The Trader's Crystal Ball: How the PMI Predicts Currency Movement

For traders and analysts seeking an early read on the global economy, the Purchasing Managers’ Index (PMI) is an indispensable tool. Released monthly, the PMI is a snapshot of current business conditions, derived from a survey of senior executives—the purchasing managers—who are often the first to feel changes in demand and supply.

Trade Deficits vs. Surpluses: Unpacking the Balance of Trade's Currency Impact

In the complex ecosystem of international finance, few economic indicators hold as much sway over a nation's currency as the Balance of Trade. This simple yet powerful metric, representing the difference between a country's exports and imports over a period, offers a snapshot of its economic health, global competitiveness, and its net flow of goods and services with the rest of the world.

From Red to Recovery: Mastering the Psychology of Trading Drawdowns

In the unforgiving world of financial markets, the phrase "drawdown" often sends shivers down a trader's spine. A drawdown is simply the peak-to-trough decline in an investment, trading account, or fund during a specific period.

Diversification in Forex vs. Stocks, Crypto, and Gold: Which Strategy Works Best for You?

Investing isn’t just about picking one winning asset and hoping for the best. Smart investors know the power of diversification—spreading your money across different types of investments to reduce risk and improve potential returns

Navigating the Forex Tempest: How Savvy Traders Hedge Their Bets

The unpredictable currents of the Forex market can be both exhilarating and daunting. For those engaging in Forex trading, especially Forex trading for beginners, understanding how to mitigate risk is not just smart—it's essential for long-term survival and success.

Unlock the Trading Code: The Exponential Power of Compounding and Position Scaling in Forex

In the high-stakes world of Forex trading, success isn't just about picking the right direction—it's about how you manage your capital and your trade size. For anyone dipping their toes into Forex Trading for Beginners, two concepts stand out as essential pillars for long-term growth: compounding profits and position scaling.

Master the Market Math: Calculating Risk-Reward Ratio Like a Pro

In the world of Forex Trading, successful long-term outcomes aren't solely determined by how often you win, but rather by how much you win when you are right versus how much you lose when you are wrong.

The Secret Language of Charts: How Triangles, Flags, and Double Tops Help You Predict the Market

Chart patterns may look like random zigzag lines, but for many Forex traders—especially Forex Trading for Beginners—they serve as a roadmap. These patterns can hint at where the market might go next. Whether you trade EUR/USD, USD/JPY, GBP/JPY, or any other major currency pair, recognizing chart patterns gives you a major edge.

Candlestick Secrets: The Chart Patterns Every Forex Trader Must Master

Candlestick patterns are the language of price. Before indicators, before trading systems, and before advanced tools, traders first learned to read the story unfolding on their charts.

