Speed vs. Stability: Mastering Adaptive Moving Averages (KAMA and HMA)

In the volatile world of Forex trading, traditional moving averages like the Simple Moving Average (SMA) often suffer from a classic dilemma: they are either too slow (lagging) or too sensitive (generating false signals).

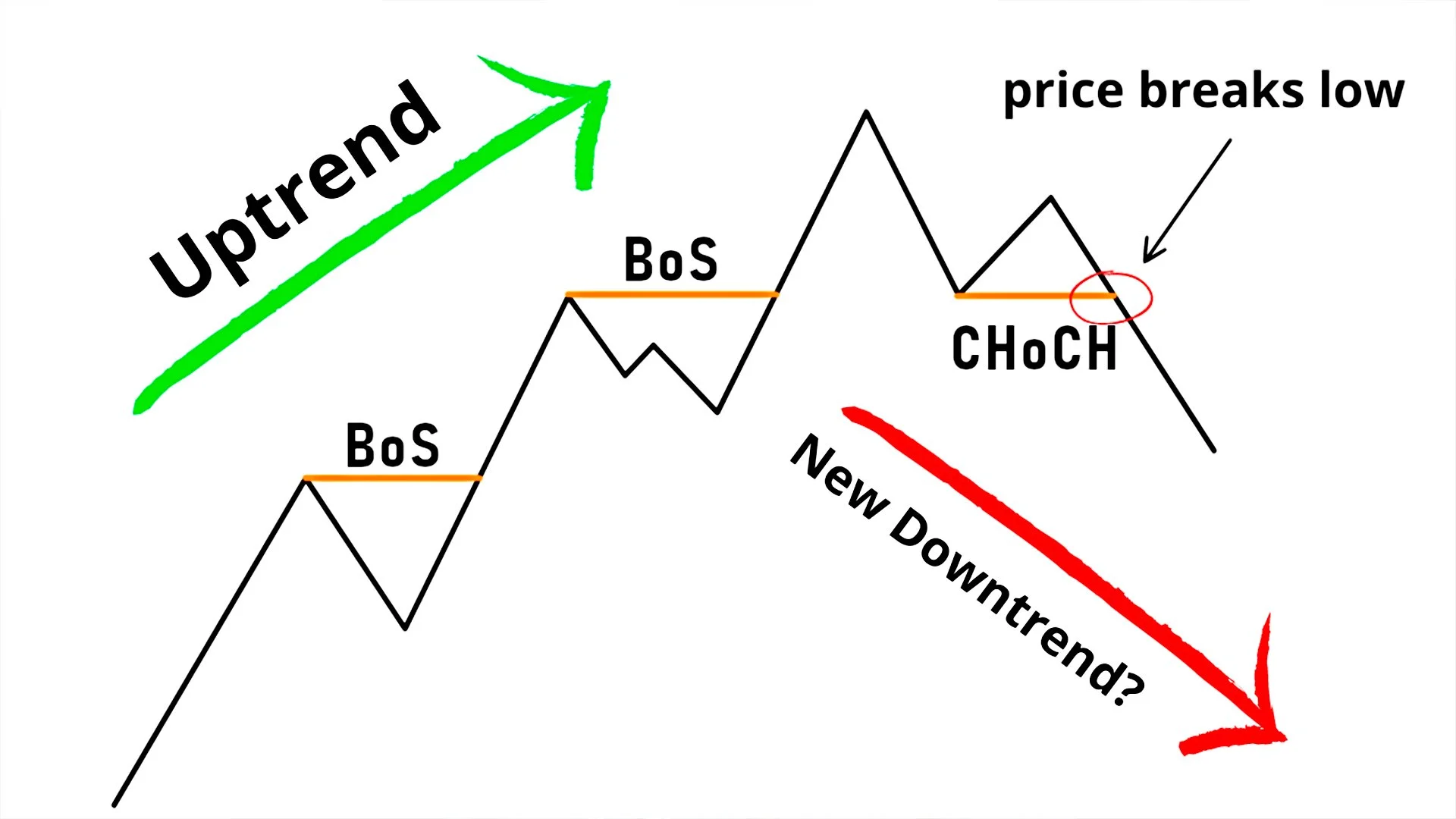

Trend Continuation vs. Reversal: Mastering BOS and CHOCH in Market Structure

In the fast-paced world of technical analysis, few concepts are as vital for your success as understanding market structure.

