The Winning Streak Trap: Is Your Success Sabotaging Your Strategy?

It is the feeling every trader chases. You’ve closed three, four, maybe five consecutive profitable trades on the EUR/USD. The charts seem crystal clear, your entries are surgical, and the profits are stacking up. In the world of Forex, this is the "Goldilocks Zone."

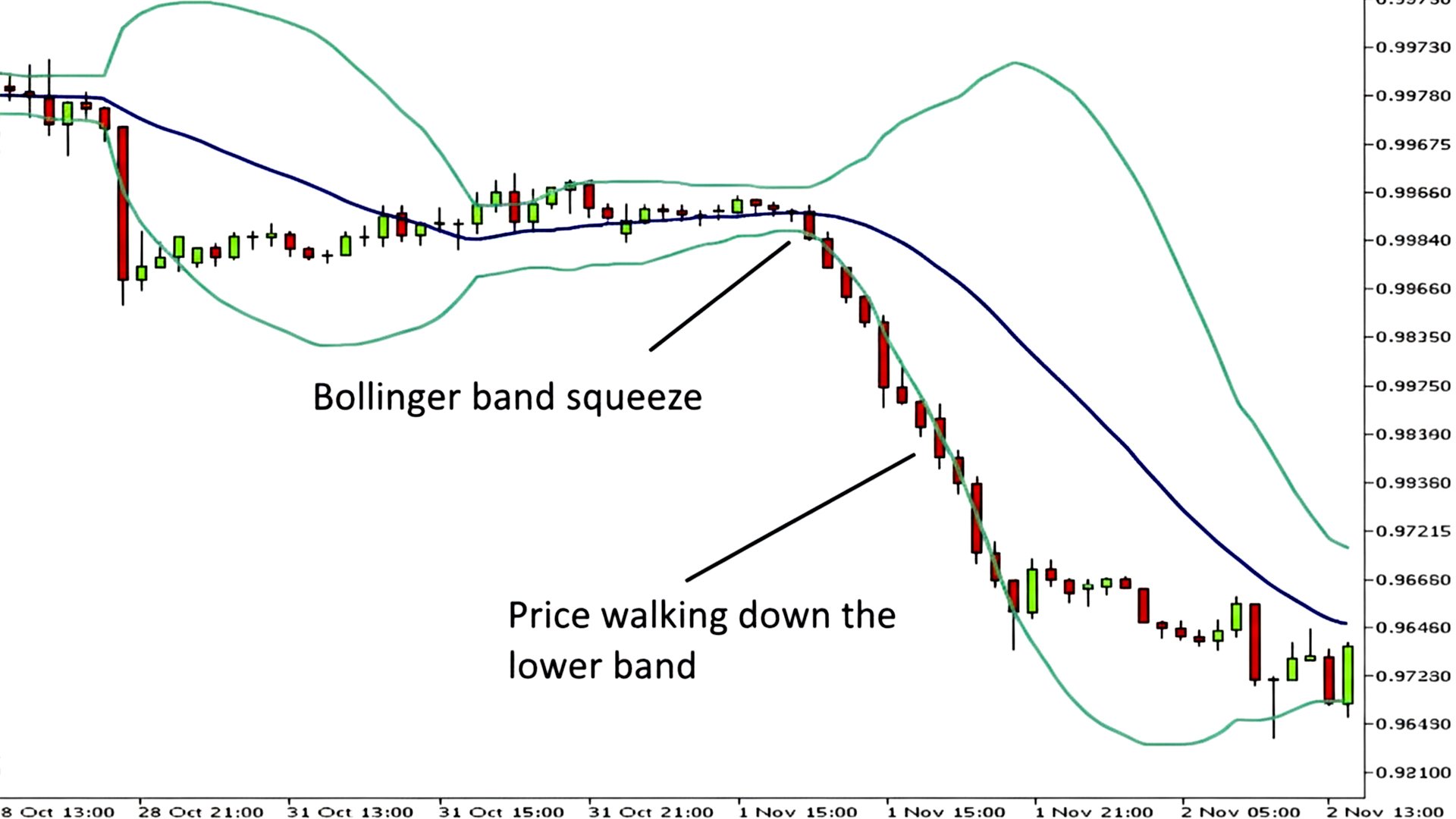

The Bollinger Band Squeeze: How to Predict the Market’s Next Explosive Move

Volatility is the lifeblood of the financial markets, yet it remains the most misunderstood concept for those just starting out in Forex trading. While most traders fear a quiet market, professionals at Global Markets Eruditio know that a period of low volatility is simply the "calm before the storm."

