Safe Havens in a Shifting Market: A Guide to Philippine Government Bonds

As global markets grapple with geopolitical uncertainty and local economies adjust to new growth targets, Philippine Government Bonds are re-emerging as the anchor of many local portfolios.

The Pulse of the Peso: Navigating OFW Remittance Peak and Low Months

For the Philippine economy, Overseas Filipino Worker (OFW) remittances are the ultimate "lifeblood." Accounting for nearly 8.3% of the National GDP, these billions of dollars dictate the rhythm of the local stock market and the strength of the Peso.

The Oil-Peso Connection: Why Crude Spikes Crush the Currency

In the Philippines, "Oil" and "Peso" are on opposite ends of a financial seesaw. When global crude prices soar, the Philippine Peso almost inevitably begins to slide.

Who Really Sets PHP Interest Rates—BSP or the Fed?

In the world of Philippine finance, a common question echoes from the boardrooms of Makati to the markets of Quiapo: Who is actually in the driver’s seat of our interest rates?

The Sun, the Sand, and the Spread: How Tourism Seasonality Drives the Peso

While many travelers view the Philippines as a year-round tropical paradise, the savvy Forex trader knows that the calendar is one of the most powerful indicators for the Philippine Peso (PHP).

The Silent Anchor: How the BPO Industry Controls the USD/PHP Exchange Rate

While international headlines often focus on the Bangko Sentral ng Pilipinas (BSP) or government policy, the true stabilizing force behind the Philippine Peso isn't always found in a boardroom. It’s found in the headsets and server rooms of the Business Process Outsourcing (BPO) sector.

The Race to the Bottom: Is Your Portfolio Ready for the "Invisible" Currency War?

In the world of high-stakes finance, some wars aren't fought with artillery, but with interest rates and printing presses. We are currently witnessing the resurgence of Competitive Devaluation—a phenomenon colloquially known as a "Currency War."

The Import Trap: Why the Philippines Can’t Shake Its Chronic Trade Deficit

In the fast-paced world of global commerce, the Philippines finds itself in a paradoxical position. As of early 2026, while the nation remains one of the fastest-growing economies in Southeast Asia, it continues to grapple with a persistent "Trade Gap."

The National War Chest: Understanding Foreign Reserves vs. Sovereign Wealth Funds

In the world of global finance, a nation's wealth isn't just measured by its GDP, but by the strength of its "War Chest." As of January 2026, the combined assets of global Foreign Exchange (FX) Reserves and Sovereign Wealth Funds (SWFs) have climbed to a staggering $25 trillion.

The Great Divergence: BRICS and the 2026 De-Dollarization Surge

The global financial landscape is undergoing a structural realignment that hasn't been seen since the end of World War II. As of late January 2026, the BRICS+ alliance—now a formidable bloc representing nearly half the world’s population.

The Petrodollar Pillars: How Energy Markets Anchored USD Dominance

For over half a century, the US Dollar (USD) has enjoyed an unparalleled position as the world’s primary reserve currency.

The Carry Trade: Turning Interest Rate Gaps into Trading Income

In the world of Forex Trading, most people think profit only comes from a currency's price going up or down. But there is a quieter, more institutional way to make money: the Carry Trade.

Economic Engineering: Why Countries Devalue Their Currency on Purpose

In the world of Forex Trading, we often see currencies fluctuating due to market news or economic data. However, there are times when a country decides to pull the trigger itself, deliberately lowering the value of its own money. This is known as Currency Devaluation.

The Invisible Hand: Decoding Central Bank Intervention in the 2026 Forex Market

In the high-stakes world of global finance, few phrases send a shiver down the spine of an investor quite like "Inverted Yield Curve."

