Unlocking the Code: Order Blocks Explained—The Institutional Footprint in Forex Trading

Tired of trading against the "Smart Money?" Order Blocks (OBs) are the foundational concept in Smart Money Concepts (SMC), representing the visible footprint left by banks and large financial institutions as they execute massive buy or sell orders. Learning to spot these high-probability zones is the key to aligning your Forex Trading strategy with institutional market flow.

In the world of Forex Trading, most retail traders operate in a reactive state, chasing price movements. Institutional traders, however, operate with immense capital, which prevents them from executing their entire positions (often billions of USD) in a single go without spiking the market against themselves. To mitigate this impact, they divide their transactions into smaller chunks, or Order Blocks (OBs), strategically placed at specific price levels.

These OBs are not just another level of support or resistance; they are precise zones of institutional entry, acting as magnetic points where the price is highly likely to return and reverse.

What Exactly is an Order Block?

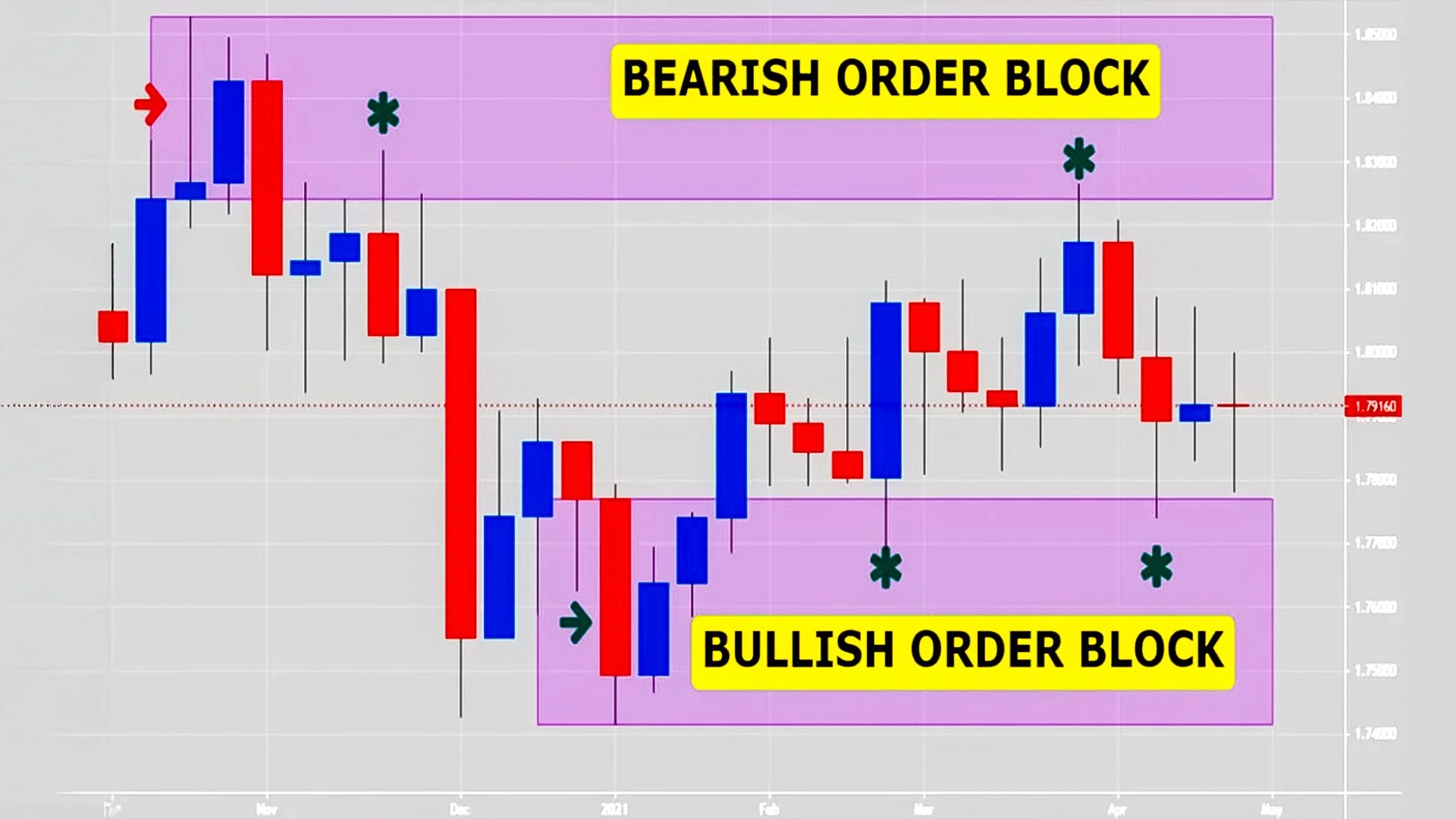

An Order Block is a specific area on a price chart—usually defined by a single candlestick—that represents the last moment where institutional traders placed orders in the opposite direction of the dominant, high-momentum move that followed.

