Is Your Safety Net Too Small? Why Volatility-Based Stops Are the Secret to Longevity

Many traders enter a position on a promising currency pair, only to see their stop-loss hit by a momentary price spike before the market ultimately moves in their favor.

The Winning Streak Trap: Is Your Success Sabotaging Your Strategy?

It is the feeling every trader chases. You’ve closed three, four, maybe five consecutive profitable trades on the EUR/USD. The charts seem crystal clear, your entries are surgical, and the profits are stacking up. In the world of Forex, this is the "Goldilocks Zone."

The Silent Edge: Why Your Trading Journal Is More Powerful Than Your Strategy

In the fast-paced world of Forex trading, most beginners spend hundreds of hours hunting for the "Holy Grail" indicator. They swap from the EUR/USD to the GBP/JPY, searching for a magic formula that never misses.

The Invisible Hand in Your Head: Breaking the Dopamine Loop of Trading Addiction

Have you ever found yourself staring at a USD chart late into the night, your heart racing as a single candle flicker determines your mood for the next four hours? If you have, you aren’t just battling the market; you are battling your own biology.

The Silent Architect of Wealth: Building Trading Habits and Discipline

While high-speed fiber optics and advanced algorithms dominate the headlines, the most powerful tool in Forex trading remains the human brain—specifically, its ability to adhere to a routine.

The "Genius" Trap: Why Consistency Beats Intelligence in Forex Trading

Many newcomers enter the world of Forex trading believing that success is a byproduct of high IQ or complex mathematical prowess.

The Silent Account Killers: Why Doing "Less" Is the Secret to Professional Forex Profits

You’ve just closed a losing trade on the EUR/USD. The sting of the loss is fresh, and your immediate instinct isn't to walk away and analyze—it’s to get that money back.

