The Engine Under the Hood: How Broker Leverage Really Works

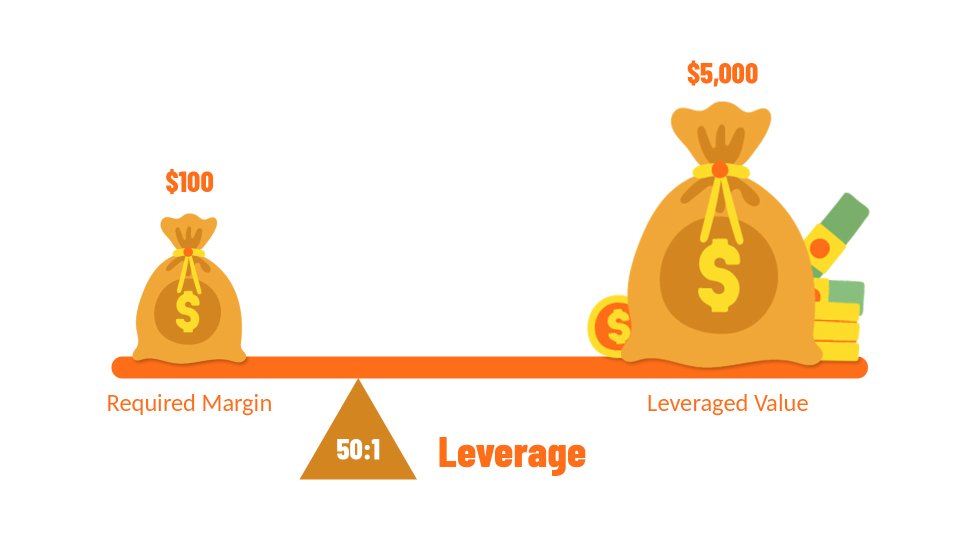

In the world of Forex trading, leverage is often described as a "loan" or a "double-edged sword." While most traders understand that a 1:100 ratio allows them to control $100,000 with just $1,000 of margin, very few understand the mechanical reality of what happens at the broker level.

At Global Markets Eruditio, we believe that understanding the "pipes" of the financial system makes you a more resilient trader. Leverage isn't magic; it’s a sophisticated credit arrangement between your broker and their liquidity providers. For those learning Forex trading for beginners, pulling back the curtain on this process is essential to understanding risk.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. The Prime Broker Connection: Where the Money Starts

Your retail broker doesn't actually have billions of dollars sitting in a vault to "lend" you for your EUR/USD trades. Instead, they have their own accounts with much larger entities called Prime Brokers or Tier-1 Banks (like JP Morgan, Deutsche Bank, or HSBC).

When you open a leveraged position, your broker isn't giving you cash; they are using their credit line with a Prime Broker to offset your trade in the real market.

The Security Deposit: Your margin (e.g., $1,000) acts as a "good faith deposit" against potential losses.

The Credit Line: The broker uses their institutional relationship to provide the "buying power" needed to control a standard lot.

2. A-Book vs. B-Book: Two Ways to Manage Your Leverage

How a broker handles your leverage depends on their business model. This is a critical concept we emphasize at GME Academy.

The A-Book (STP/ECN) Model

In this model, the broker passes your trade directly to the liquidity provider. If you buy USD/JPY, the broker immediately buys the same amount from their bank. They make money on commissions or a small spread markup. Here, the "leverage" is physically matched in the interbank market.

The B-Book (Market Maker) Model

In a B-Book model, the broker acts as your counterparty. When you "buy," the broker effectively "sells" to you internally. They don't always offset the trade with a bank. Instead, they manage the risk by matching "buyers" and "sellers" within their own client base.

The Risk: If you win, the broker pays you from their own pocket.

The Leverage: The broker is essentially "virtualizing" the leverage for you. This is why B-Book brokers can often offer extreme ratios like 1:500 or 1:1000—they aren't always paying the institutional costs to bridge those trades to the real market.

3. Margin Calls: The Broker’s Safety Switch

Because the broker is liable to their liquidity provider for the full value of the trade, they cannot afford for your account to go into the negative.

If your trade in a pair like GBP/JPY goes against you and your "floating loss" approaches the limit of your deposited margin, the broker’s automated system will trigger a Margin Call. If you don't add more funds, they will execute a Stop Out, closing your position instantly to protect their capital with the Prime Broker.

4. The Cost of Borrowing: Swaps and Rollovers

Leverage isn't free. Because you are technically "borrowing" one currency to buy another, you are subject to interest rate differentials.

Every day at 5:00 PM EST, brokers "roll over" open positions. If you are long on a high-interest currency like the US Dollar (USD) against a low-interest one like the Japanese Yen (JPY), you might earn interest. Conversely, if you're on the wrong side of the interest differential, the broker deducts a "swap fee." This is the interest cost of the leverage you are using.

Master the Mechanics of the Market

Understanding leverage at the broker level removes the "gambling" mindset and replaces it with an institutional perspective. When you know how the broker manages risk, you can better manage your own.

Stop trading in the dark.

Want to see exactly how these institutional mechanics affect your daily P&L?

Join our FREE Forex Workshop. We’ll break down the technical barriers and show you how to navigate the markets like a pro, from understanding liquidity to mastering margin management.