The Engine Under the Hood: How Broker Leverage Really Works

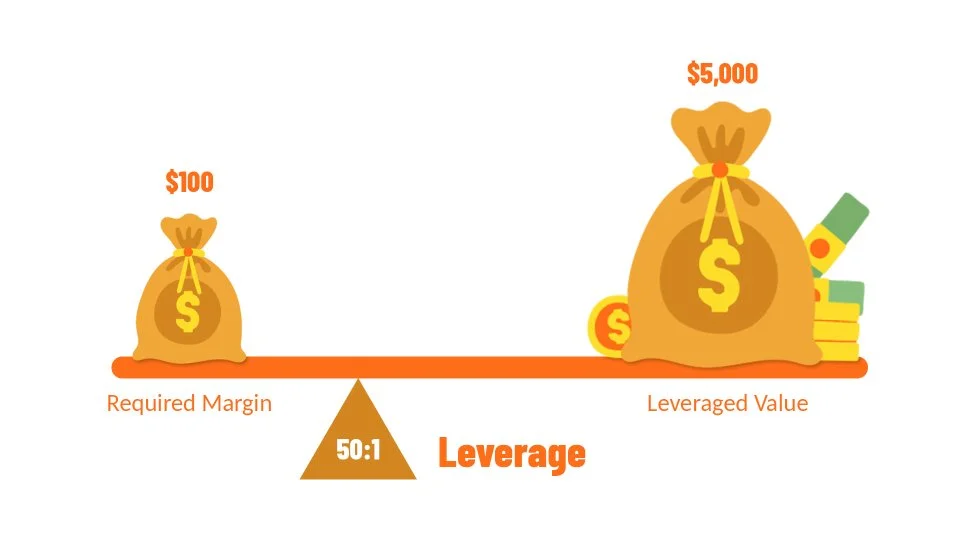

In the world of Forex trading, leverage is often described as a "loan" or a "double-edged sword." While most traders understand that a 1:100 ratio allows them to control $100,000 with just $1,000 of margin, very few understand the mechanical reality of what happens at the broker level.

The Silent Account Killer: Why "Doing Nothing" Is Sometimes the Best Trade

In the fast-paced world of Forex trading, there is a common misconception that more screen time equals more profit. For many, the itch to click "buy" or "sell" is constant. However, one of the most vital lessons taught at Global Markets Eruditio is that knowing when not to trade is just as important as knowing your entry signals.

The Silent Edge: Why Your Trading Journal Is More Powerful Than Your Strategy

In the fast-paced world of Forex trading, most beginners spend hundreds of hours hunting for the "Holy Grail" indicator. They swap from the EUR/USD to the GBP/JPY, searching for a magic formula that never misses.

The Invisible Hand in Your Head: Breaking the Dopamine Loop of Trading Addiction

Have you ever found yourself staring at a USD chart late into the night, your heart racing as a single candle flicker determines your mood for the next four hours? If you have, you aren’t just battling the market; you are battling your own biology.

The Invisible Saboteurs: Are These 3 Psychological Biases Killing Your Forex Profits?

You’ve mastered the charts. You understand support and resistance, and your technical indicators are perfectly tuned. Yet, despite having a "winning" strategy, your account balance remains stagnant—or worse, it’s shrinking.

The Volatility Shield: Why ATR is the Ultimate Stop-Loss Tool for Forex Traders

In the world of Forex Trading, one of the most heartbreaking experiences for a beginner is the "Stop-Out-then-Rally."

The "Institutional Magnet": Why VWAP and Anchored VWAP Are the Ultimate Truth-Tellers in Forex

In the high-stakes world of Forex Trading, most retail traders are taught to look at simple price averages—lines that tell you where the market was.

