Trend Continuation vs. Reversal: Mastering BOS and CHOCH in Market Structure

In the fast-paced world of technical analysis, few concepts are as vital for your success as understanding market structure. For those currently studying with Global Markets Eruditio, mastering the difference between a Break of Structure (BOS) and a Change of Character (CHOCH) is the key to differentiating a trend that is gaining steam from one that is about to collapse.

These two signals form the foundation of Smart Money Concepts (SMC) and ICT methodologies, helping traders align themselves with institutional order flow rather than getting trapped in "retail noise."

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

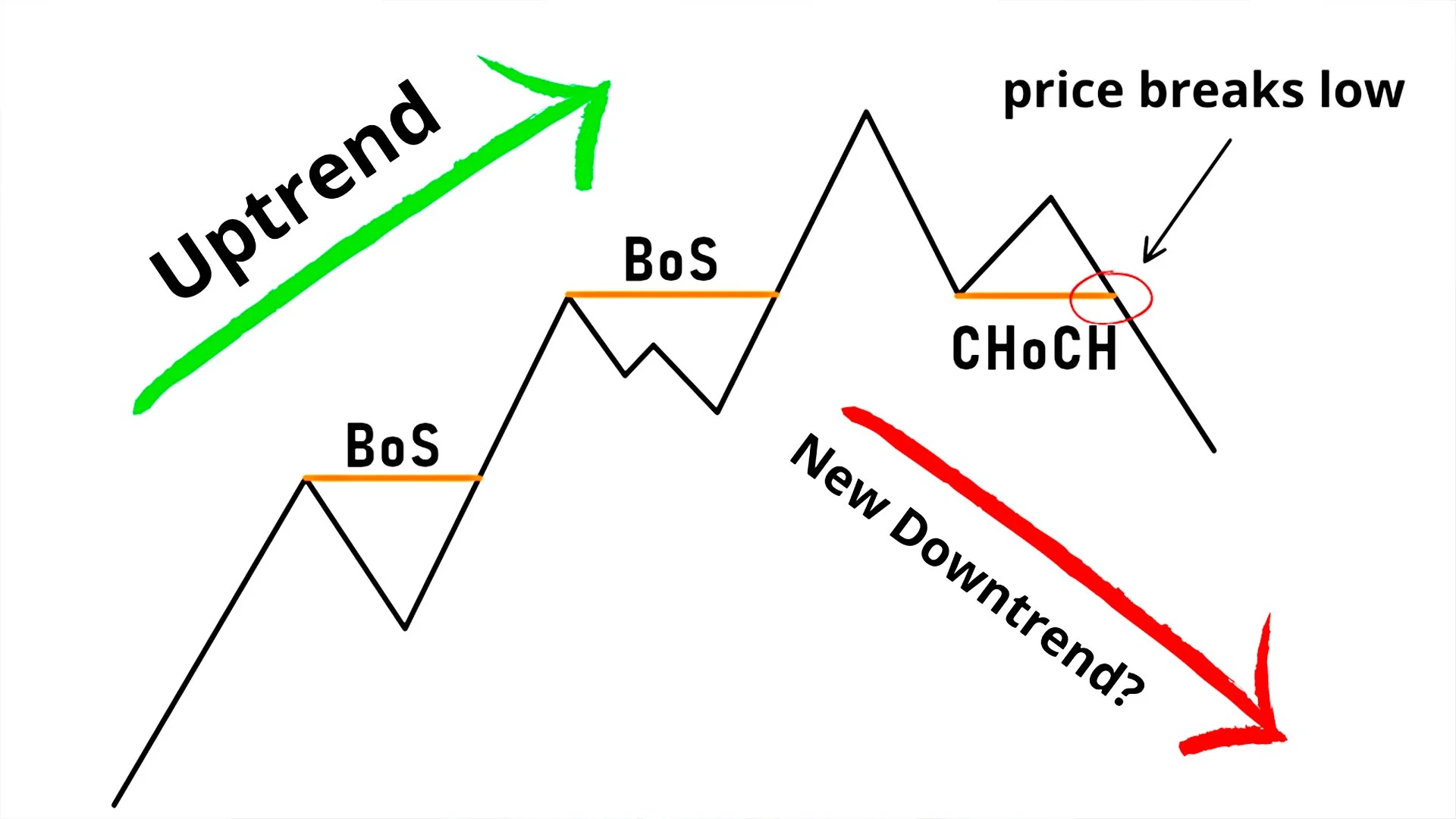

What is a Break of Structure (BOS)?

A Break of Structure (BOS) is a signal of trend continuation. It occurs when the market decisively moves past a previous swing high or swing low, confirming that the current momentum is still intact.

In a Bullish Trend: A BOS occurs when the price breaks above the previous Higher High (HH). This tells you that buyers are still in control and are willing to push the price to new heights.

In a Bearish Trend: A BOS occurs when the price breaks below the previous Lower Low (LL). This confirms that sellers are dominating the market and the downward pressure is likely to persist.

Why it matters for Forex Trading

For anyone starting with Forex trading for beginners, the BOS is your best friend for trend-following. If you see a series of BOS on the EUR/USD or the US Dollar (USD) index, it provides a "green light" to look for entries in the direction of that trend. It validates that the market "character" remains unchanged.

What is a Change of Character (CHOCH)?

While the BOS is about continuation, a Change of Character (CHOCH) is about trend reversal. It is the first early warning sign that the market’s "personality" is shifting.