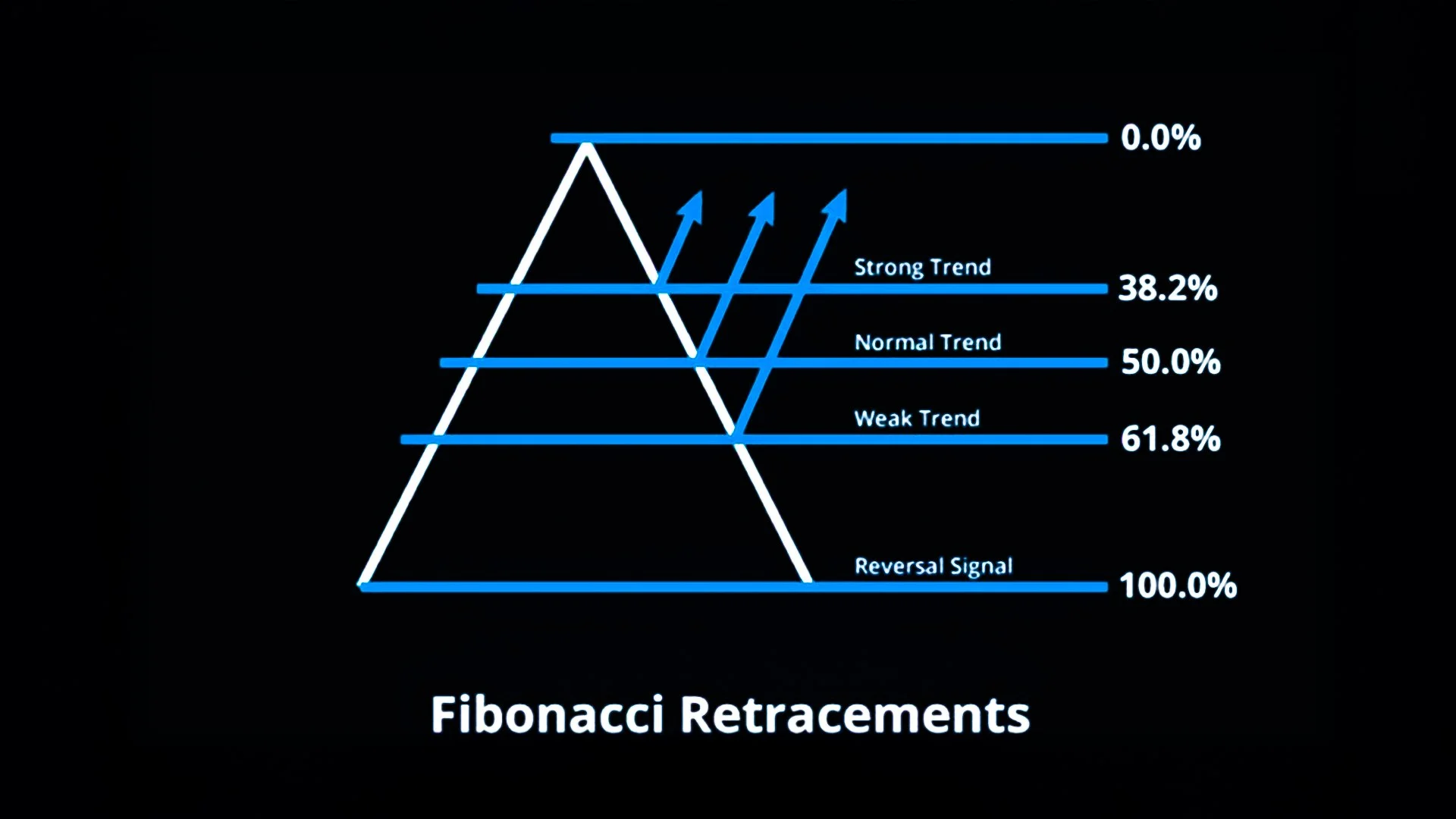

The Hidden Geometry of the Markets: How Fibonacci Retracements & Extensions Guide Smart Forex Traders

In Forex trading, price movements often look chaotic at first glance—but beneath the surface lies a rhythm that many traders rely on for clarity.