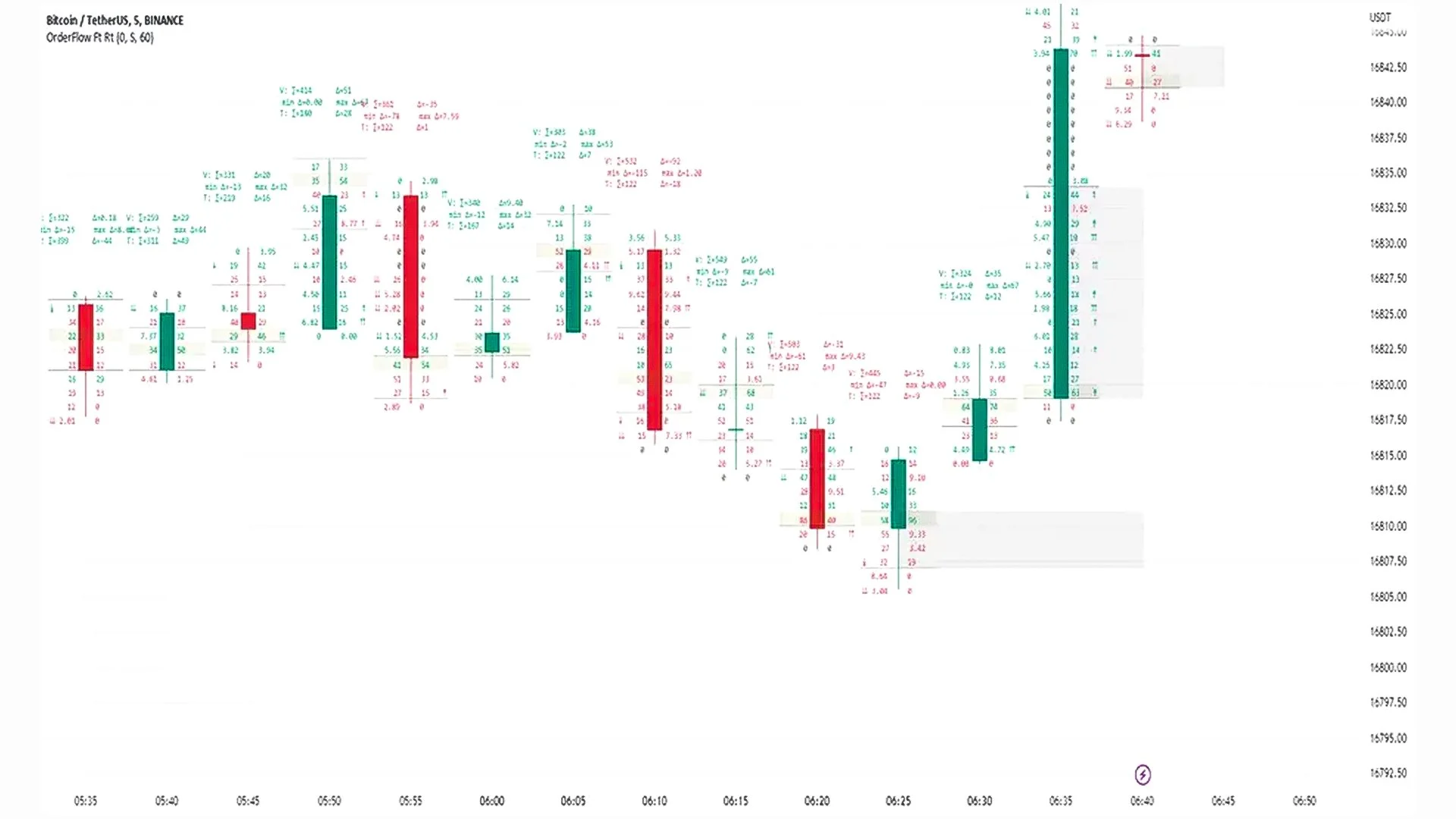

Cracking the Code: How Footprint Charts and Order Flow Reveal the "Smart Money"

In the standard world of Forex Trading, most participants are essentially looking at a map of where the market was. Candlesticks tell you the high, low, open, and close, but they leave out the most critical piece of the puzzle: the actual struggle between buyers and sellers happening inside each bar

Beyond the Candlestick: Mastering Volume and Market Profile in Forex

In the fast-paced world of Forex Trading, most beginners start with traditional vertical volume bars and standard candlesticks. However, professional traders often look "inside" the price action to understand where the real battle between bulls and bears is happening.