A CHOCH occurs when the price fails to maintain its current structure and instead breaks a significant swing point in the opposite direction.

Bearish CHOCH: In an uptrend (Higher Highs and Higher Lows), the price suddenly drops and breaks below the most recent Higher Low (HL). This signals that the "bullish character" has ended and a reversal may be starting.

Bullish CHOCH: In a downtrend (Lower Lows and Lower Highs), the price rallies and breaks above the most recent Lower High (LH). This indicates that the "bearish character" is shifting toward a potential uptrend.

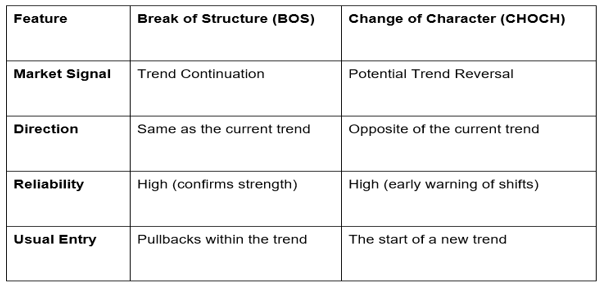

BOS vs. CHOCH: Key Differences at a Glance

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Practical Application: Trading the CAD and Major Pairs

At GME Academy, we teach that these patterns are universal. Whether you are trading the Canadian Dollar (CAD) during a heavy oil report or watching GBP/JPY volatility, the rules of structure apply.

Wait for the Close: A true BOS or CHOCH is confirmed when the candle body closes beyond the level. A simple "wick" past the level is often just a "liquidity sweep" designed to trap impatient traders.

Look for Confluence: A CHOCH is much more powerful if it happens at a key Supply or Demand zone or a major psychological level on a higher timeframe.

Refine Your Entry: Use the BOS to stay in winning trades longer and use the CHOCH to exit early or prepare for a counter-trend move.

Elevate Your Market Mastery

Understanding these technical nuances is what separates a professional trader from a novice. By recognizing when the market is continuing its path versus when it is changing its character, you can trade with a clarity that most retail traders never achieve.

Join our FREE Forex Workshop today and let the mentors at Global Markets Eruditio walk you through live chart examples of BOS and CHOCH. We’ll show you how to combine these structural shifts with institutional order flow to build a high-probability trading strategy for 2026.