The Volatility Shield: Why ATR is the Ultimate Stop-Loss Tool for Forex Traders

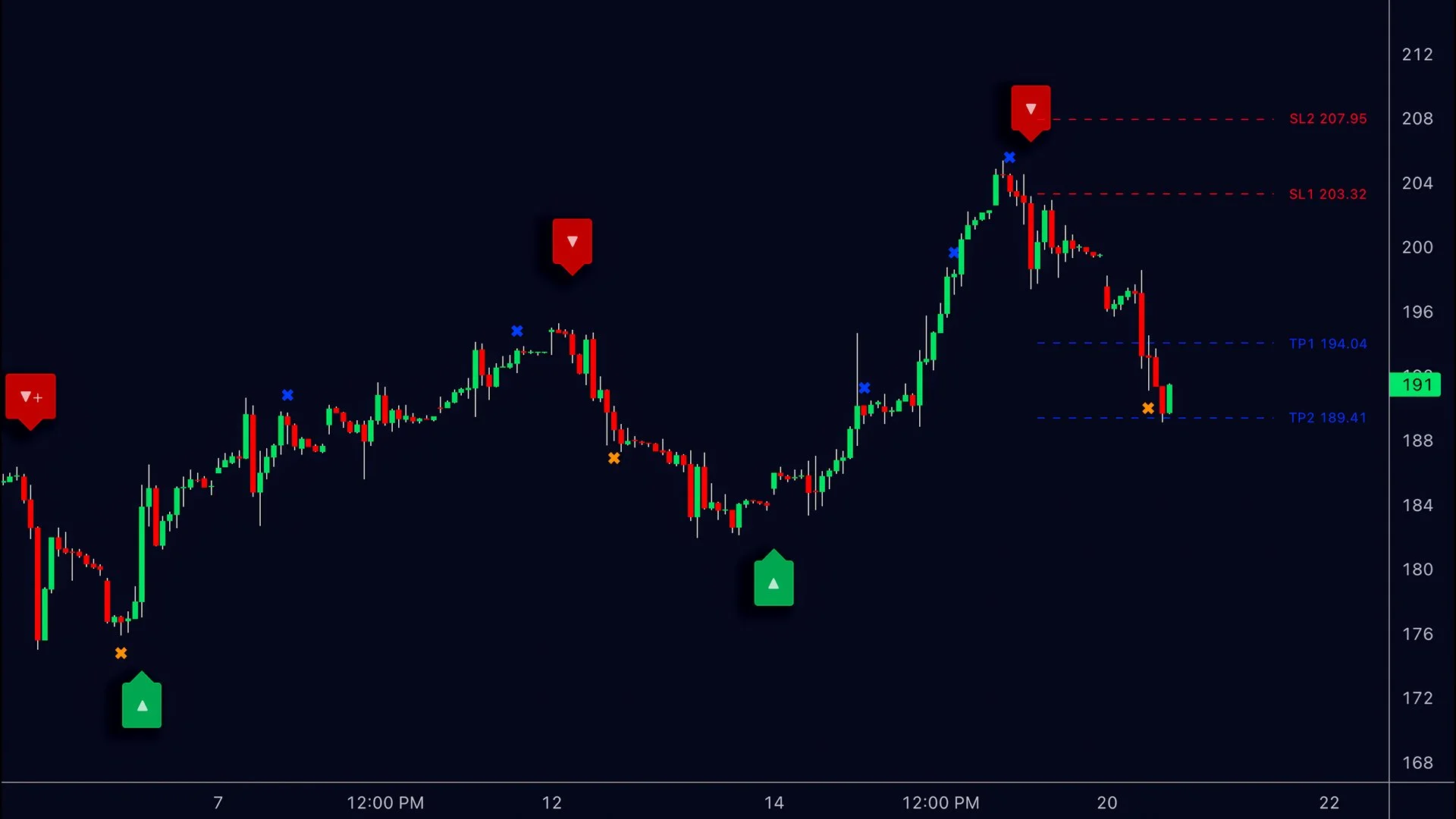

In the world of Forex Trading, one of the most heartbreaking experiences for a beginner is the "Stop-Out-then-Rally." You enter a perfect trade on the EUR/USD, set a tight stop-loss, get knocked out by a random price spike, and then watch in frustration as the market heads exactly where you predicted—without you.

