The Imbalance Magnet: Trading Fair Value Gaps (FVG) and the Smart Money Footprint

The Fair Value Gap (FVG), often synonymous with a price imbalance or inefficiency, has become a cornerstone of modern Forex Trading strategies, particularly within the Smart Money Concepts (SMC) framework.

Unlocking the Code: Order Blocks Explained—The Institutional Footprint in Forex Trading

Tired of trading against the "Smart Money?" Order Blocks (OBs) are the foundational concept in Smart Money Concepts (SMC), representing the visible footprint left by banks and large financial institutions as they execute massive buy or sell orders

Trading the Institutional Footprint: Mastering Smart Money Concepts (SMC) for Forex Success

The vast majority of retail traders operate using technical indicators or patterns that, unfortunately, are often exploited by large financial institutions—the "Smart Money." These large banks, hedge funds, and market makers create market movements, often pausing just long enough to trap retail traders before making the decisive move.

The Unbreakable Link: How Bond Yields Dictate Currency Correlation in Forex Trading

The global Forex market operates on the perpetual movement of capital seeking the highest safe return. In the world of finance, the safest return is typically offered by sovereign bonds—debt issued by governments, such as U.S. Treasuries, German Bunds, or Japanese Government Bonds (JGBs).

Decoding the Checkout: Why Retail Sales Are the Forex Market’s Loudest Whisper

The concept of Retail Sales is simple: it measures the total receipts from merchandise sold by retail businesses over a defined period. Yet, this figure holds immense power, acting as a crucial indicator of the economic pulse.

The Confidence Conundrum: Why the Consumer Confidence Index Is a Ticking Clock for Forex Trading

For a nation like the United States, consumer spending fuels roughly 70% of economic activity. Therefore, knowing how consumers feel about the economy is often more important than knowing what they did last month. This psychological barometer is precisely what the monthly Consumer Confidence Index (CCI), released by The Conference Board, attempts to quantify.

The Trader's Crystal Ball: How the PMI Predicts Currency Movement

For traders and analysts seeking an early read on the global economy, the Purchasing Managers’ Index (PMI) is an indispensable tool. Released monthly, the PMI is a snapshot of current business conditions, derived from a survey of senior executives—the purchasing managers—who are often the first to feel changes in demand and supply.

Trade Deficits vs. Surpluses: Unpacking the Balance of Trade's Currency Impact

In the complex ecosystem of international finance, few economic indicators hold as much sway over a nation's currency as the Balance of Trade. This simple yet powerful metric, representing the difference between a country's exports and imports over a period, offers a snapshot of its economic health, global competitiveness, and its net flow of goods and services with the rest of the world.

This Christmas, Give Yourself the Gift of No Stress.

Christmas is for spending, but it can also be for growing. Discover 3 simple ways to enjoy the holidays while protecting your wallet and preparing for a brighter financial future.

From Red to Recovery: Mastering the Psychology of Trading Drawdowns

In the unforgiving world of financial markets, the phrase "drawdown" often sends shivers down a trader's spine. A drawdown is simply the peak-to-trough decline in an investment, trading account, or fund during a specific period.

Diversification in Forex vs. Stocks, Crypto, and Gold: Which Strategy Works Best for You?

Investing isn’t just about picking one winning asset and hoping for the best. Smart investors know the power of diversification—spreading your money across different types of investments to reduce risk and improve potential returns

Navigating the Forex Tempest: How Savvy Traders Hedge Their Bets

The unpredictable currents of the Forex market can be both exhilarating and daunting. For those engaging in Forex trading, especially Forex trading for beginners, understanding how to mitigate risk is not just smart—it's essential for long-term survival and success.

Unlock the Trading Code: The Exponential Power of Compounding and Position Scaling in Forex

In the high-stakes world of Forex trading, success isn't just about picking the right direction—it's about how you manage your capital and your trade size. For anyone dipping their toes into Forex Trading for Beginners, two concepts stand out as essential pillars for long-term growth: compounding profits and position scaling.

Master the Market Math: Calculating Risk-Reward Ratio Like a Pro

In the world of Forex Trading, successful long-term outcomes aren't solely determined by how often you win, but rather by how much you win when you are right versus how much you lose when you are wrong.

The Secret Language of Charts: How Triangles, Flags, and Double Tops Help You Predict the Market

Chart patterns may look like random zigzag lines, but for many Forex traders—especially Forex Trading for Beginners—they serve as a roadmap. These patterns can hint at where the market might go next. Whether you trade EUR/USD, USD/JPY, GBP/JPY, or any other major currency pair, recognizing chart patterns gives you a major edge.

