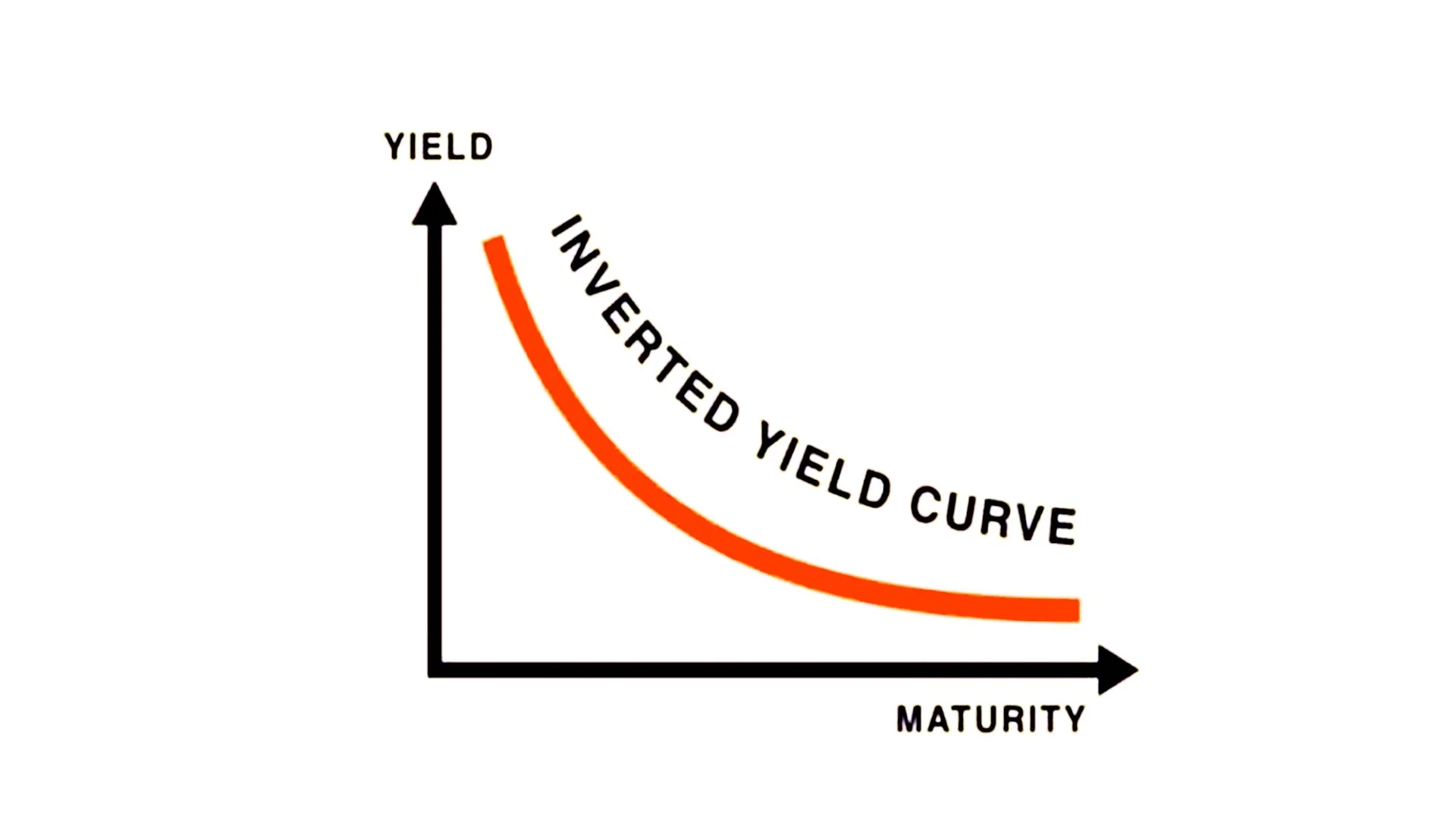

When the Compass Flips: Decoding the Inverted Yield Curve as a Recession Signal

In the high-stakes world of global finance, few phrases send a shiver down the spine of an investor quite like "Inverted Yield Curve."

The Invisible Hand: Why the Bond Market is the Real Boss of Forex

To the uninitiated, the Forex market seems like a chaotic tug-of-war between headlines, central bank speeches, and flashing red and green candles.