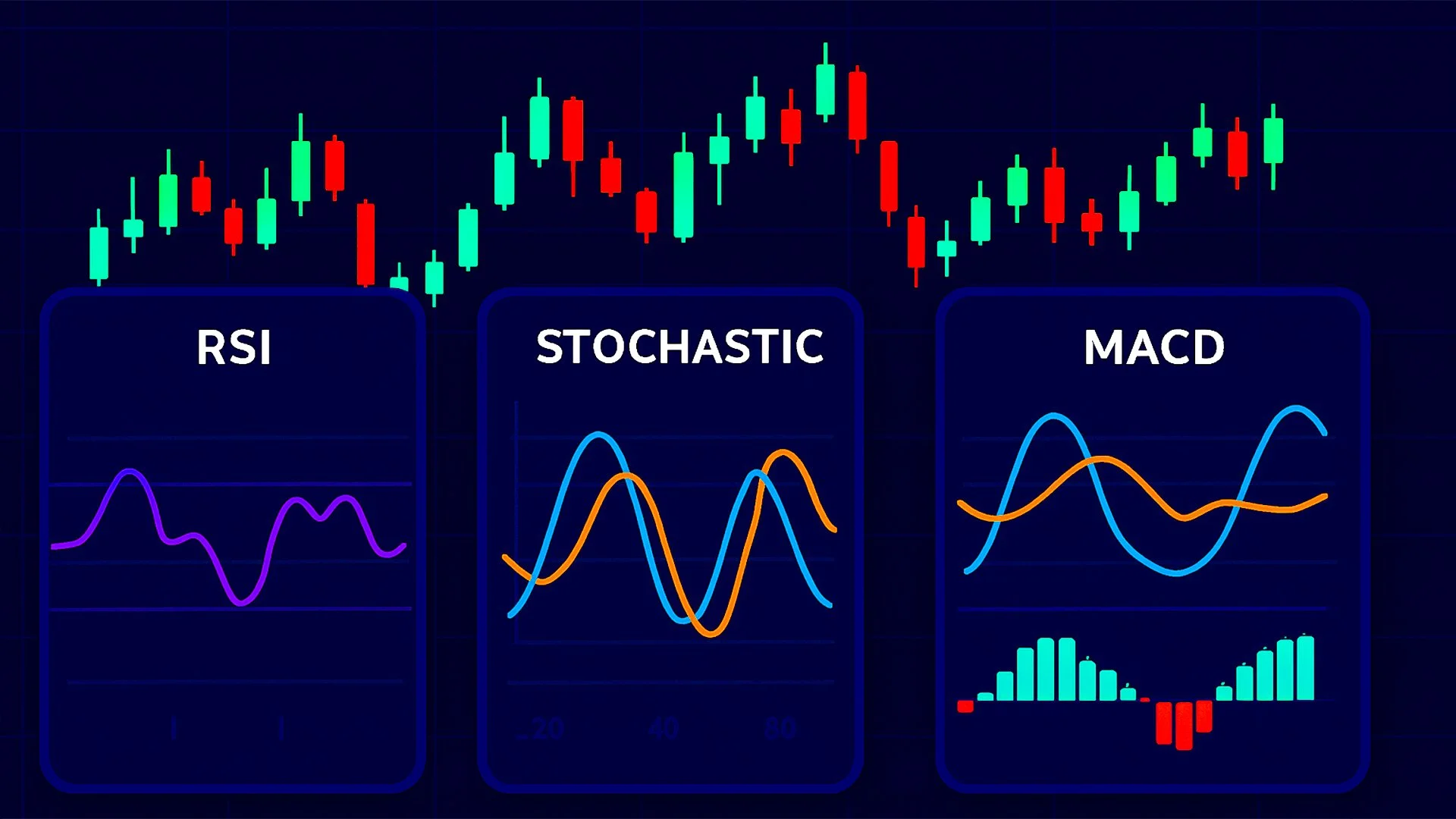

RSI, MACD, and Stochastic: Momentum Indicators Every Forex Trader Should Know

If you’re venturing into Forex trading, understanding market momentum is key to spotting opportunities before others do. Momentum indicators are technical tools that help traders gauge the strength of a currency pair’s price movement and anticipate potential reversals.