Candlestick Secrets: The Chart Patterns Every Forex Trader Must Master

Candlestick patterns are the language of price. Before indicators, before trading systems, and before advanced tools, traders first learned to read the story unfolding on their charts.

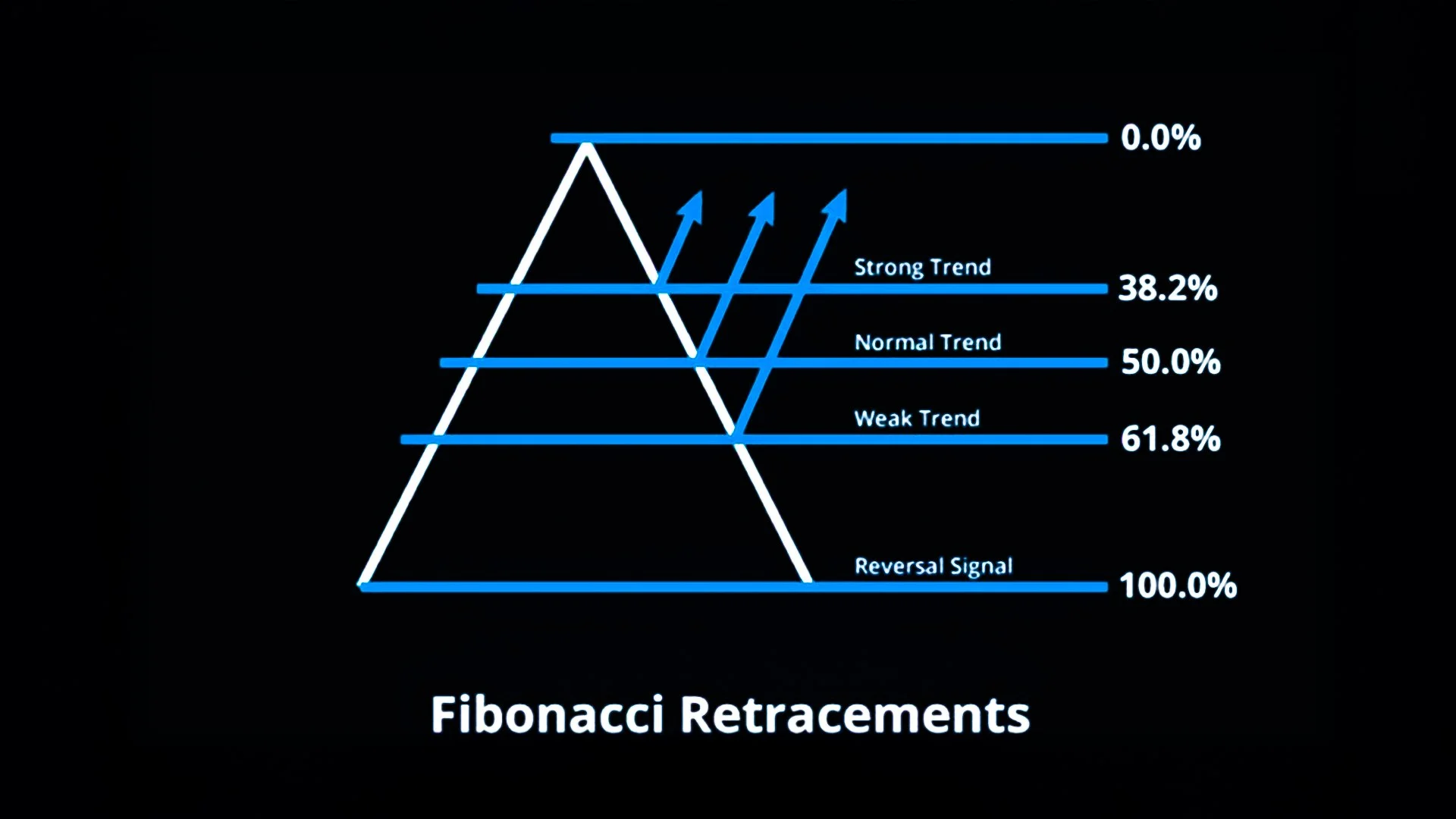

The Hidden Geometry of the Markets: How Fibonacci Retracements & Extensions Guide Smart Forex Traders

In Forex trading, price movements often look chaotic at first glance—but beneath the surface lies a rhythm that many traders rely on for clarity.

Understanding Safe Haven Currencies: How USD, JPY, CHF, and Gold Protect Traders in Volatile Markets

In the ever-changing world of Forex trading, understanding the concept of safe-haven assets is crucial. These are currencies and commodities that investors turn to in times of economic uncertainty, political tension, or global market turbulence.

