The Great Cooling: UK Inflation Tumbles to 3.2% as Food and Alcohol Prices Ease

The UK economy received a significant pre-Christmas boost as official data revealed that CPI inflation fell more sharply than expected in November 2025.

The UK Job Market’s Warning Flare: Rising Unemployment and Falling Payrolls Confront Stubborn Pay Growth

The UK labour market overview for December 2025 delivered a decisive yet complex signal to the Bank of England (BoE), characterized by a clear slowdown in hiring and rising joblessness, even as wage growth remains stubbornly high in nominal terms

China’s Consumption Crisis Deepens: Retail Sales Plunge to 1.3%, Sounding Alarm for Global Growth

China’s transition to a consumption-led economy suffered a major setback in November, as official data revealed a sharp deceleration across key economic pillars. Retail sales growth collapsed to just 1.3% year-on-year, significantly missing market estimates of 2.9% and falling sharply from the prior month's 2.9%.

Red Flag Raised: US Initial Jobless Claims Surge by 44,000, Sounding a Major Alarm for the Fed and the USD

The U.S. labor market just delivered a sharp shock: initial jobless claims for the week ending December 6 surged by a massive 44,000 to 236,000 (seasonally adjusted), a level far exceeding market expectations.

The Dovish Cut, The Divided Vote: Fed Lowers Rates to 3.5%-3.75% as Employment Risks Mount

The Federal Open Market Committee (FOMC) concluded its December 2025 meeting by delivering a widely anticipated 1/4 percentage point (25 basis point) rate cut, moving the Federal Funds Rate target range to 3-1/2 to 3-3/4 percent.

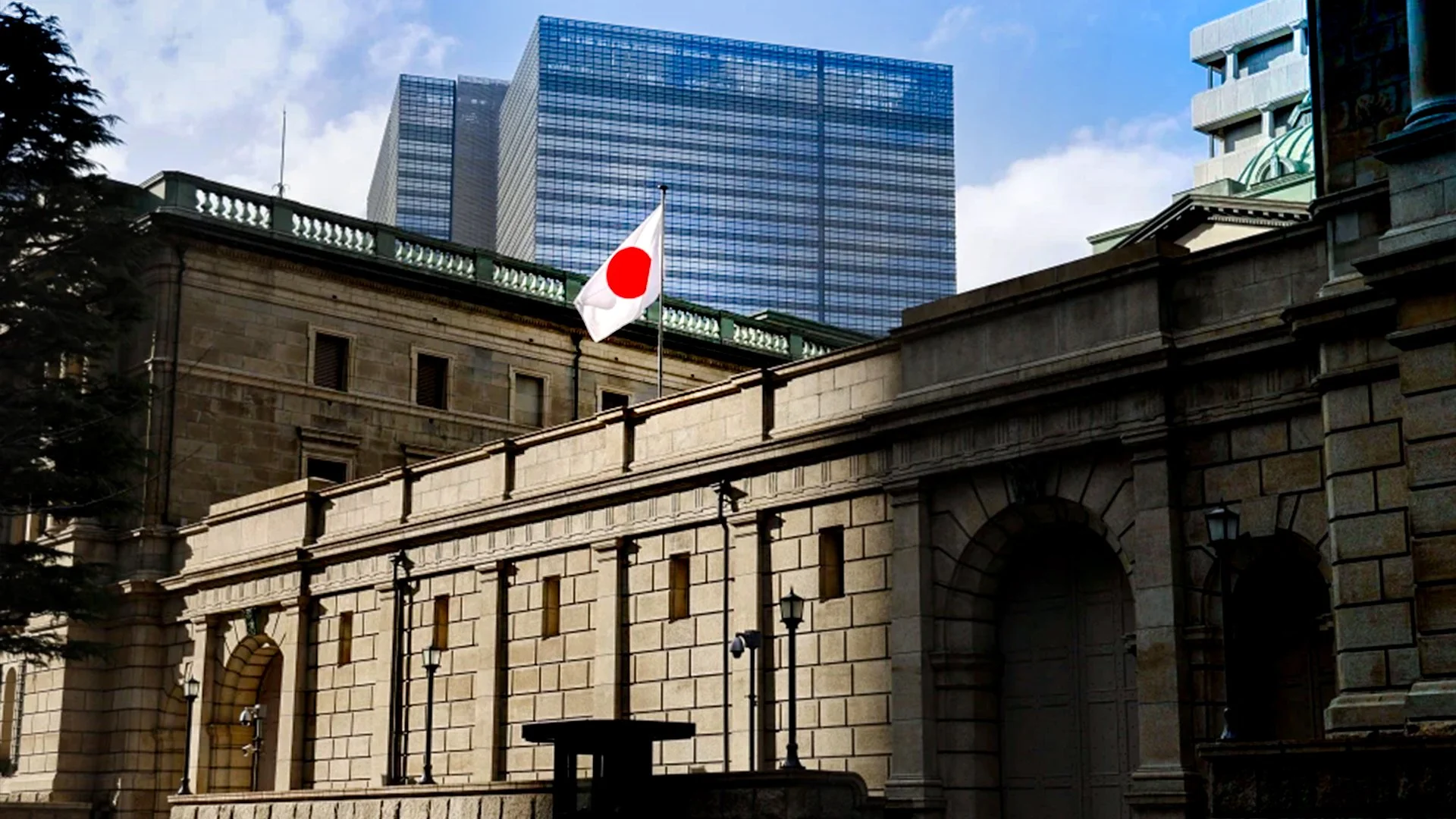

Yen Alert: BOJ's Ueda Confirms Q4 Growth Rebound and Durable Inflation, Bolstering Rate Hike Bets

Bank of Japan (BOJ) Governor Kazuo Ueda has delivered a notably optimistic assessment of the Japanese economy, stating he "believe[s] that the economy will go back to positive growth in Q4 and beyond that.