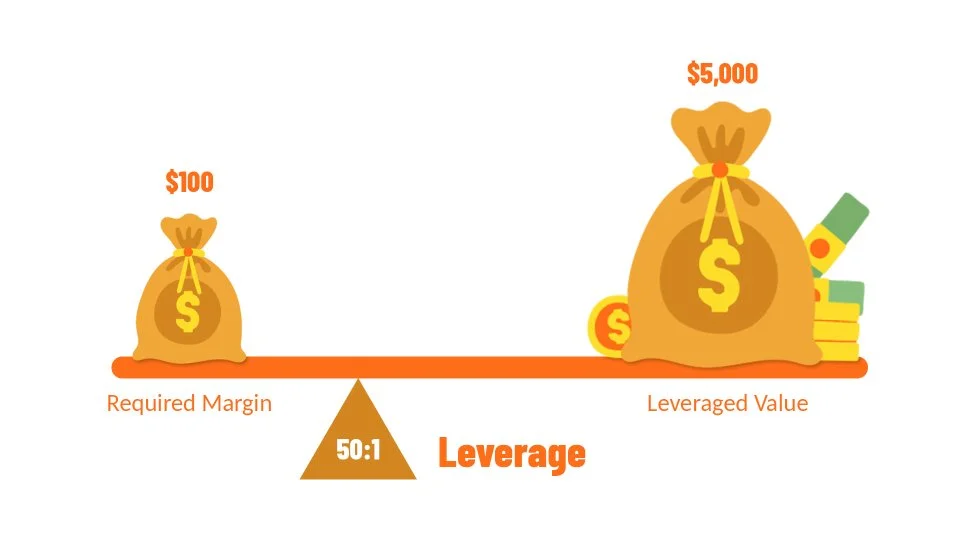

The Engine Under the Hood: How Broker Leverage Really Works

In the world of Forex trading, leverage is often described as a "loan" or a "double-edged sword." While most traders understand that a 1:100 ratio allows them to control $100,000 with just $1,000 of margin, very few understand the mechanical reality of what happens at the broker level.

The Silent Account Killer: Why "Doing Nothing" Is Sometimes the Best Trade

In the fast-paced world of Forex trading, there is a common misconception that more screen time equals more profit. For many, the itch to click "buy" or "sell" is constant. However, one of the most vital lessons taught at Global Markets Eruditio is that knowing when not to trade is just as important as knowing your entry signals.

The Great Snap-Back: Can You Profit When Markets Overextend?

In the world of financial physics, what goes up must eventually come down—or at least return to its historical average. This is the fundamental premise of Mean Reversion Strategies.

