The "Institutional Magnet": Why VWAP and Anchored VWAP Are the Ultimate Truth-Tellers in Forex

In the high-stakes world of Forex Trading, most retail traders are taught to look at simple price averages—lines that tell you where the market was. But institutional giants, the ones who move trillions in US Dollar and Euro liquidity every day, don’t look at price alone. They look at Value.

To find value, you must look at VWAP (Volume-Weighted Average Price). If price is the advertisement, volume is the money that backs it up. At Global Markets Eruditio, we believe that understanding the "Institutional Magnet" is what separates a guessing game from a professional strategy. For those just starting their journey in Forex Trading for Beginners, mastering these tools is like learning to read the footprints of the world's largest banks.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

What is VWAP? The "Fair Value" Baseline

VWAP is a technical indicator that calculates the average price of a currency pair, weighted by the volume of trades at each price level. Unlike a Simple Moving Average (SMA), which treats a 1-lot trade the same as a 1,000-lot trade, VWAP gives more weight to the prices where the most money changed hands.

In the Forex market, VWAP acts as a benchmark for "Fair Value" for the current trading session.

Above VWAP: The market has a bullish bias; buyers are willing to pay a premium.

Below VWAP: The market has a bearish bias; sellers are dominating.

Institutional traders use VWAP to execute large orders without "moving the market." If a hedge fund wants to buy a massive amount of CAD (Canadian Dollar), they will try to buy as close to or below the VWAP as possible to ensure they aren't overpaying compared to the rest of the market.

The Power of "Anchoring": Mastering the Anchored VWAP

While the standard VWAP resets every single day, the Anchored VWAP (AVWAP) gives you the power of a time machine. It allows you to "anchor" the calculation to a specific, significant event—like a major news release, a high-impact Fed announcement, or a swing high/low.

Why does this matter for Forex Trading? Because markets have "memory."

Imagine the EUR/USD crashes following a surprise interest rate hike. By anchoring your VWAP to the exact minute of that news release, you can see the average price paid by every single trader since that shift in sentiment. This line becomes a "dynamic" level of support or resistance that carries much more weight than a random line on a chart.

3 Ways to Use VWAP in Your Daily Routine

1. The "Mean Reversion" Magnet

Price has a natural tendency to return to the VWAP. If the US Dollar (USD) overextends too far from its VWAP during the London session, it often "snaps back" to the average during the New York open. Traders look for these "stretched" conditions to catch the move back to fair value.

2. Spotting Institutional Defense

When a major currency pair like USD/JPY trends strongly, institutions will often "defend" their average price. If you see price pull back to a daily VWAP or an Anchored VWAP and immediately start to consolidate or "bounce," you are likely seeing institutional algorithms adding to their positions.

3. Filtering False Breakouts

For Forex Trading for Beginners, "fakes" are the enemy. VWAP helps you filter these. A breakout above a resistance level that occurs below the VWAP is often weak and prone to failure. However, a breakout that occurs with price sustained above a rising VWAP indicates strong, volume-backed momentum.

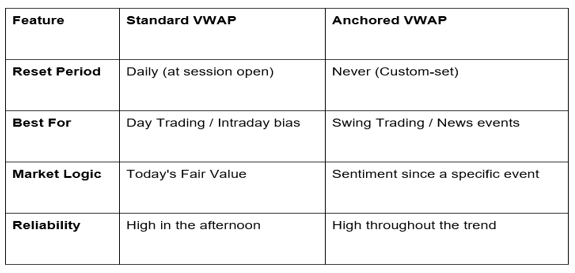

Comparing the Tools: Standard vs. Anchored

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The "Erudition" Edge: Beyond the Indicator

At GME Academy, we teach that indicators don't trade the market—traders do. VWAP and Anchored VWAP are not magic wands; they are tools that reveal Market Structure and Auction Theory. When you combine a 3.4% Australia CPI print with an Anchored VWAP on the AUD/USD, you aren't just looking at a line; you are looking at the collective psychology of every trader in the world.

Mastering the volume-weighted average is the first step toward stop thinking like a retail "gambler" and start thinking like a market "liquidator."

Stop guessing where the market will turn. Start seeing where the money is actually moving.

Join our FREE Forex workshop today and learn the professional secrets of VWAP and Anchored VWAP with GME Academy!