It marks the precise zone where control flipped from the "weak money" (retail traders) to the "smart money" (banks and large desks).

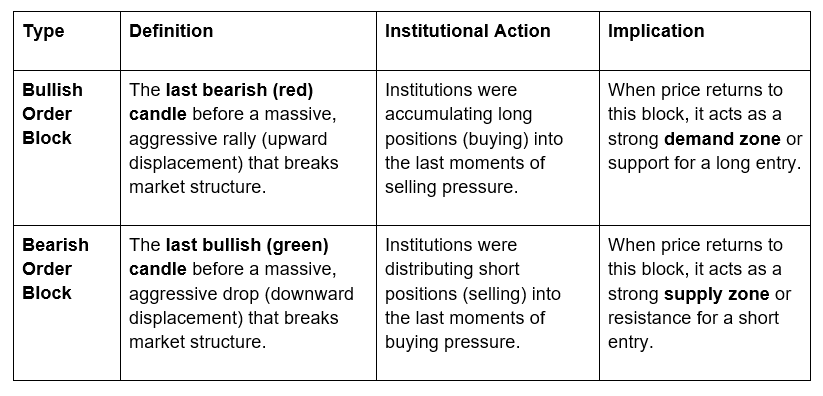

Types of Order Blocks

The Anatomy of a Valid Order Block

Not every opposing candle is a valid Order Block. For an OB to represent a high-probability institutional footprint, it must possess specific characteristics that are the foundation of GME Academy's approach to Smart Money Concepts:

Displacement (Impulsive Move): The move away from the OB must be sharp, strong, and aggressive, leaving no doubt about the institutional commitment. This confirms that significant capital was deployed.

Imbalance/Fair Value Gap (FVG): The aggressive move should create an inefficiency in the price action, also known as a Fair Value Gap (an area where the price moved so fast that it didn't leave overlapping candle wicks/bodies). Price is magnetically drawn back to this imbalance to "fill the gap" and mitigate the Order Block before continuing the trend.

Break of Structure (BOS): The move away from the OB must successfully break a previous swing high (for a bullish OB) or a previous swing low (for a bearish OB). This confirms a shift in market structure driven by institutional intent.

Liquidity Sweep: The best OBs often involve the price momentarily pushing past a previous swing high or low just before the strong reversal. This action is the liquidity grab or "stop hunt," where institutions harvest retail stop-loss orders to ensure their massive orders get the cheapest and best fills.

Trading Strategy: Aligning with the Smart Money

For Forex Trading for Beginners seeking to move beyond simple support and resistance, trading Order Blocks offers precision entries and favorable risk-to-reward ratios on major currency pairs like EUR/USD or USD/CAD.

Identify the Order Block: Use a higher timeframe (e.g., Daily or H4) to mark the valid OB zone (the last opposing candle before the break of structure).

Wait for the Retracement: Be patient. Wait for the price to move back to the OB zone, often seeking to fill the accompanying Fair Value Gap. Do not trade counter-trend.

Confirm Entry: As price enters the OB zone, drop to a lower timeframe (e.g., M15 or M5). Look for a confirmation signal, such as a strong reversal candlestick pattern (e.g., a bullish engulfing candle at a bullish OB) or a small break of structure on that lower timeframe.

Set Risk: Place your Stop Loss (SL) a few pips just beyond the outer boundary of the Order Block zone. This protects you if the institutional level fails.

Set Target: Target the next area of opposing liquidity, such as a prior untouched swing high/low, or a large liquidity pool that was recently created. Aim for a minimum 2:1 Risk/Reward Ratio.

By focusing on Order Blocks, you are no longer guessing where the market might turn. You are watching the visible memory of where the biggest players put their money down, giving you a powerful edge in the volatile Forex market.

Are You Ready to Trade the Footprints of the Banks?

The most sophisticated Forex Trading involves understanding Smart Money Concepts. Stop trading against the professionals and start trading with their intent.

Master the art of identifying high-probability Order Blocks.

Join the GME Academy community today and sign up for our FREE Forex Workshop to learn how to translate institutional footprints into high-precision Forex Trading entries, securing a comprehensive understanding of the forces that move the market.