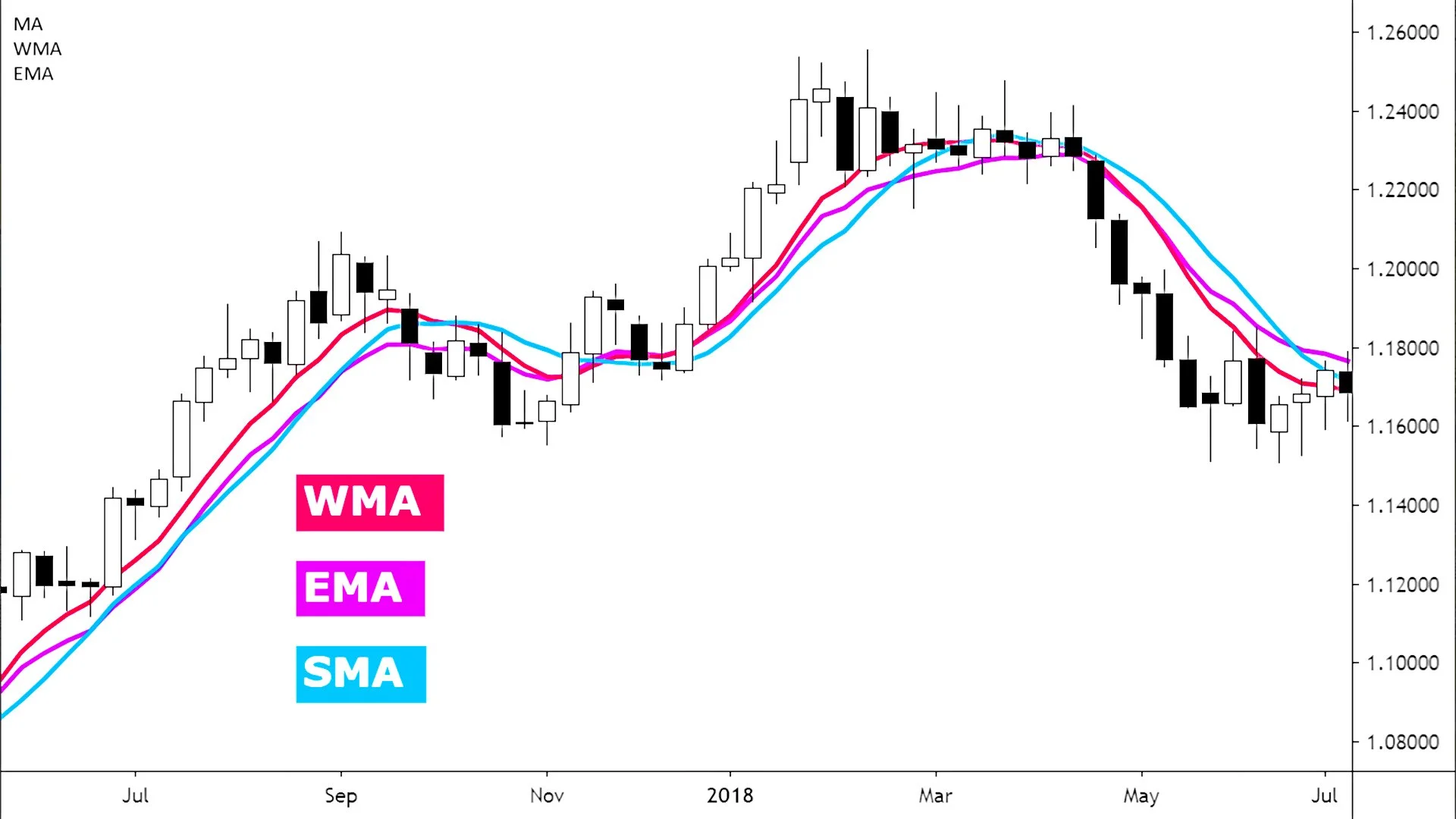

Understanding Moving Averages: SMA, EMA, and WMA for Smarter Forex Trading

If you’re starting in Forex trading, one of the most common tools you’ll encounter is the moving average. Whether you’re analyzing the EUR/USD, GBP/JPY, or USD/CAD, moving averages help traders identify trends, spot potential reversals, and make more informed decisions.

How Geopolitical Risk Fuels Market Volatility: A Forex Trader’s Guide

Global events don’t just make headlines—they move markets. For Forex traders, understanding geopolitical risk is crucial because it directly impacts currency values, market sentiment, and trading strategies.

Understanding Safe Haven Currencies: How USD, JPY, CHF, and Gold Protect Traders in Volatile Markets

In the ever-changing world of Forex trading, understanding the concept of safe-haven assets is crucial. These are currencies and commodities that investors turn to in times of economic uncertainty, political tension, or global market turbulence.

How Wars, Sanctions, and Trade Tensions Shape Currency Markets: A Forex Perspective

In the complex world of Forex trading, geopolitical events like wars, sanctions, and trade tensions can significantly impact currency values. Investors often view such events as signals of risk or uncertainty, prompting shifts in capital flows and altering the demand for various currencies.

