The Winning Streak Trap: Is Your Success Sabotaging Your Strategy?

It is the feeling every trader chases. You’ve closed three, four, maybe five consecutive profitable trades on the EUR/USD. The charts seem crystal clear, your entries are surgical, and the profits are stacking up. In the world of Forex, this is the "Goldilocks Zone."

The Silent Edge: Why Your Trading Journal Is More Powerful Than Your Strategy

In the fast-paced world of Forex trading, most beginners spend hundreds of hours hunting for the "Holy Grail" indicator. They swap from the EUR/USD to the GBP/JPY, searching for a magic formula that never misses.

The Invisible Hand in Your Head: Breaking the Dopamine Loop of Trading Addiction

Have you ever found yourself staring at a USD chart late into the night, your heart racing as a single candle flicker determines your mood for the next four hours? If you have, you aren’t just battling the market; you are battling your own biology.

The Silent Architect of Wealth: Building Trading Habits and Discipline

While high-speed fiber optics and advanced algorithms dominate the headlines, the most powerful tool in Forex trading remains the human brain—specifically, its ability to adhere to a routine.

The "Genius" Trap: Why Consistency Beats Intelligence in Forex Trading

Many newcomers enter the world of Forex trading believing that success is a byproduct of high IQ or complex mathematical prowess.

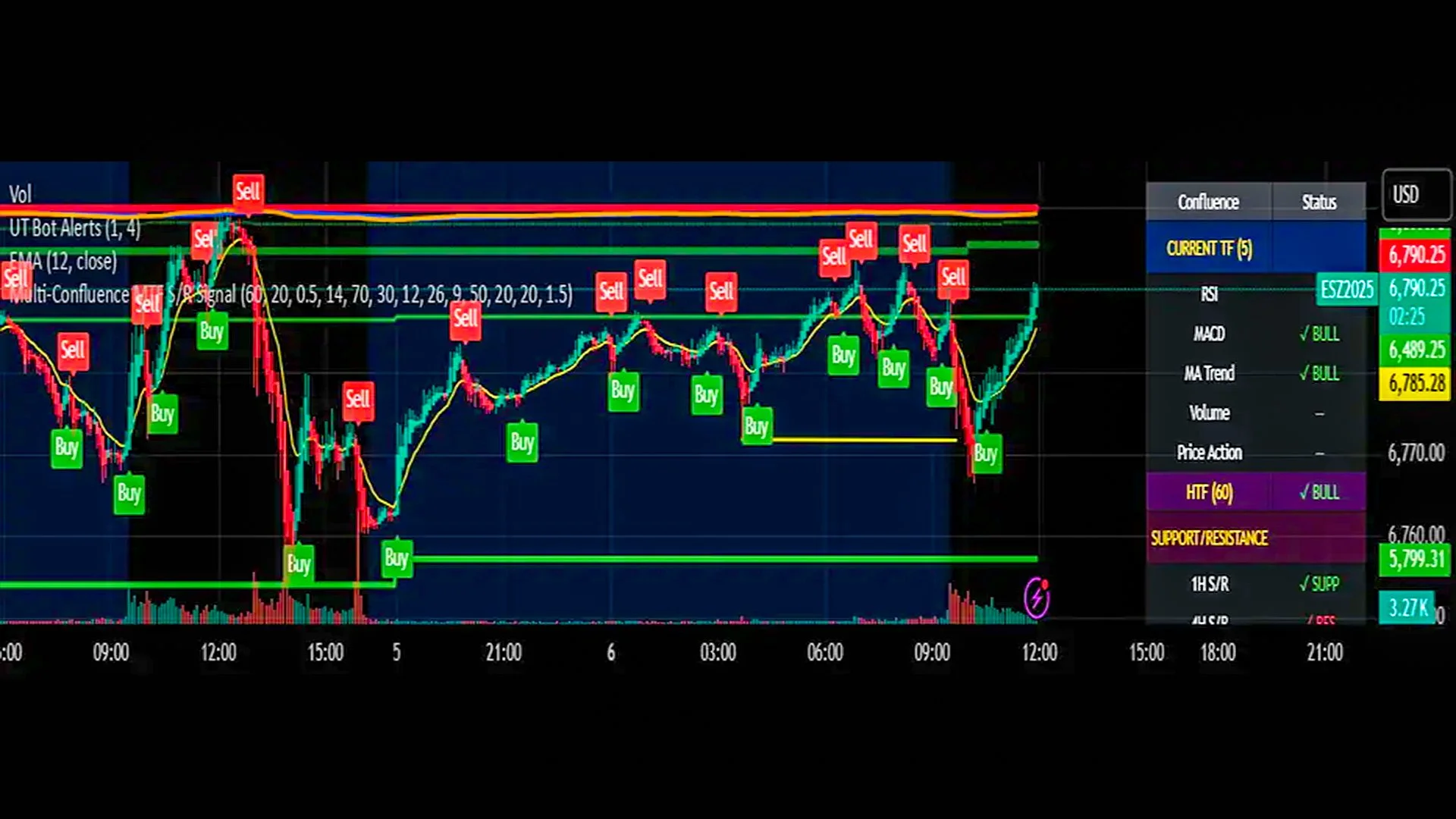

The Power of the "Perfect Storm": Understanding Confluence

In the high-stakes world of currency markets, relying on a single signal is often like trying to navigate a storm with a compass but no map. To truly master the art of market analysis, professional traders turn to a concept known as Confluence.