This Christmas, Give Yourself the Gift of No Stress.

Christmas is for spending, but it can also be for growing. Discover 3 simple ways to enjoy the holidays while protecting your wallet and preparing for a brighter financial future.

Diversification in Forex vs. Stocks, Crypto, and Gold: Which Strategy Works Best for You?

Investing isn’t just about picking one winning asset and hoping for the best. Smart investors know the power of diversification—spreading your money across different types of investments to reduce risk and improve potential returns

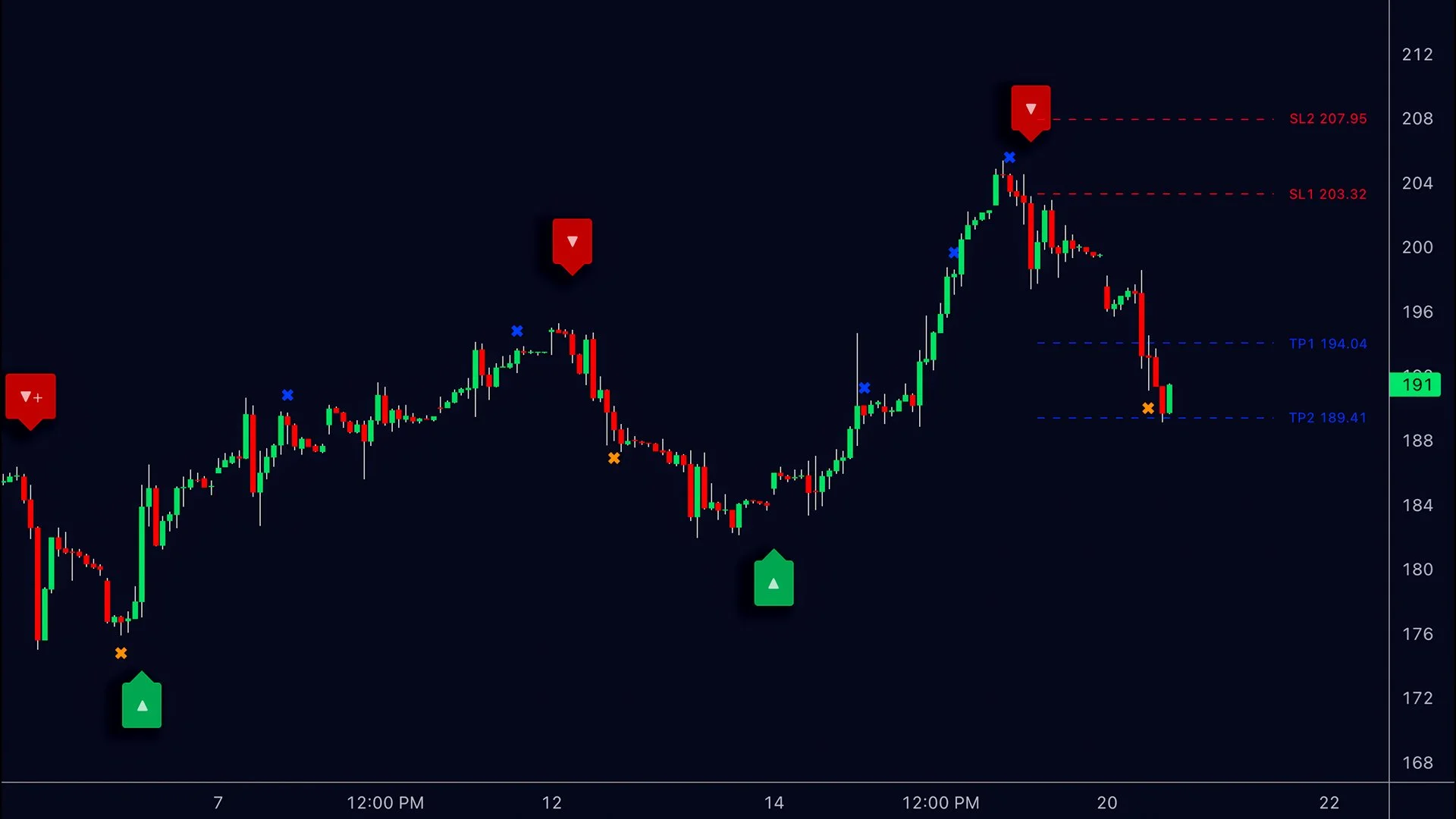

The Secret Language of Charts: How Triangles, Flags, and Double Tops Help You Predict the Market

Chart patterns may look like random zigzag lines, but for many Forex traders—especially Forex Trading for Beginners—they serve as a roadmap. These patterns can hint at where the market might go next. Whether you trade EUR/USD, USD/JPY, GBP/JPY, or any other major currency pair, recognizing chart patterns gives you a major edge.