How Wars, Sanctions, and Trade Tensions Shape Currency Markets: A Forex Perspective

In the complex world of Forex trading, geopolitical events like wars, sanctions, and trade tensions can significantly impact currency values. Investors often view such events as signals of risk or uncertainty, prompting shifts in capital flows and altering the demand for various currencies.

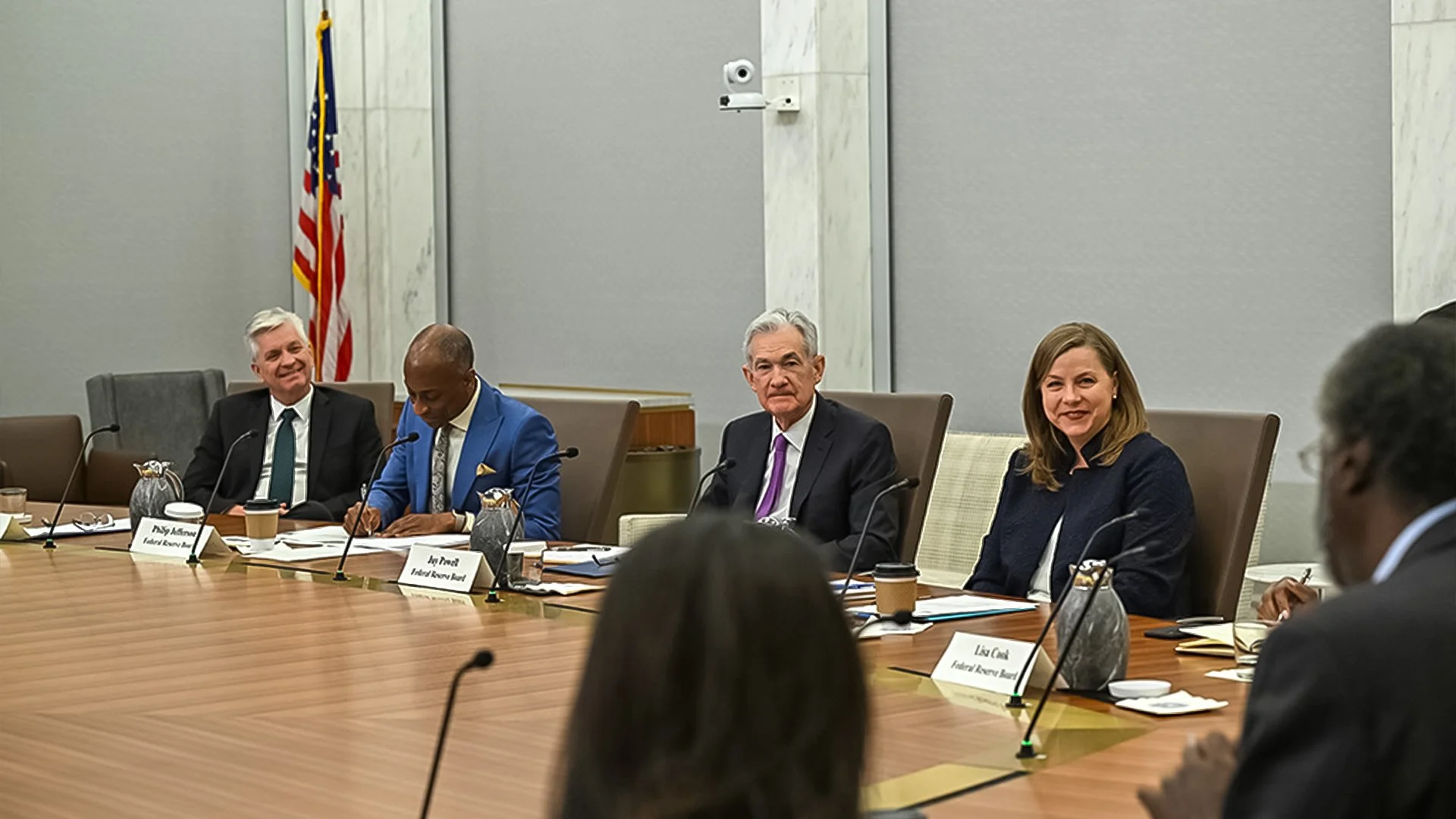

Trading Around Central Bank Announcements: FOMC, BOE, ECB, and BOJ Insights for Forex Traders

In the world of Forex trading, few events move the markets as dramatically as central bank announcements.