Beyond the Basics: Is Ichimoku Kinko Hyo the Ultimate “One-Look” Trading Edge?

In the fast-paced world of Forex trading, beginners often feel like they are drowning in a sea of jagged lines and flashing numbers.

The Great Economic Elasticity: Why the Market “Returns to the Mean”

In the high-speed world of global finance, prices often behave like a stretched rubber band. They may fly to extreme highs during a "bull market" or snap down to terrifying lows during a crash, but eventually, they tend to snap back toward a central average.

Riding the Morning Wave: A Guide to Trading Gaps and Market Open Volatility

The first hour of the trading day is often compared to the start of a wild horse race. For a few frantic minutes, orders that accumulated overnight or over the weekend flood the market, causing price "gaps" and intense volatility.

Diversification in Forex vs. Stocks, Crypto, and Gold: Which Strategy Works Best for You?

Investing isn’t just about picking one winning asset and hoping for the best. Smart investors know the power of diversification—spreading your money across different types of investments to reduce risk and improve potential returns

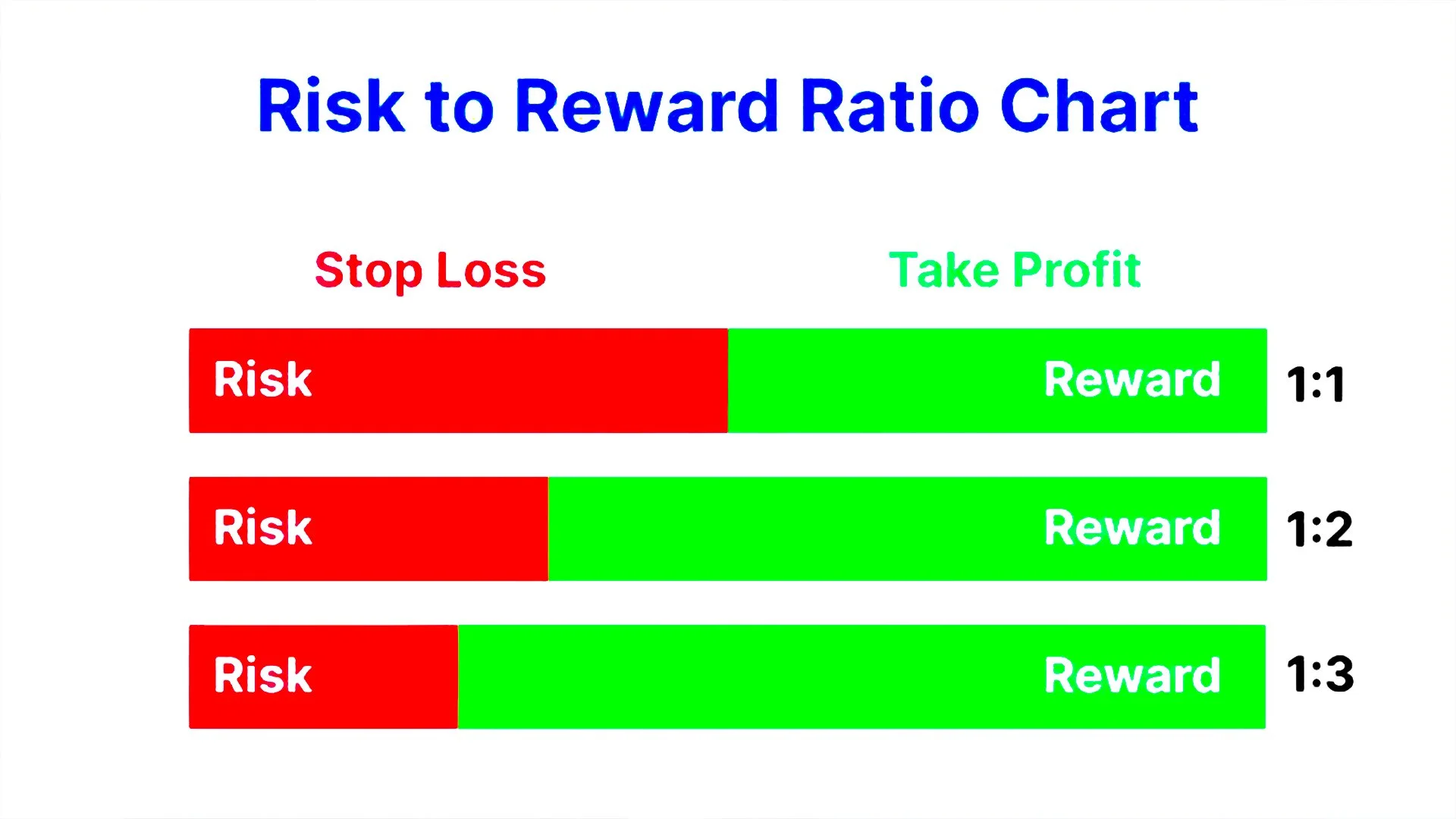

Master the Market Math: Calculating Risk-Reward Ratio Like a Pro

In the world of Forex Trading, successful long-term outcomes aren't solely determined by how often you win, but rather by how much you win when you are right versus how much you lose when you are wrong.