This happens because most traders use "static" stop-losses—fixed pip amounts that don't account for the market's current "mood." At Global Markets Eruditio, we teach our students that the market is a living, breathing entity. To survive, your risk management must be as dynamic as the market itself. This is where the Average True Range (ATR) indicator becomes your greatest ally.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

What is ATR? Measuring the Market's "Breath"

Developed by J. Welles Wilder Jr., the Average True Range (ATR) is a volatility indicator that shows how much a currency pair moves, on average, over a specific period (usually 14 days).

Unlike other indicators, ATR doesn't tell you the direction. Instead, it tells you the magnitude of price action.

A high ATR means the market is "lively" or volatile (think GBP/JPY during a Bank of Japan announcement).

A low ATR means the market is "quiet" or consolidating (think USD/CAD during a holiday session).

Why Fixed Stop-Losses Fail

Imagine setting a 20-pip stop-loss on the USD/JPY. If the pair's ATR is currently 15 pips per hour, a 20-pip stop is perfectly reasonable. However, if the ATR jumps to 50 pips due to a shift in US Dollar sentiment, that 20-pip stop is now "inside the noise." You are almost guaranteed to be stopped out by normal market fluctuations.

By using an ATR-based stop-loss, you are essentially giving your trade enough "breathing room" to survive the noise while still protecting your capital from a true trend reversal.

The Strategy: How to Calculate a Volatility-Based Stop

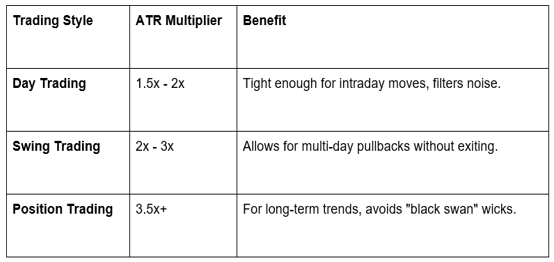

Professional traders often use a multiplier of the ATR to set their stops. A common standard at GME Academy is the 2x ATR rule.

The Formula:

For Long Positions: Stop Loss = Entry Price - (ATR \times Multiplier)

For Short Positions: Stop Loss = Entry Price + (ATR \times Multiplier)

Example:

You want to go long on EUR/USD at 1.0850. You check the ATR (14-period) on your daily chart and see it is currently 0.0060 (60 pips).

Using a 2x multiplier: 60 X 2 = 120 pips.

Your stop-loss would be placed at 1.0730 ($1.0850 - 0.0120$).

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Moving with the Market: The ATR Trailing Stop

The ATR isn't just for your initial entry. As your trade moves into profit, you can use the ATR to "trail" your stop. If the US Dollar begins to trend strongly and volatility drops, the ATR will decrease, allowing your trailing stop to tighten automatically and lock in more profit.

This is the foundation of the Chandelier Exit, a famous strategy where the stop-loss "hangs" from the highest high (for longs) at a distance of 3x ATR. As the high moves up, your stop moves up with it.

The GME Academy Edge: Context and Discipline

While the ATR is a powerful tool, it is part of a larger ecosystem of "erudition" we practice at Global Markets Eruditio. We teach our students to combine ATR with Market Structure. For instance, if your 2x ATR stop-loss sits right in the middle of a major support zone, it’s often wise to "nudge" it just below that zone for extra protection.

For those engaging in Forex Trading for Beginners, the ATR removes the emotional guesswork. You no longer ask, "Where feels safe?" Instead, you ask, "What is the market's current volatility telling me is safe?"

Tired of being "hunted" by market noise? Learn to set stops that actually work.

Join our FREE Forex workshop today and master professional risk management with GME Academy!