The Invisible Hand in Your Head: Breaking the Dopamine Loop of Trading Addiction

Have you ever found yourself staring at a USD chart late into the night, your heart racing as a single candle flicker determines your mood for the next four hours? If you have, you aren’t just battling the market; you are battling your own biology.

The "Genius" Trap: Why Consistency Beats Intelligence in Forex Trading

Many newcomers enter the world of Forex trading believing that success is a byproduct of high IQ or complex mathematical prowess.

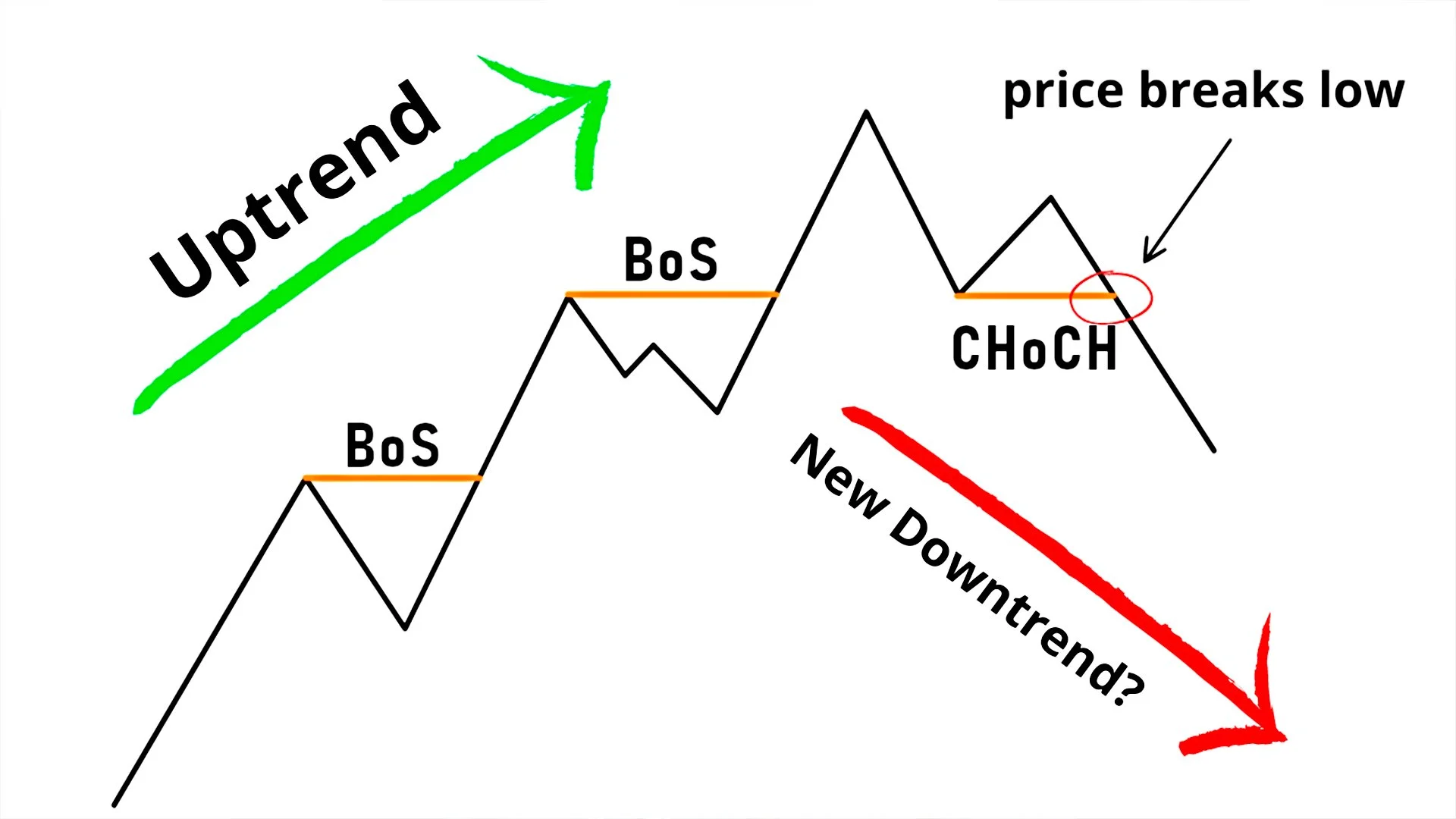

Trend Continuation vs. Reversal: Mastering BOS and CHOCH in Market Structure

In the fast-paced world of technical analysis, few concepts are as vital for your success as understanding market structure.