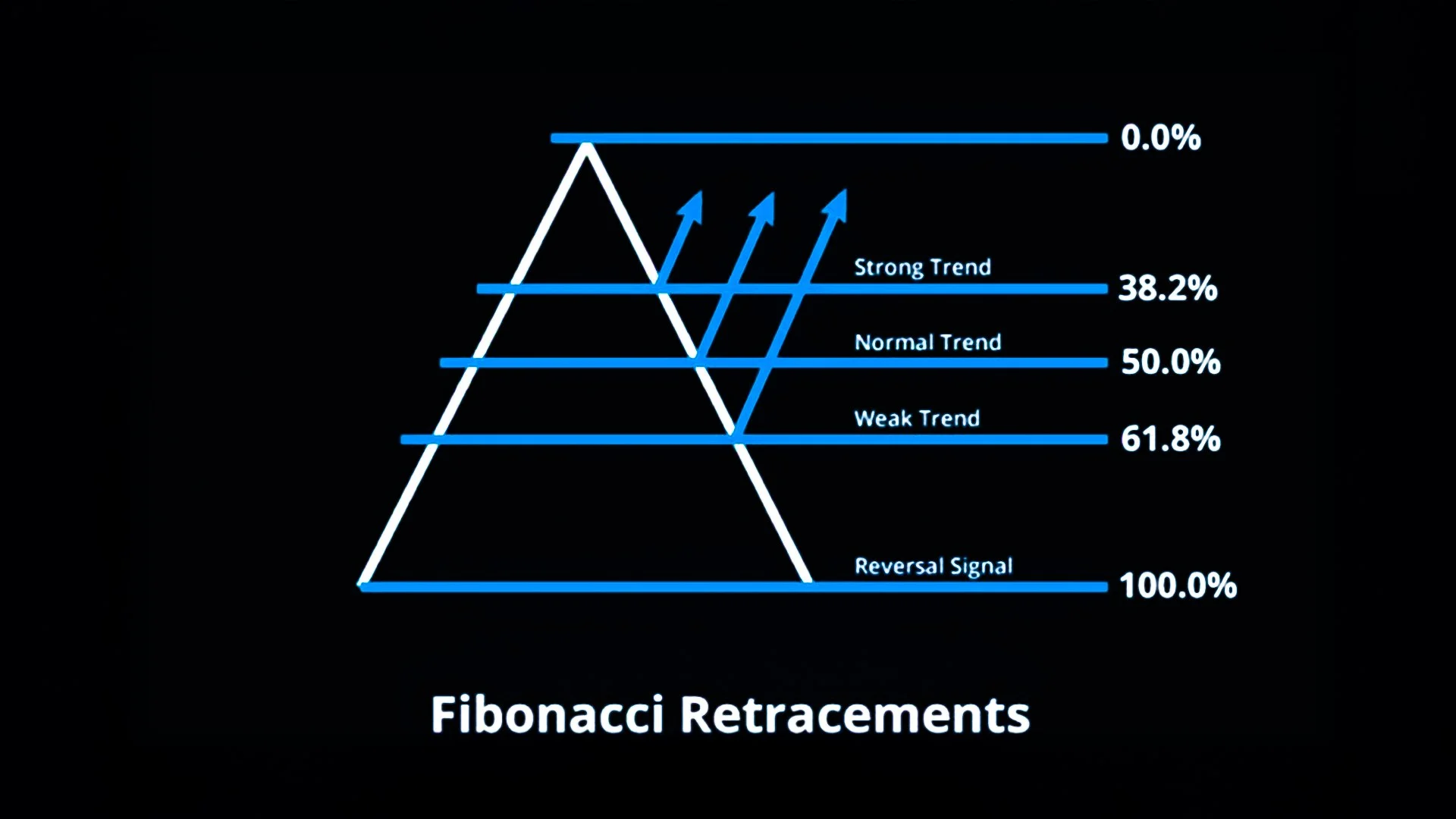

The Hidden Geometry of the Markets: How Fibonacci Retracements & Extensions Guide Smart Forex Traders

In Forex trading, price movements often look chaotic at first glance—but beneath the surface lies a rhythm that many traders rely on for clarity.

How Wars, Sanctions, and Trade Tensions Shape Currency Markets: A Forex Perspective

In the complex world of Forex trading, geopolitical events like wars, sanctions, and trade tensions can significantly impact currency values. Investors often view such events as signals of risk or uncertainty, prompting shifts in capital flows and altering the demand for various currencies.