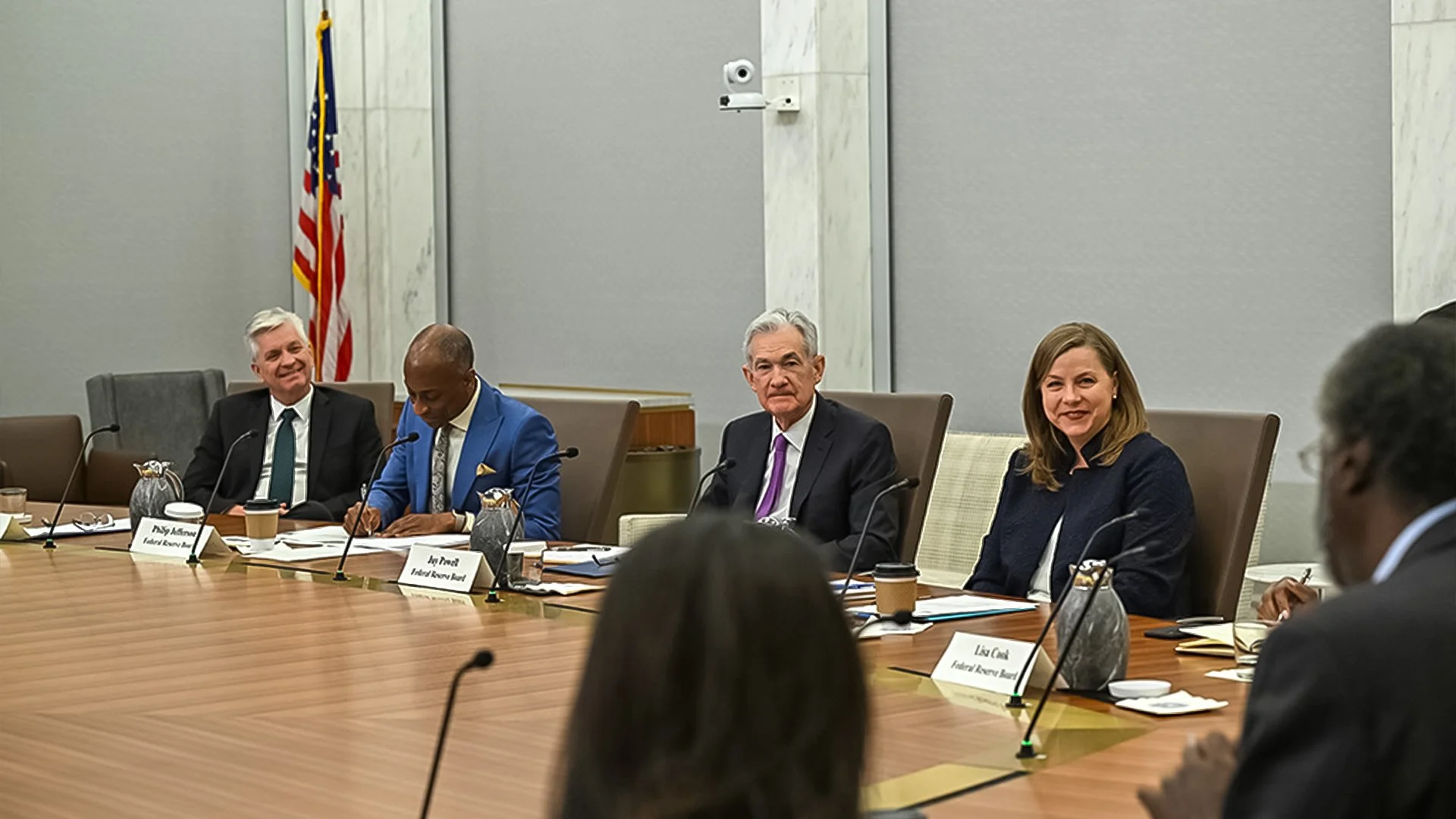

Trading Around Central Bank Announcements: FOMC, BOE, ECB, and BOJ Insights for Forex Traders

In the world of Forex trading, few events move the markets as dramatically as central bank announcements.

Elections and Forex: How Political Shifts Like Trump-Xi Meetings and Central Bank Changes Move Currency Markets

Elections are not just political milestones—they are major drivers of Forex market volatility. Traders monitor political developments closely because leadership changes and policy shifts can directly affect monetary policy, trade agreements, and international investment flows.

Never Miss a Market Move: How to Stay Updated with the Most Reliable Forex News Sources

In the fast-paced world of Forex trading, every second counts. A sudden policy shift from the U.S. Federal Reserve can send the USD soaring, while a surprise economic announcement from Japan could swing GBP/JPY in seconds.

The Trader’s Mindset: Turning Losses into Lessons

Every trader dreams of consistent profits — but the truth is, every successful Forex trader has also faced their fair share of losses.

In fact, what separates a winning trader from a losing one isn’t luck or fancy indicators — it’s mindset.

From Demo to Live: How to Master Fear and Build Discipline in Forex Trading

Transitioning from a demo account to live Forex trading is one of the biggest emotional and psychological hurdles traders face—especially for forex trading beginners.