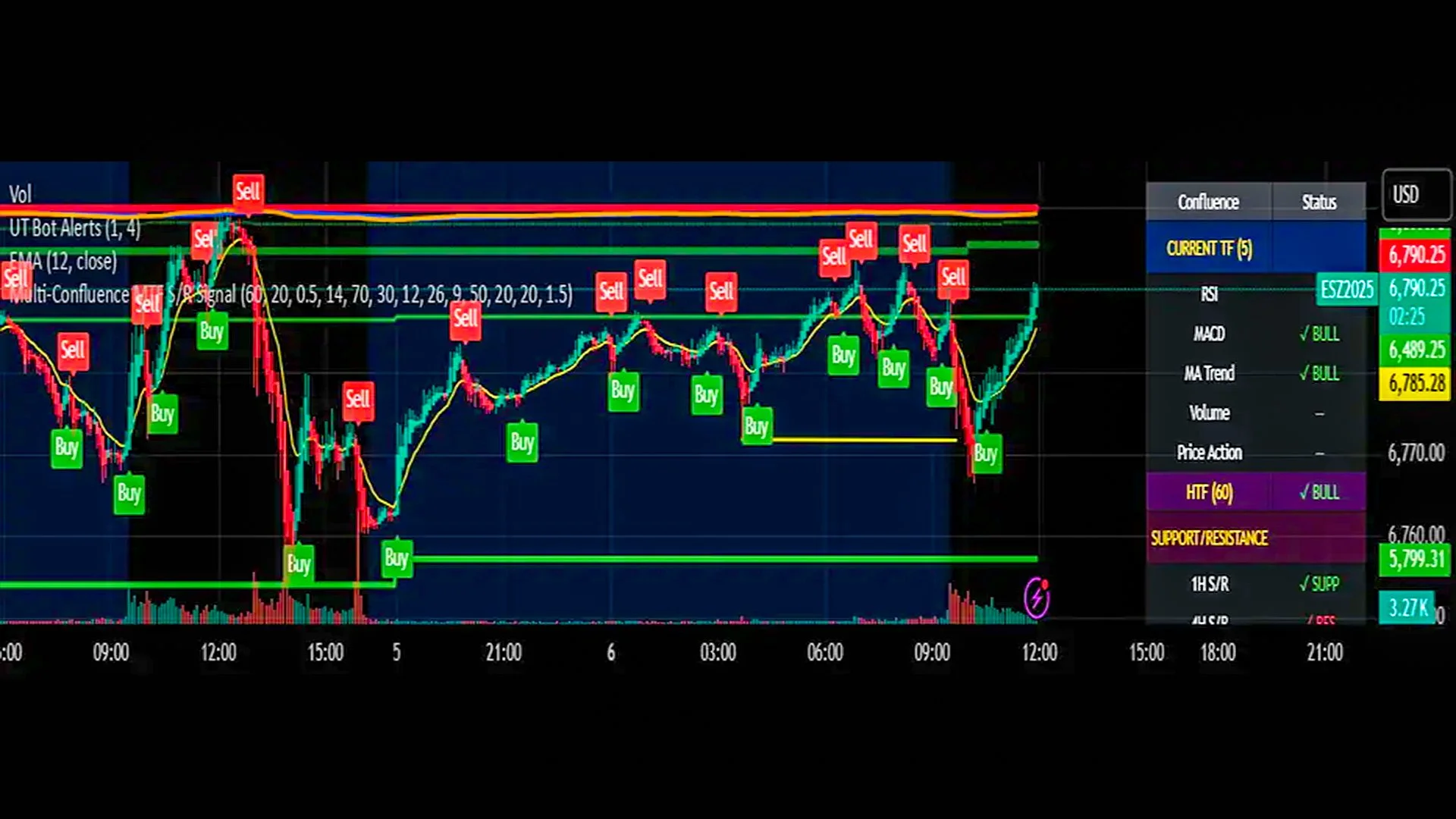

The Power of the "Perfect Storm": Understanding Confluence

In the high-stakes world of currency markets, relying on a single signal is often like trying to navigate a storm with a compass but no map. To truly master the art of market analysis, professional traders turn to a concept known as Confluence.

Beyond the Basics: Is Ichimoku Kinko Hyo the Ultimate “One-Look” Trading Edge?

In the fast-paced world of Forex trading, beginners often feel like they are drowning in a sea of jagged lines and flashing numbers.

The Great Economic Elasticity: Why the Market “Returns to the Mean”

In the high-speed world of global finance, prices often behave like a stretched rubber band. They may fly to extreme highs during a "bull market" or snap down to terrifying lows during a crash, but eventually, they tend to snap back toward a central average.

Riding the Morning Wave: A Guide to Trading Gaps and Market Open Volatility

The first hour of the trading day is often compared to the start of a wild horse race. For a few frantic minutes, orders that accumulated overnight or over the weekend flood the market, causing price "gaps" and intense volatility.