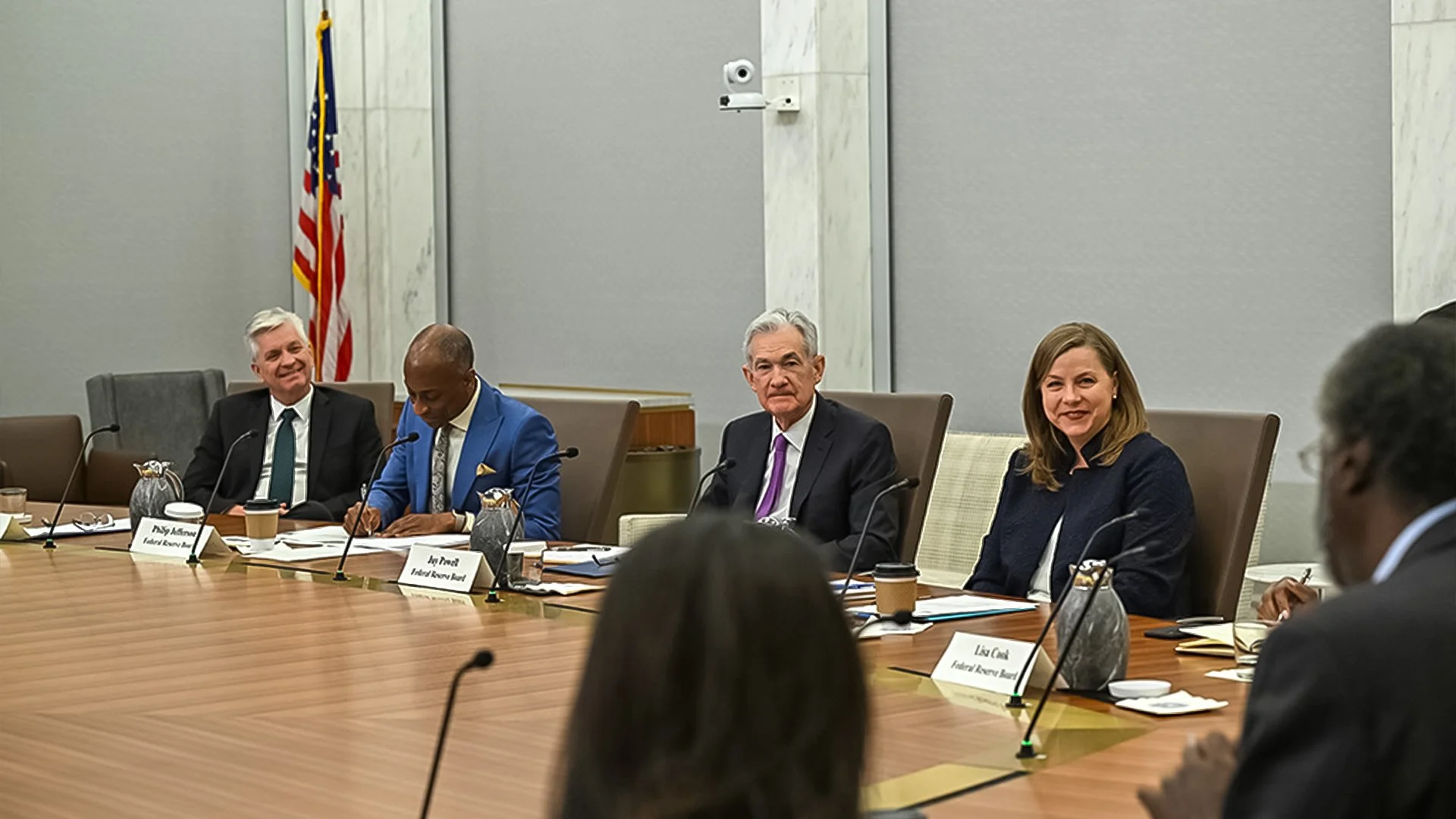

Trading Around Central Bank Announcements: FOMC, BOE, ECB, and BOJ Insights for Forex Traders

In the world of Forex trading, few events move the markets as dramatically as central bank announcements.

Elections and Forex: How Political Shifts Like Trump-Xi Meetings and Central Bank Changes Move Currency Markets

Elections are not just political milestones—they are major drivers of Forex market volatility. Traders monitor political developments closely because leadership changes and policy shifts can directly affect monetary policy, trade agreements, and international investment flows.

Green Finance and Forex: How ESG and Environmental Policies Shape Global Currency Markets

In today’s evolving global economy, Environmental, Social, and Governance (ESG) standards have become a major factor influencing investor sentiment and international capital flows. What started as a framework for corporate responsibility has now become a financial driver—one that is reshaping how currencies behave in the global Forex market.

The Future of Digital Currencies and CBDCs: How They Could Reshape Global Finance

The financial world is entering a new age — one where digital money is no longer just a concept, but a government-led reality. Around the world, central banks are exploring the creation of Central Bank Digital Currencies (CBDCs) — digital versions of their national currencies designed to make transactions faster, more secure, and more transparent.

Building Forex Literacy Among Filipinos: Why It Matters More Than Ever

In a world where currencies shift in value every second, financial literacy—particularly in Forex trading—has become a critical skill. Yet in the Philippines, while millions of Overseas Filipino Workers (OFWs) contribute to the economy through remittances and countless citizens engage in financial products, many still lack a deep understanding of how global markets affect their daily lives.

How OFW Remittances Affect the Peso: Understanding Their Role in the Philippine Economy

Overseas Filipino Workers (OFWs) are often called the modern-day heroes of the Philippines — not only because of their sacrifices abroad but also due to the vital role their remittances play in sustaining the nation’s economy. Every month, millions of Filipinos send money home to support their families, but beyond personal aid, these remittances have a significant influence on the Philippine peso (PHP) and the overall foreign exchange market.