The Hawk Speaks: ECB's Schnabel Signals Comfort with Rate Hike Bets, Boosting the Euro

European Central Bank (ECB) Executive Board member Isabel Schnabel, a known hawk, has rattled markets by stating she is "rather comfortable" with investor bets that the central bank's next move will be a rate hike, not a cut. Citing a resilient economy and stalled core inflation, her comments introduce significant upside risk to the EUR/USD currency pair and push back the prevailing market narrative of an inevitable easing cycle.

JPY Shockwave: Is the BOJ Finally Ready to End an Era?

The Bank of Japan is now highly likely to raise interest rates at its December meeting, according to Reuters sources. Crucially, the move has the Japanese government's tolerance, removing a major political hurdle to normalizing monetary policy and signaling an end to the decades-long zero-rate era. This shift introduces massive volatility for the Japanese Yen (JPY) and global capital flows.

The Labor Market Cracks: ADP Report Reveals 32,000 Job Loss, Rocking the USD

The release of the November 2025 ADP National Employment Report delivered a profound shock to the market. Private employers did not just slow hiring; they actively cut 32,000 jobs, marking the weakest monthly performance since the acute disruptions of the post-pandemic era. This figure stood in stark contrast to consensus forecasts, which had generally anticipated a modest gain in employment.

Political Inferno: Trump Targets the Fed Chair and Promises Tariff Refunds

President Trump has once again put the Federal Reserve and his economic agenda squarely in the spotlight, confirming his intent to name a successor to current Fed Chair Jerome Powell in early next year. The announcement, which comes months before the current Chair's term expires, is clearly coupled with the President's explicit demand that the new Fed leader should "reduce rates."

US Factory Floor Flashes Red: ISM Manufacturing PMI Drops, Fueling Rate Cut Bets

The Institute for Supply Management’s (ISM®) November 2025 Manufacturing PMI® report delivered a sobering message to markets: the factory sector is weakening, and contraction is deepening. The headline figure of 48.2%—a 0.5 percentage point drop from October—marks the ninth consecutive month of contraction for the manufacturing industry.

The Fed Reveal: Trump Confirms Choice for New Chair, Signaling Aggressive Rate Cuts

President Donald Trump announced on Sunday that he has made his final decision regarding the next Chairman of the Federal Reserve, confirming he knows his pick but declining to name the individual. The impending announcement of the new nominee, who will succeed current Fed Chief Jerome Powell when his term expires in May 2026, has already intensified speculation about the future direction of U.S. monetary policy.

The Looming Pivot: Can Kevin Hassett Steer the Fed to Lower Rates?

The question of who will lead the Federal Reserve, the world's most influential central bank, is arguably the most significant piece of financial news for the global economy.

UK Chancellor Reeves Unveils Budget Plan: Inflation Targeted, Investment Secured, and Borrowing on the Decline

In a major fiscal announcement, UK Chancellor Reeves outlined the government’s budgetary roadmap, emphasizing economic stability, investment continuity, and a commitment to controlling inflation.

Yen Worries Force BOJ’s Hand: Rate Hike Bets Surge for December

The Bank of Japan (BOJ) is actively preparing markets for a potential interest rate increase at its upcoming December policy meeting, according to market sources.

Fed Divide Deepens: Daly Calls for December Rate Cut Citing 'Vulnerable' Job Market Risk

Federal Reserve Bank of San Francisco President Mary Daly has significantly amplified the growing debate within the central bank, making a forceful case for an interest-rate cut in December.

The US Economy's Double-Edged Sword: Faster Growth Meets Fraying Price Stability

The latest economic signals from the United States have delivered a potent mix for global markets: accelerating economic expansion paired with an unwelcome intensification of price pressures.

U.S. Labor Market Stalls: What the September 2025 Employment Report Means for the Dollar and Forex Traders

The latest Employment Situation Summary for September 2025 is finally out—six weeks late due to the U.S. federal government shutdown—and the data paints a picture of a U.S. economy that’s slowing, cooling, and showing signs of strain.

Federal Reserve Rate Cut: What It Means for Forex Traders and the US Dollar

The Federal Reserve made waves in financial markets with its October 28–29, 2025 FOMC meeting, lowering the federal funds rate by 25 basis points to 3.75–4 percent.

BOE’s Pill Signals Caution: UK Underlying Inflation Still Stronger Than It Appears

Bank of England (BOE) Governor Jonathan Pill has issued a note of caution to markets and policymakers, highlighting that underlying inflation dynamics in the UK remain higher than headline figures suggest.