Trading Around Central Bank Announcements: FOMC, BOE, ECB, and BOJ Insights for Forex Traders

Understanding the Power of Central Bank Decisions

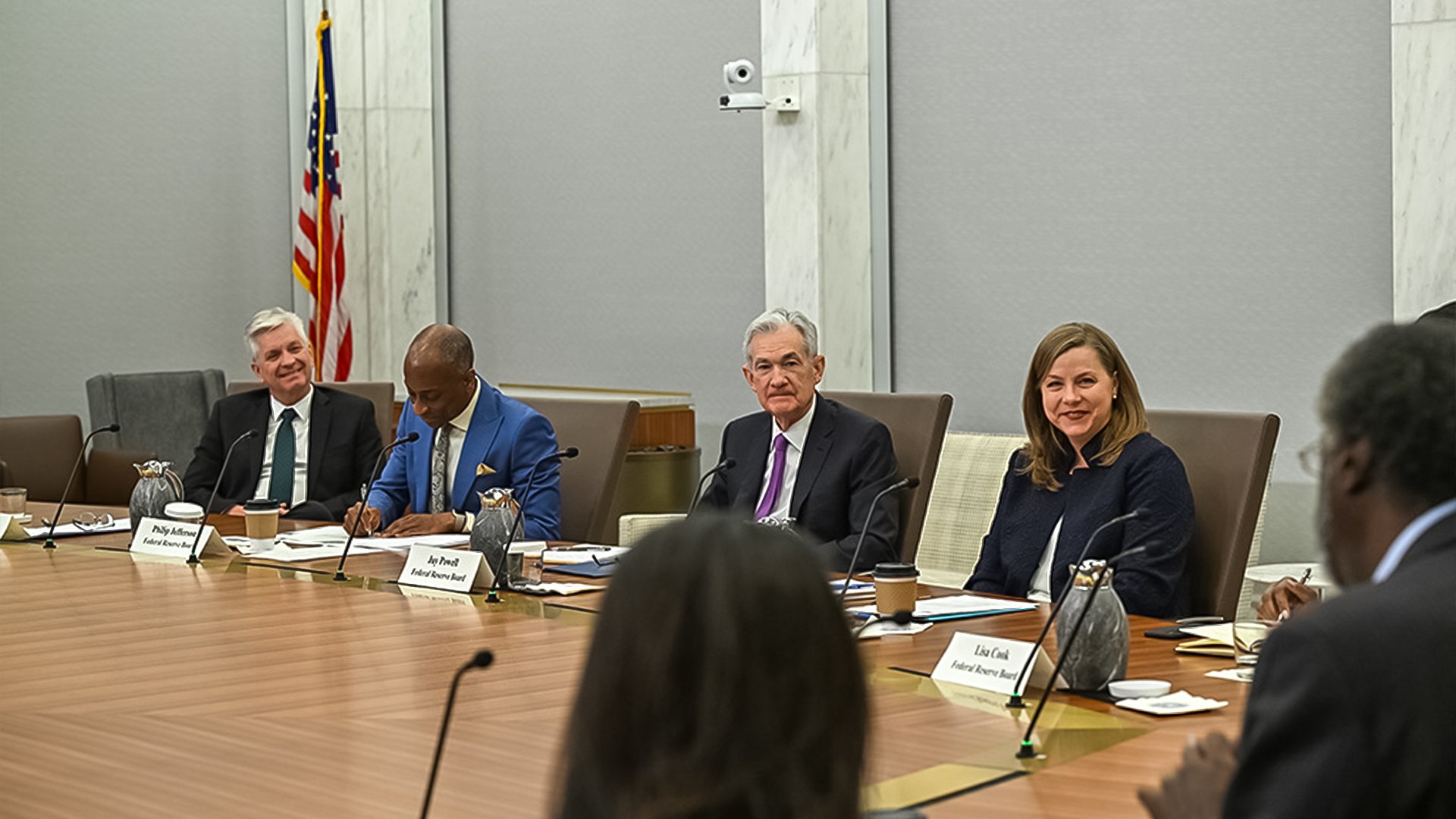

In the world of Forex trading, few events move the markets as dramatically as central bank announcements. The monetary policy decisions and guidance issued by institutions such as the Federal Reserve (FOMC), Bank of England (BOE), European Central Bank (ECB), and Bank of Japan (BOJ) can create rapid price swings in major currency pairs, offering both opportunities and risks for traders.