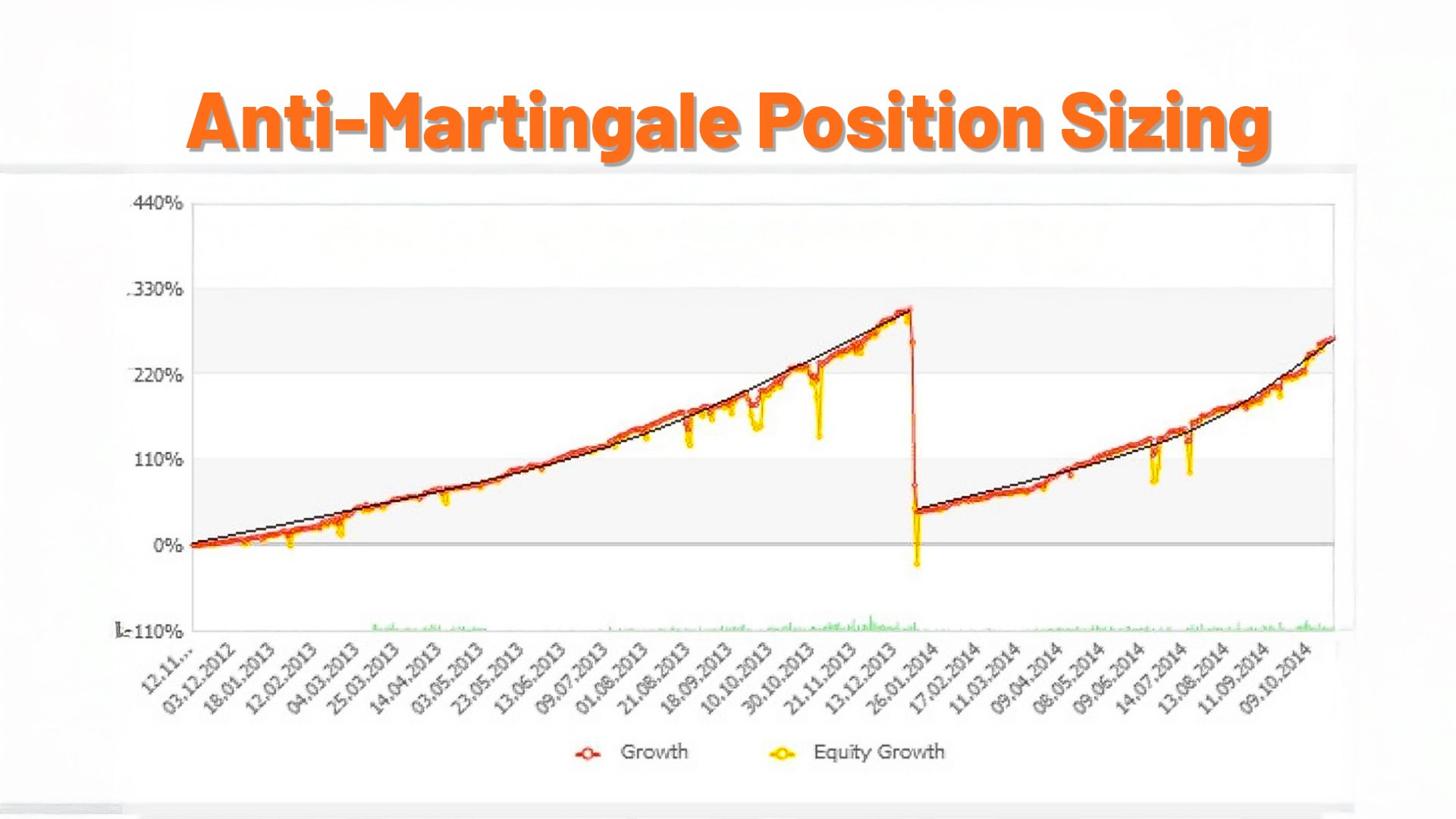

The "Hot Hand" Advantage: Can You Ride the Wave with Anti-Martingale Sizing?

In the fast-paced world of the currency markets, most traders focus intensely on where to enter a trade. Yet, seasoned professionals often whisper a different truth: your entry matters far less than your position sizing.

The Lone Wolf Myth: Why Your Forex Journey Needs a Pack

The image of a solitary trader, backlit by glowing monitors in a dark room, is a common trope in Hollywood. In reality, that image is often a recipe for burnout and account depletion.

The Winning Streak Trap: Is Your Success Sabotaging Your Strategy?

It is the feeling every trader chases. You’ve closed three, four, maybe five consecutive profitable trades on the EUR/USD. The charts seem crystal clear, your entries are surgical, and the profits are stacking up. In the world of Forex, this is the "Goldilocks Zone."

The Silent Edge: Why Your Trading Journal Is More Powerful Than Your Strategy

In the fast-paced world of Forex trading, most beginners spend hundreds of hours hunting for the "Holy Grail" indicator. They swap from the EUR/USD to the GBP/JPY, searching for a magic formula that never misses.

The Silent Architect of Wealth: Building Trading Habits and Discipline

While high-speed fiber optics and advanced algorithms dominate the headlines, the most powerful tool in Forex trading remains the human brain—specifically, its ability to adhere to a routine.

The "Genius" Trap: Why Consistency Beats Intelligence in Forex Trading

Many newcomers enter the world of Forex trading believing that success is a byproduct of high IQ or complex mathematical prowess.

The Silent Account Killers: Why Doing "Less" Is the Secret to Professional Forex Profits

You’ve just closed a losing trade on the EUR/USD. The sting of the loss is fresh, and your immediate instinct isn't to walk away and analyze—it’s to get that money back.

The Invisible Saboteurs: Are These 3 Psychological Biases Killing Your Forex Profits?

You’ve mastered the charts. You understand support and resistance, and your technical indicators are perfectly tuned. Yet, despite having a "winning" strategy, your account balance remains stagnant—or worse, it’s shrinking.

