The Secret Language of Charts: How Triangles, Flags, and Double Tops Help You Predict the Market

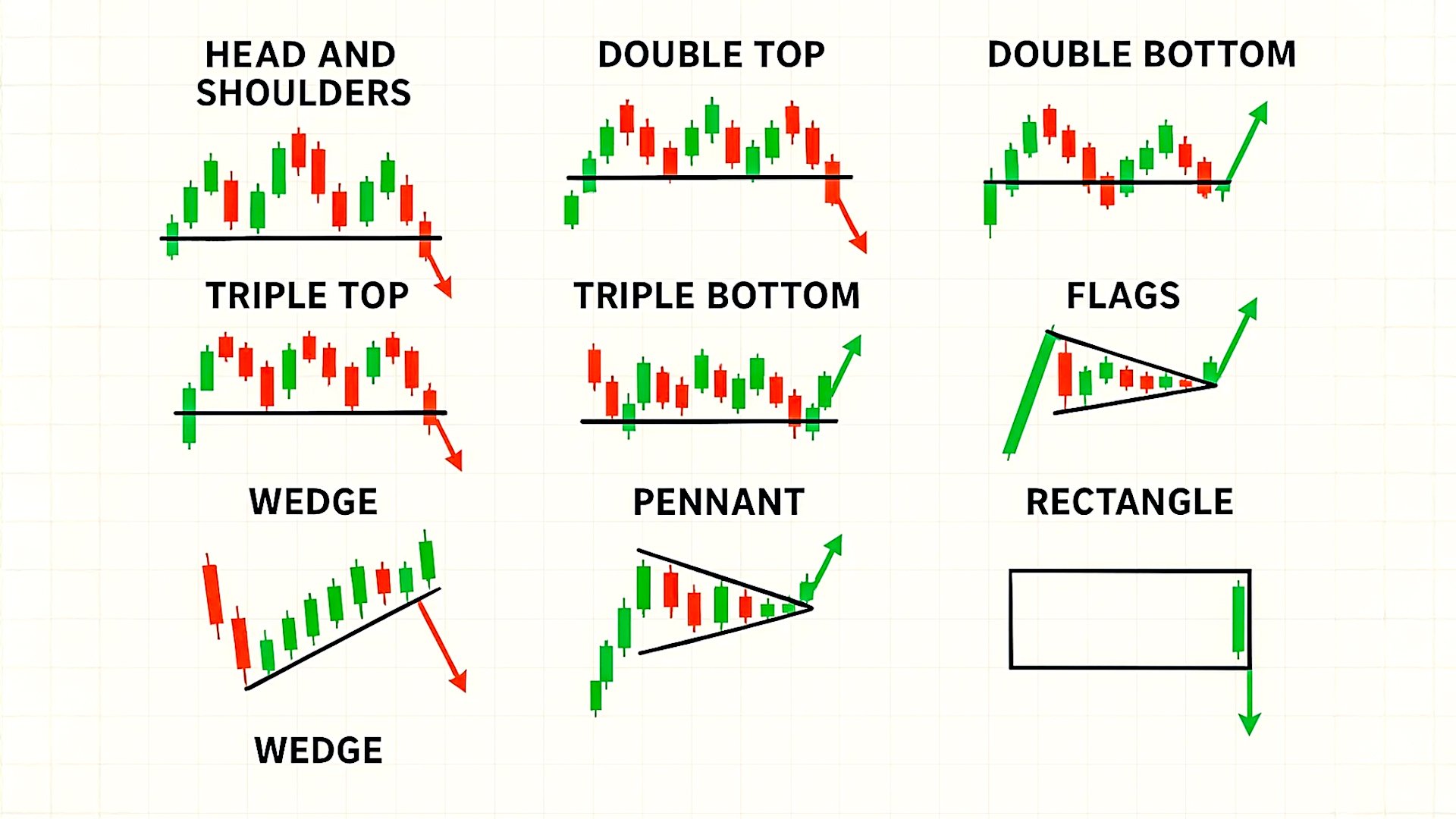

Chart patterns may look like random zigzag lines, but for many Forex traders—especially Forex Trading for Beginners—they serve as a roadmap. These patterns can hint at where the market might go next. Whether you trade EUR/USD, USD/JPY, GBP/JPY, or any other major currency pair, recognizing chart patterns gives you a major edge.

At GME Academy (Global Markets Eruditio), we teach that charts tell stories… and the good news is, anyone can learn how to read them.

Triangle Patterns: When the Market is Quiet Before the Storm

Triangles appear when the market is “pressing pause.” Think of it like two people arguing, but slowly getting tired—their voices (price swings) get smaller until one finally breaks and walks away.

Types of Triangles

Symmetrical Triangle

Price forms lower highs and higher lows. The market is tightening.

Why It Matters: A breakout can go either direction, so traders watch closely.

Forex Example: When EUR/USD forms a symmetrical triangle before a major U.S. economic report, traders anticipate a sharp move.Ascending Triangle

Price keeps hitting the same ceiling but forms higher lows.

Why It Matters: Often hints at bullish breakout.

Real-Life Analogy: It’s like pushing a door that won’t open—until it suddenly does.Descending Triangle

Price repeatedly hits a floor but makes lower highs.

Why It Matters: Often leads to bearish breakout.

Why It’s Important for Ordinary Filipinos

Triangle breakouts show potential entry points even for small accounts. With proper risk management, even OFWs or working-class beginners can join the trend early before big moves happen.

Flag Patterns: Fast Moves and Quick Opportunities

Flags appear after a strong move—think of them as the market “catching its breath.”

What They Look Like

A strong pole (big price movement)

A small rectangular consolidation (the flag)

A continuation in the same direction

Example: If USD/JPY surges due to a hawkish Federal Reserve update, it may form a bull flag, signalling more upside ahead.

Why Traders Love Flags

They are quick patterns

They often lead to strong follow-through

Perfect for momentum traders

For beginners in Forex Trading, flag patterns are easier to spot compared to more complicated formations.

Double Tops and Double Bottoms: Classic Reversal Signals

These two are among the most trusted patterns in Forex Trading.

Double Top

Price hits a high twice and fails both times.

Why It Matters: Signals potential downward trend.

Daily-Life Analogy: Imagine trying twice to lift something heavy and giving up—price often reacts the same.

Double Bottom

Price hits a low twice and refuses to go lower.

Why It Matters: Suggests a possible upward reversal.

Example: A double bottom in GBP/USD often appears during market recoveries after big sell-offs.

Head and Shoulders: The Market’s “Warning Signal”

This pattern looks like a head with two shoulders—one of the most powerful reversal patterns.

Left Shoulder: Price rises then falls

Head: Price rises higher then drops

Right Shoulder: A lower high forms, followed by a decline

When the neckline breaks, many traders take it as a confirmation that the trend is reversing.

Forex Angle: If CAD/JPY forms a clean head-and-shoulders pattern during oil price drops, many traders expect the Canadian Dollar to weaken.

Why Chart Patterns Matter for Filipino Traders

Most traders struggle not because they don’t know the news—but because they can’t read market structure. Chart patterns:

help identify trends

highlight potential entries and exits

reduce emotional trading

give structure to your strategy

Whether you're an OFW saving for balikbayan plans or a beginner looking for a second income stream, chart patterns give you clarity in an unpredictable market.

Ready to Trade Smarter? Learn Chart Patterns the Right Way.

If you want to master patterns like triangles, flags, and double tops—and understand how to use them in real Forex Trading—then you’ll love what we’re doing at GME Academy.

Join our FREE Forex Workshop and start reading charts like a pro, even if you’re a complete beginner.