When the Compass Flips: Decoding the Inverted Yield Curve as a Recession Signal

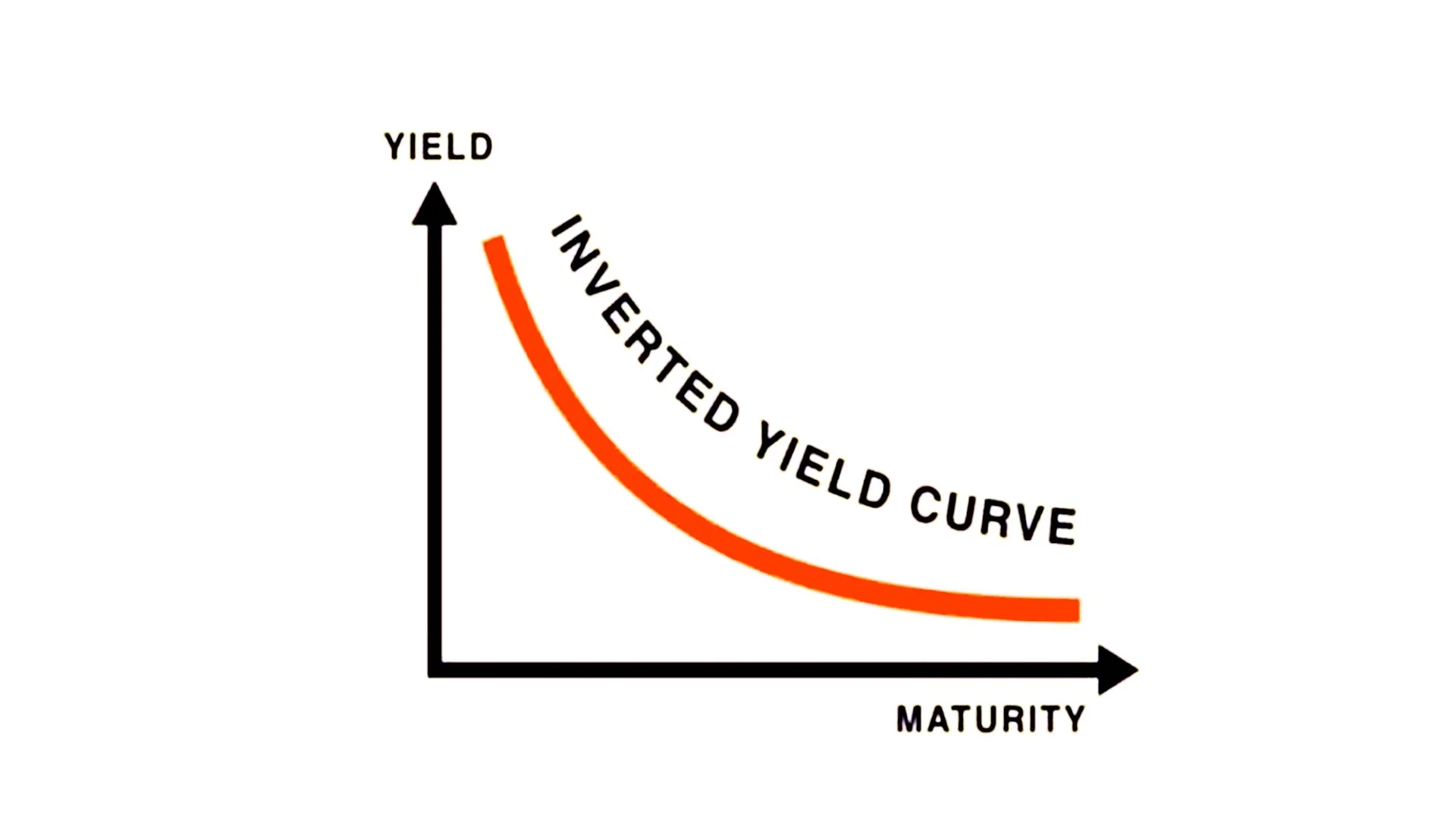

In the high-stakes world of global finance, few phrases send a shiver down the spine of an investor quite like "Inverted Yield Curve."

The Invisible Hand: Why the Bond Market is the Real Boss of Forex

To the uninitiated, the Forex market seems like a chaotic tug-of-war between headlines, central bank speeches, and flashing red and green candles.