Unlocking the Code: Order Blocks Explained—The Institutional Footprint in Forex Trading

Tired of trading against the "Smart Money?" Order Blocks (OBs) are the foundational concept in Smart Money Concepts (SMC), representing the visible footprint left by banks and large financial institutions as they execute massive buy or sell orders

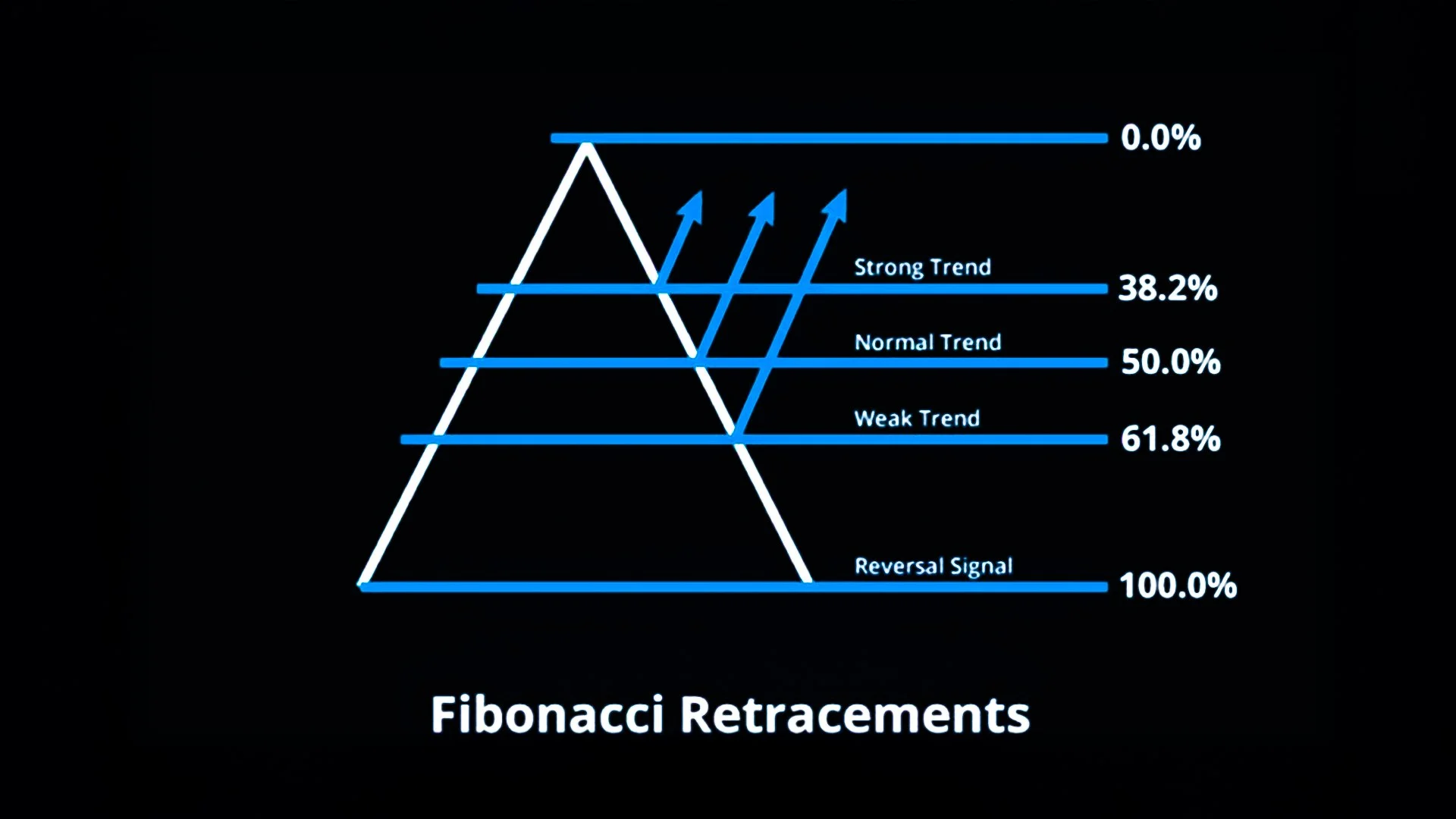

The Hidden Geometry of the Markets: How Fibonacci Retracements & Extensions Guide Smart Forex Traders

In Forex trading, price movements often look chaotic at first glance—but beneath the surface lies a rhythm that many traders rely on for clarity.

How Wars, Sanctions, and Trade Tensions Shape Currency Markets: A Forex Perspective

In the complex world of Forex trading, geopolitical events like wars, sanctions, and trade tensions can significantly impact currency values. Investors often view such events as signals of risk or uncertainty, prompting shifts in capital flows and altering the demand for various currencies.