Speed vs. Stability: Mastering Adaptive Moving Averages (KAMA and HMA)

In the volatile world of Forex trading, traditional moving averages like the Simple Moving Average (SMA) often suffer from a classic dilemma: they are either too slow (lagging) or too sensitive (generating false signals).

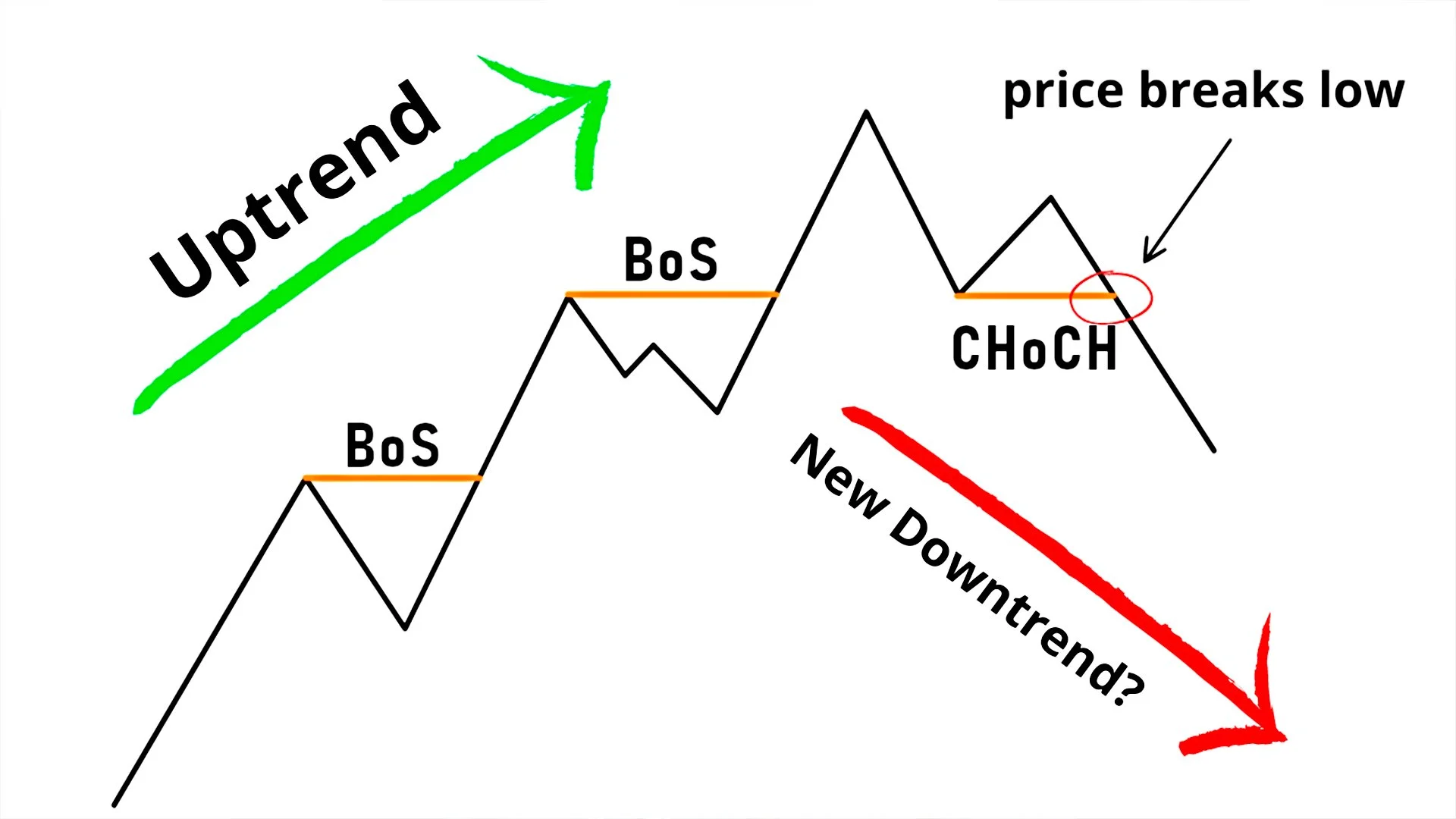

Trend Continuation vs. Reversal: Mastering BOS and CHOCH in Market Structure

In the fast-paced world of technical analysis, few concepts are as vital for your success as understanding market structure.

