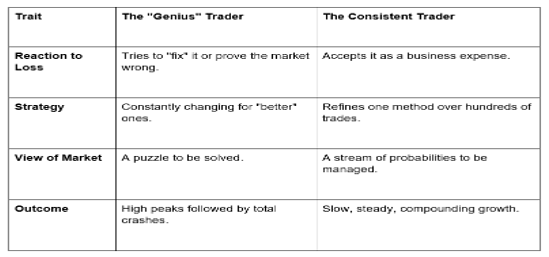

Many newcomers enter the world of Forex trading believing that success is a byproduct of high IQ or complex mathematical prowess. They imagine that if they can just master the most intricate indicators or predict the exact movement of the US Dollar (USD) using advanced algorithms, they will unlock a fortune. However, the reality of the market is often a cold shower for the "geniuses."

In the high-stakes arena of currency pairs, a brilliant mind can actually be a liability if it isn't paired with a disciplined spirit. This is a core philosophy we emphasize at Global Markets Eruditio, where we’ve seen that the most profitable traders aren't necessarily the smartest people in the room—they are the most consistent.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The Paradox of the "Smart" Trader

Why does intelligence sometimes fail in Forex? High-IQ individuals are often used to being "right." They are accustomed to solving problems through sheer brainpower. But the market doesn't care about your GPA or your ability to calculate Fibonacci retracements in your head.

When a trade on a major pair like EUR/USD goes south, an "intelligent" trader might try to outsmart the market. They might double down on a losing position, convinced that the market is "wrong" and their analysis is "right." This ego-driven approach is a fast track to a blown account.

Why Consistency is the True "Holy Grail"

Forex trading for beginners is often marketed as a hunt for the perfect strategy—the "Holy Grail." In truth, a mediocre strategy executed with 100% consistency will always outperform a "perfect" strategy executed with 50% consistency.

Consistency manifests in three critical areas:

Risk Management: A consistent trader risks the same small percentage (e.g., 1-2%) on every trade, whether it's a volatile cross like GBP/JPY or a steadier move in the Canadian Dollar (CAD). They don't let a "sure thing" tempt them into over-leveraging.

Trade Execution: They wait for their specific setup. If the criteria aren't met, they don't trade. Period. They understand that "no trade" is often the most profitable position to hold.

Emotional Regulation: They treat a win and a loss with the same level of indifference. They don't celebrate a lucky break on the GBP/USD, nor do they "revenge trade" after a stop-loss is hit.

The Power of the Trading Routine

At GME Academy, we teach that trading is less like a sprint and more like a marathon. To survive, you need a routine that removes the burden of decision-making during high-stress moments.

Consider the impact of single-economy news, such as a Fed interest rate hike affecting the US Dollar. An inconsistent trader might panic-buy or sell based on a headline. A consistent trader, however, already has a plan: they know exactly how they will react if the news hits certain thresholds, or they may choose to sit out the volatility entirely.

By automating your behavior through habits, you bypass the "intelligence" that tries to talk you into bad decisions. You become a professional who executes a process, rather than a gambler chasing a feeling.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Mastering the Boring Path to Success

The truth that many won't tell you is that successful Forex trading is often... boring. It involves looking at the same currency pairs day after day, waiting for the same signals, and following the same risk rules.

But it is within this boredom that wealth is built. When you stop trying to be the smartest person in the market and start being the most disciplined, you align yourself with the 5% of traders who actually take money home. Intelligence gets you in the door, but consistency keeps the lights on.

Ready to Build Your Path to Consistency?

Understanding the theory is the first step, but applying it to the live charts is where the real journey begins. If you’re tired of the "boom and bust" cycle and want to learn a professional, process-driven approach to the markets, we are here to help.

Join our FREE Forex Workshop this weekend! We’ll break down the exact routines used by professional traders to stay consistent in any market condition. Whether you are interested in the USD, EUR, or exotic crosses, this session will change the way you look at the charts forever.