Central banks influence market expectations for interest rates, inflation, and economic growth, all of which are closely tied to currency valuations. For example, a surprise interest rate hike by the Federal Reserve typically strengthens the USD, impacting pairs like EUR/USD, GBP/USD, and USD/JPY. Conversely, dovish statements signaling slower growth or potential rate cuts can weaken the currency.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Why Central Bank Announcements Matter

Forex markets react to three main components of central bank communications:

Rate Decisions – Changes in interest rates directly impact a currency’s attractiveness to investors. Higher rates tend to attract foreign capital, boosting demand for that currency.

Forward Guidance – Central banks often provide projections for future economic conditions, which shape market expectations for upcoming policy actions.

Economic Commentary – Statements about inflation, employment, or growth provide insight into how central banks perceive the economy, influencing sentiment and market positioning.

For instance, when the ECB’s Luis de Guindos recently noted that Eurozone growth remains positive but very low, traders quickly adjusted their positions in EUR/USD based on expectations of cautious monetary policy. Similarly, BOJ announcements around quantitative easing or rate adjustments can influence USD/JPY volatility.

Trading Strategies Around Announcements

Trading around central bank events requires preparation and a clear strategy:

Pre-Announcement Positioning: Many traders monitor economic indicators and central bank signals in advance to gauge market expectations. Positioning too aggressively before the announcement can be risky due to unexpected outcomes.

Straddle Strategy: This involves placing trades both above and below a price range to capture volatility, a technique often used around FOMC statements.

Wait-and-React: Some traders prefer to wait until after the announcement to trade, using the market’s initial reaction to confirm trends. This approach can reduce exposure to slippage and sudden spikes.

Correlation Awareness: Central bank announcements affect not only domestic currency pairs but also cross-currency pairs. For example, a Fed rate hike can influence GBP/USD and EUR/JPY, requiring traders to monitor multiple pairs simultaneously.

Understanding historical market responses to announcements is crucial. For example, unexpected rate hikes often lead to sharp USD appreciation, while dovish signals can trigger broad market sell-offs.

Risk Management During High Volatility

Central bank events are high-volatility periods, and risk management is essential:

Use Stop-Loss Orders: Protect positions from sudden reversals by setting well-planned stop-loss levels.

Limit Leverage: High leverage can amplify losses during sudden swings, so reduce exposure around announcement times.

Position Sizing: Adjust the size of trades to account for potential volatility spikes.

By applying disciplined risk management, traders can take advantage of central bank announcements without exposing themselves to catastrophic losses.

The Role of Education and Analysis

For beginners and seasoned traders alike, understanding the mechanics behind FOMC, BOE, ECB, and BOJ announcements is key. Educational platforms like GME Academy (Global Markets Eruditio) teach traders how to integrate macroeconomic news, central bank policy, and real-world market data into actionable Forex strategies.

Following announcements closely allows traders to anticipate potential swings in pairs like EUR/USD, USD/JPY, GBP/USD, and USD/CAD, while learning how global events interconnect with domestic currency movements.

Bottom Line

Central bank announcements are among the most influential events in Forex markets, driving short-term volatility and shaping long-term trends. Traders who understand how to read rate decisions, guidance, and economic commentary can turn these events into trading opportunities.

Whether you are trading USD, EUR, GBP, JPY, or other currency pairs, learning to navigate central bank announcements is essential for successful Forex trading.

Join Our FREE Forex Workshop

At GME Academy, we provide practical training for Forex trading for beginners and advanced strategies using real-world economic and central bank news. Learn how to trade major currency pairs like EUR/USD, USD/JPY, and GBP/USD around FOMC, BOE, ECB, and BOJ announcements, turning economic developments into actionable trading insights