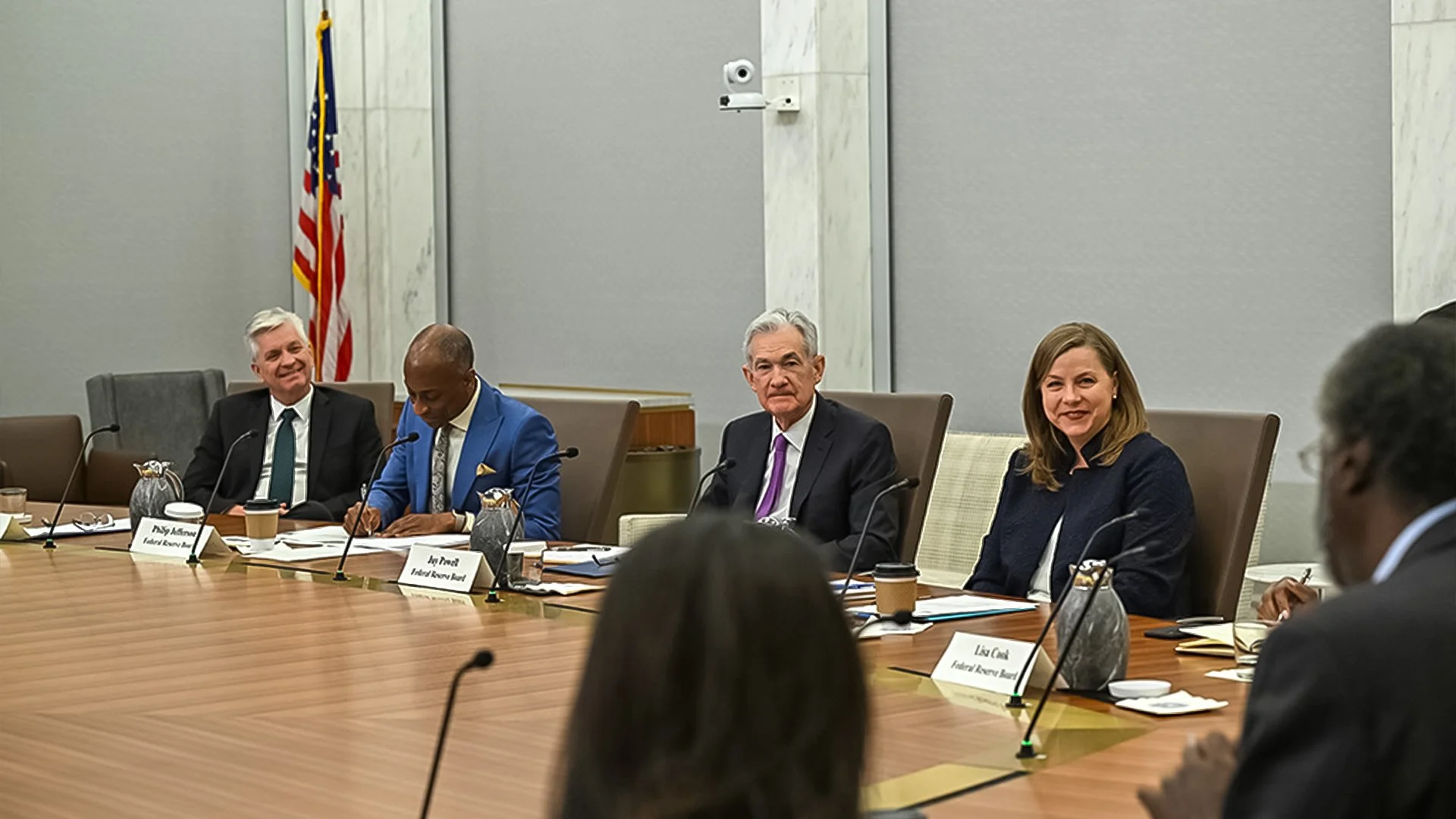

Trading Around Central Bank Announcements: FOMC, BOE, ECB, and BOJ Insights for Forex Traders

In the world of Forex trading, few events move the markets as dramatically as central bank announcements.

Three Forex Trade Setups to Watch as Trump’s Canada Tariff Threat Shakes the Markets

The forex market thrives on movement — and few things move currencies like politics. When former U.S. President Donald Trump threatened to slap a 10% tariff increase on Canadian imports for “not pulling down a critical ad sooner,” traders didn’t just see a headline — they saw an opportunity.

The Hidden Driver of Currency Strength: Understanding Interest Rate Differentials in Forex Trading

When people first enter Forex trading, they often focus on charts, indicators, and patterns. But behind every sharp move in currency pairs like EUR/USD, GBP/JPY, or USD/CAD, there’s one powerful fundamental factor — interest rate differentials.

Turning Dates into Profits: How to Read Economic Calendars and Use Them in Your Forex Strategy

In the fast-moving world of Forex trading, knowing when key economic events happen can make or break a trade. For many beginners, it’s easy to get caught up in charts and price action — but one tool often overlooked is the economic calendar. This calendar is your roadmap to understanding what drives currencies like the USD, EUR, GBP, JPY, or CAD.

Mastering USD Pair Trading Strategies: How to Trade the World’s Most Powerful Currency

In the world of Forex, one currency stands above all — the US Dollar (USD). It’s the benchmark for global trade, the safe haven during uncertainty, and the most traded currency across all major pairs. Whether you’re watching EUR/USD, USD/JPY, or GBP/USD, the USD’s movement often drives the rest of the market.

Money Supply & Quantitative Easing: How Central Banks Shape Forex Markets

Have you ever wondered why the value of the US Dollar rises one day and falls the next, or why EUR/USD seems to move with the blink of an eye? A big part of the answer lies in money supply and quantitative easing (QE)—tools that central banks use to manage economies. For Forex traders, especially beginners, understanding these concepts is crucial because they directly influence currency values and market trends.