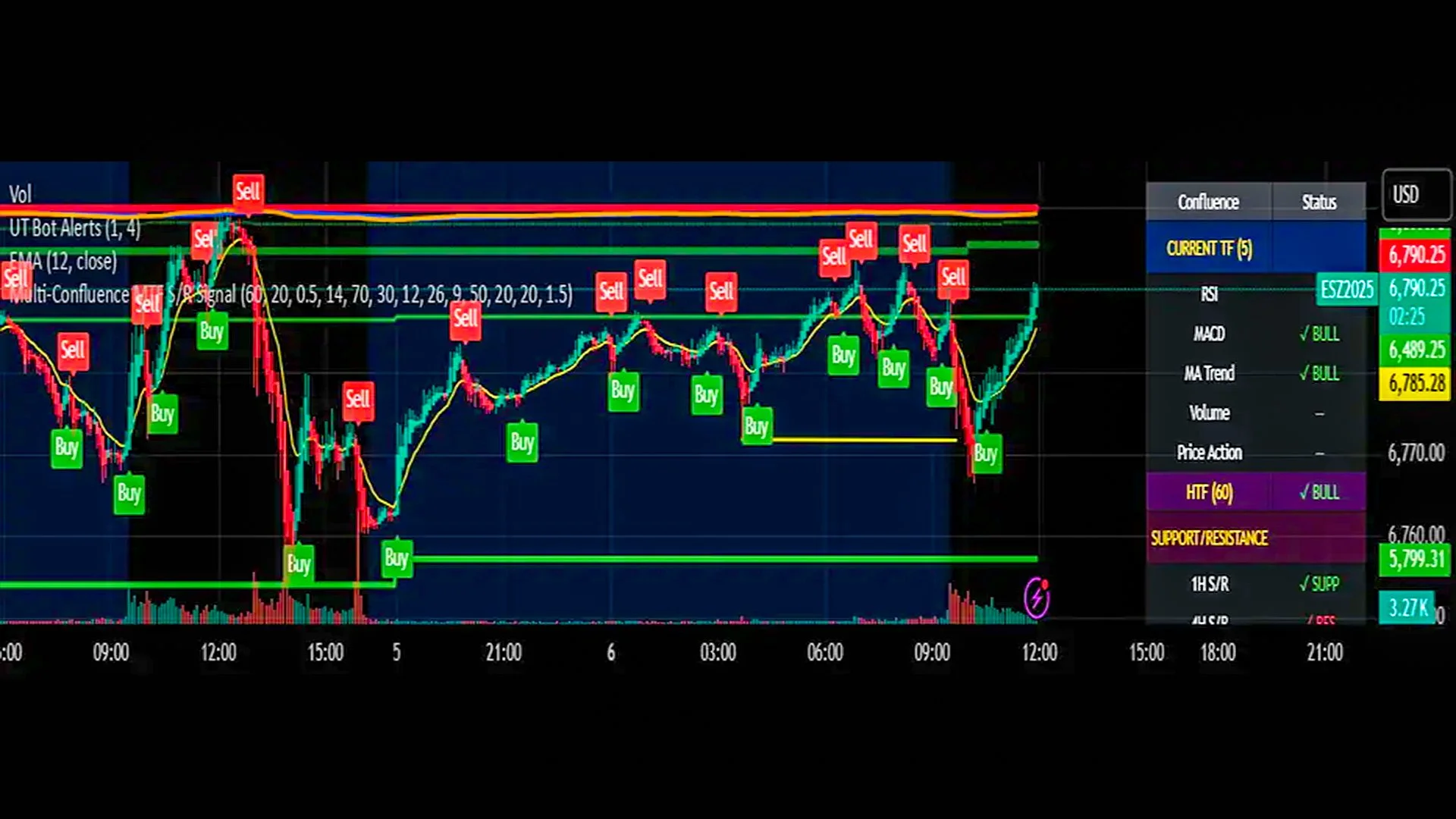

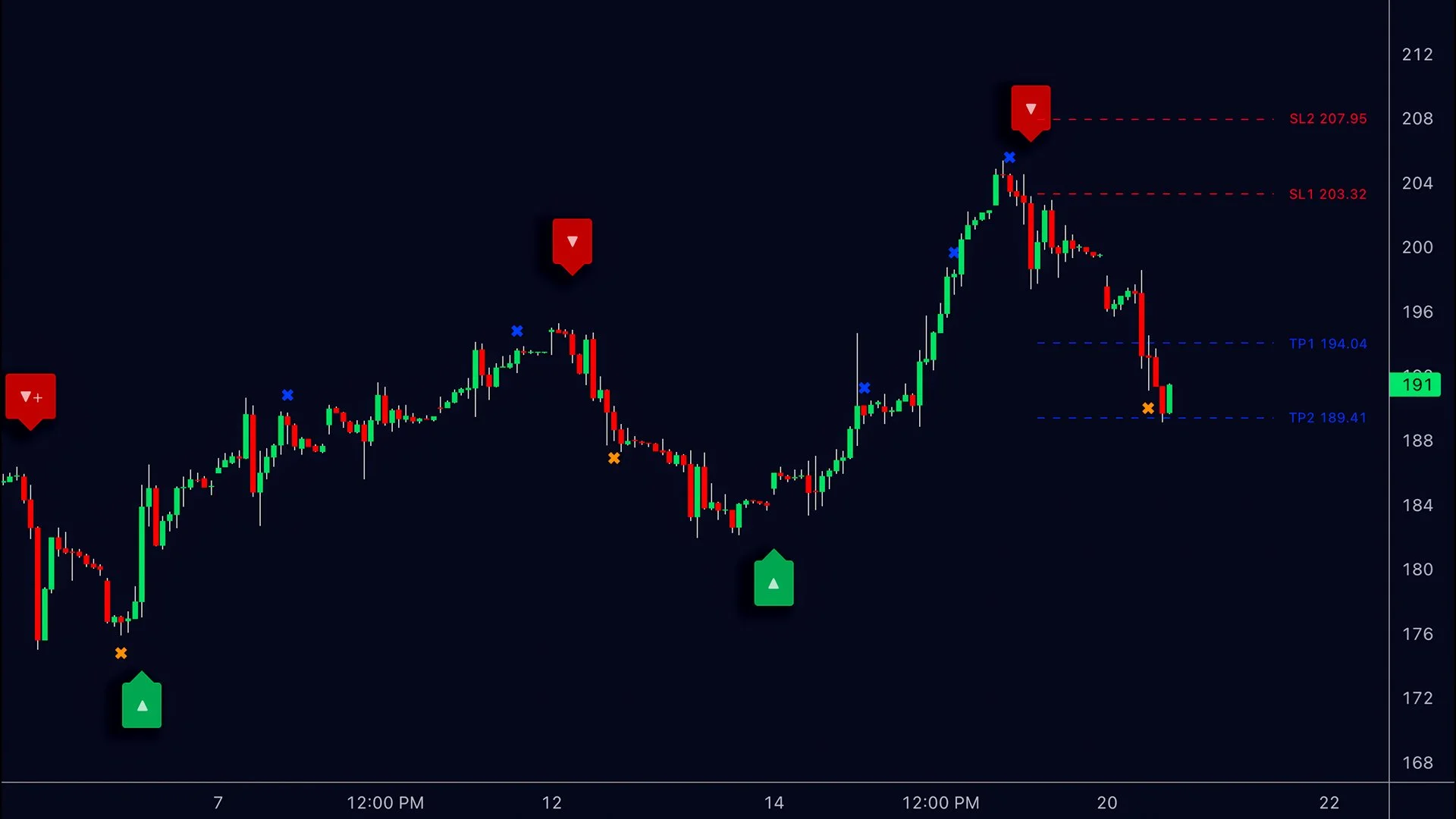

The Power of the "Perfect Storm": Understanding Confluence

In the high-stakes world of currency markets, relying on a single signal is often like trying to navigate a storm with a compass but no map. To truly master the art of market analysis, professional traders turn to a concept known as Confluence.

The Volatility Shield: Why ATR is the Ultimate Stop-Loss Tool for Forex Traders

In the world of Forex Trading, one of the most heartbreaking experiences for a beginner is the "Stop-Out-then-Rally."

Riding the Morning Wave: A Guide to Trading Gaps and Market Open Volatility

The first hour of the trading day is often compared to the start of a wild horse race. For a few frantic minutes, orders that accumulated overnight or over the weekend flood the market, causing price "gaps" and intense volatility.

Master the Market Math: Calculating Risk-Reward Ratio Like a Pro

In the world of Forex Trading, successful long-term outcomes aren't solely determined by how often you win, but rather by how much you win when you are right versus how much you lose when you are wrong.