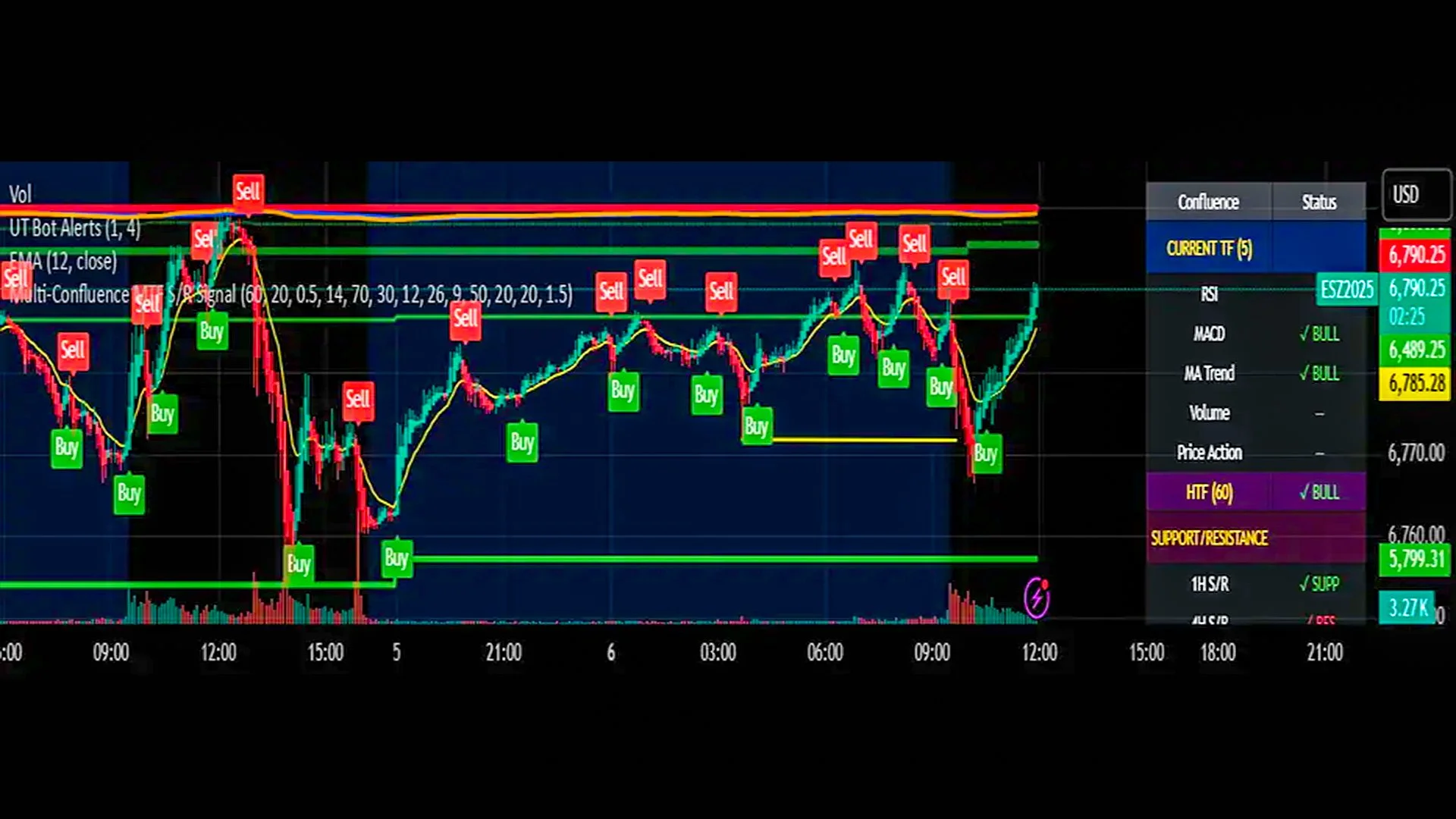

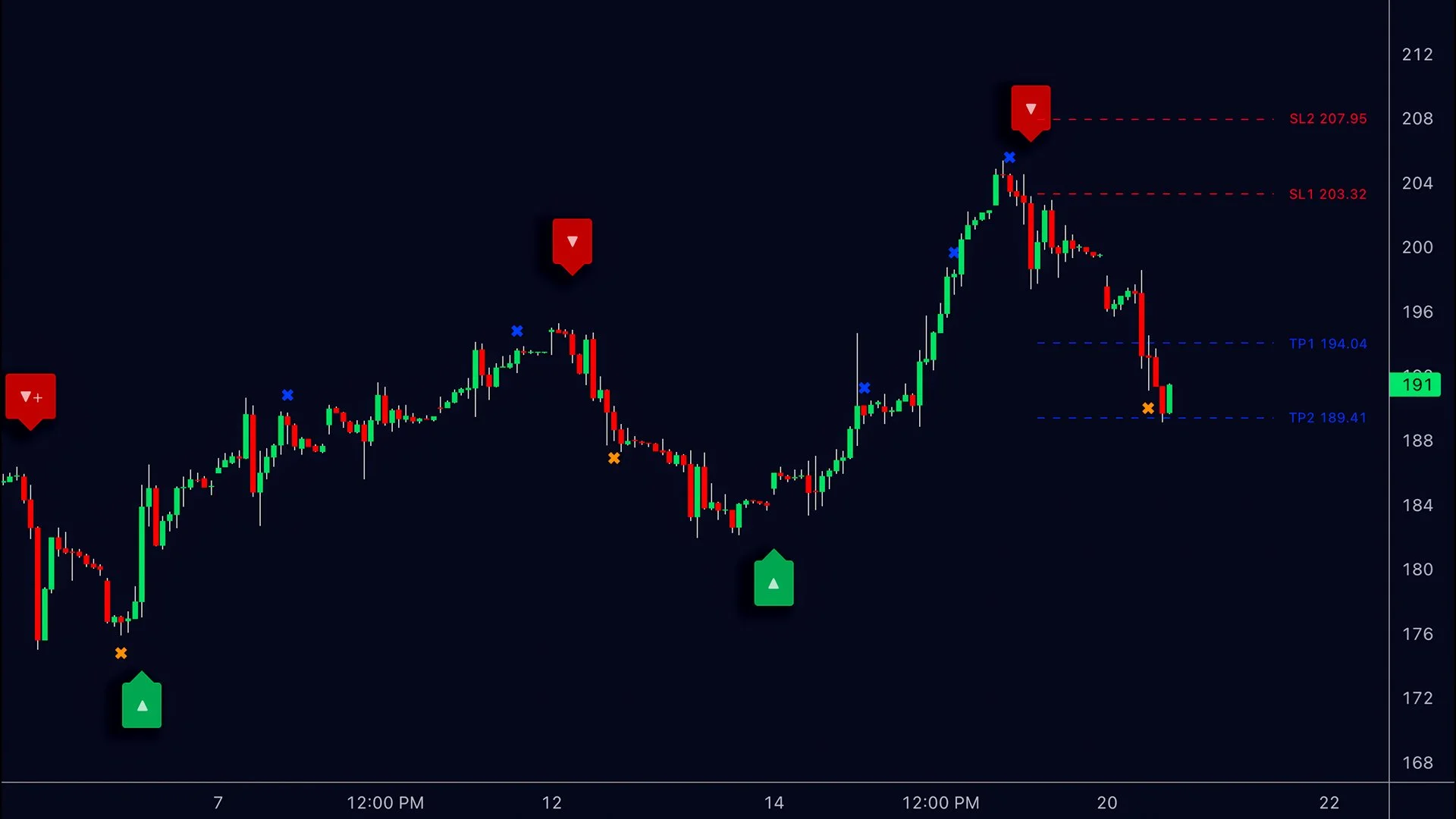

The Power of the "Perfect Storm": Understanding Confluence

In the high-stakes world of currency markets, relying on a single signal is often like trying to navigate a storm with a compass but no map. To truly master the art of market analysis, professional traders turn to a concept known as Confluence.