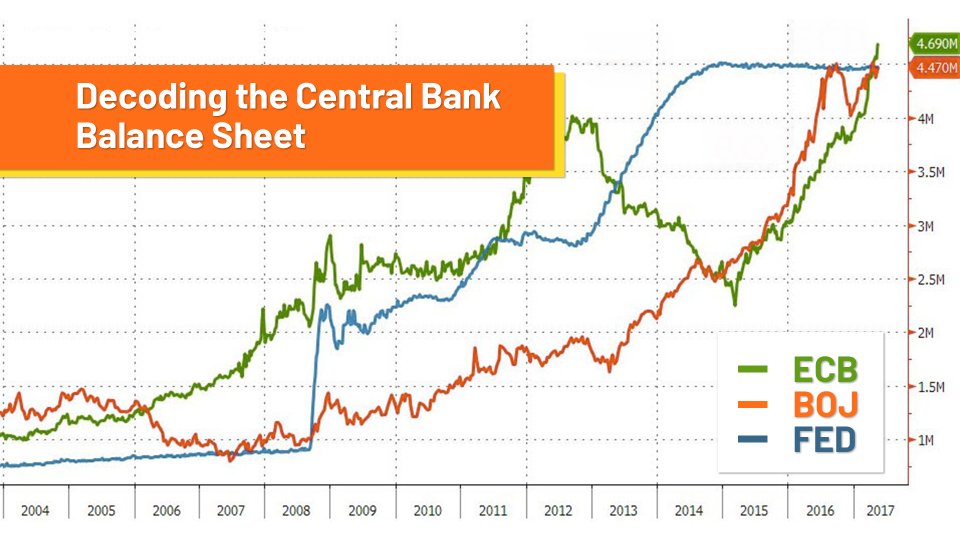

The Pulse of Nations: Decoding the Central Bank Balance Sheet

To the average observer, a central bank is often seen as a mysterious institution that simply "sets interest rates." However, the true story of a nation’s economic health is told through its financial statements.

Is Your Safety Net Too Small? Why Volatility-Based Stops Are the Secret to Longevity

Many traders enter a position on a promising currency pair, only to see their stop-loss hit by a momentary price spike before the market ultimately moves in their favor.

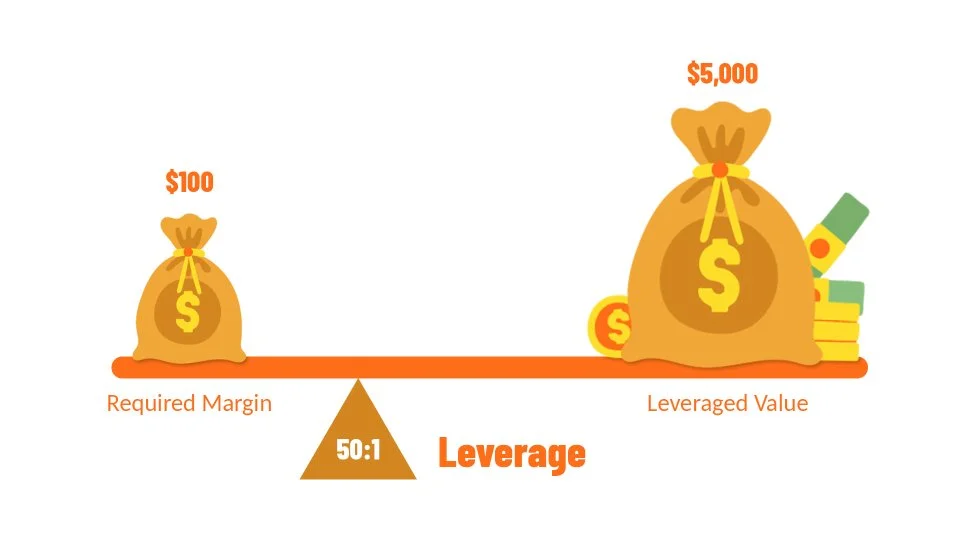

The Engine Under the Hood: How Broker Leverage Really Works

In the world of Forex trading, leverage is often described as a "loan" or a "double-edged sword." While most traders understand that a 1:100 ratio allows them to control $100,000 with just $1,000 of margin, very few understand the mechanical reality of what happens at the broker level.

The Silent Account Killer: Why "Doing Nothing" Is Sometimes the Best Trade

In the fast-paced world of Forex trading, there is a common misconception that more screen time equals more profit. For many, the itch to click "buy" or "sell" is constant. However, one of the most vital lessons taught at Global Markets Eruditio is that knowing when not to trade is just as important as knowing your entry signals.