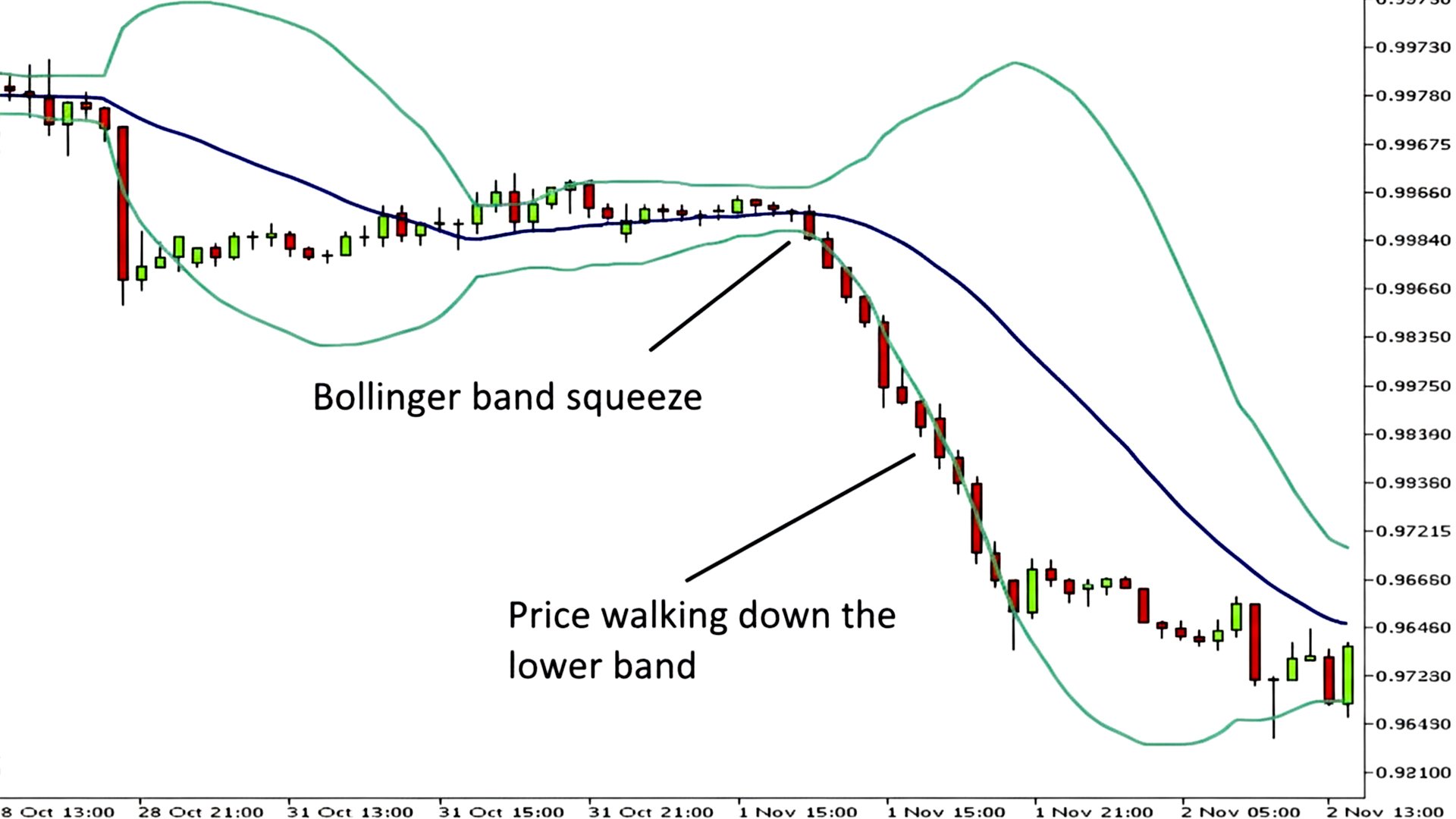

The Bollinger Band Squeeze: How to Predict the Market’s Next Explosive Move

Volatility is the lifeblood of the financial markets, yet it remains the most misunderstood concept for those just starting out in Forex trading. While most traders fear a quiet market, professionals at Global Markets Eruditio know that a period of low volatility is simply the "calm before the storm."

Beyond the Basics: Is Ichimoku Kinko Hyo the Ultimate “One-Look” Trading Edge?

In the fast-paced world of Forex trading, beginners often feel like they are drowning in a sea of jagged lines and flashing numbers.

The Volatility Shield: Why ATR is the Ultimate Stop-Loss Tool for Forex Traders

In the world of Forex Trading, one of the most heartbreaking experiences for a beginner is the "Stop-Out-then-Rally."

The "Institutional Magnet": Why VWAP and Anchored VWAP Are the Ultimate Truth-Tellers in Forex

In the high-stakes world of Forex Trading, most retail traders are taught to look at simple price averages—lines that tell you where the market was.