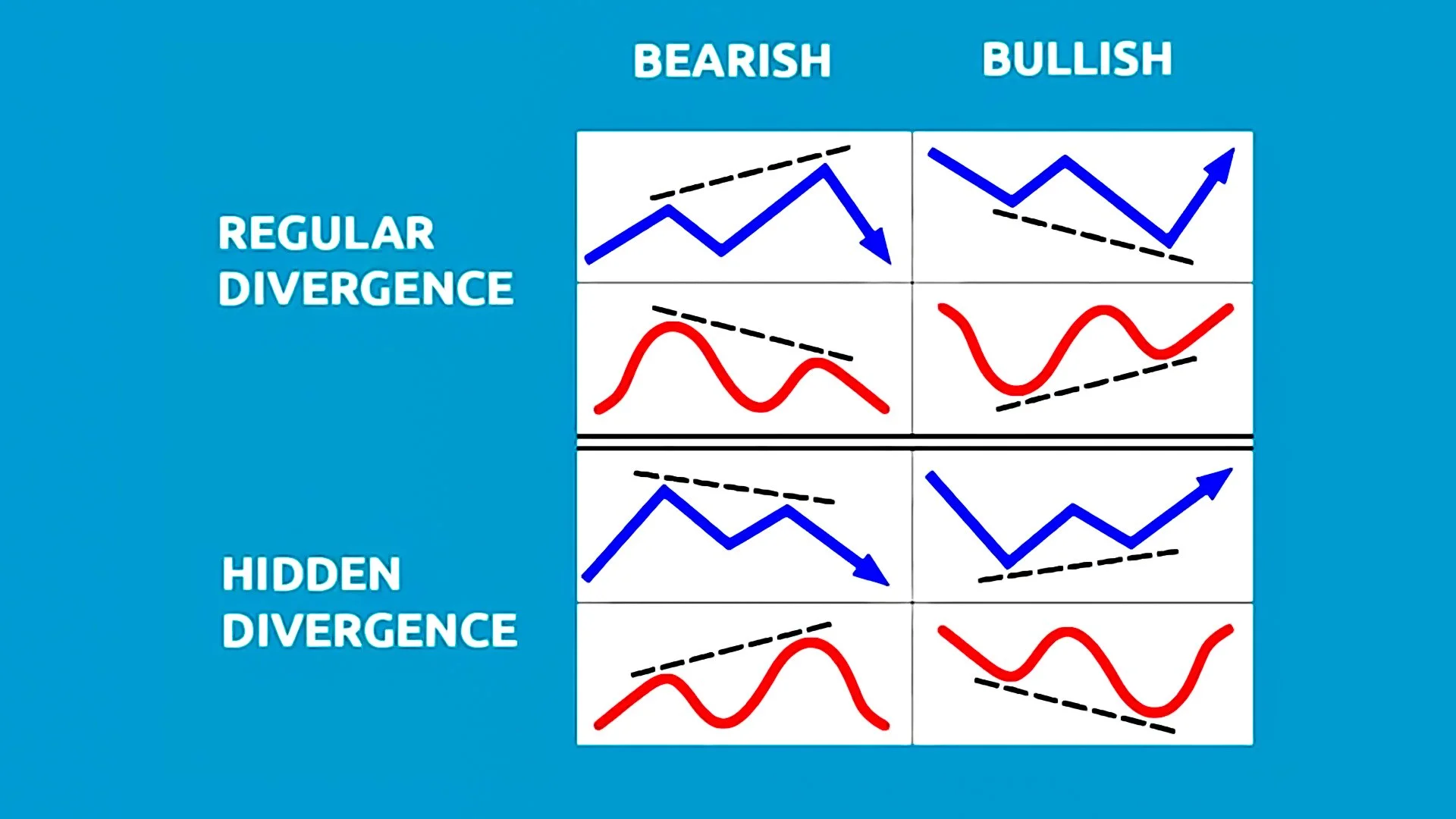

The Market's "Check Engine" Light: What is Divergence?

In the fast-paced environment of Forex trading, most market participants simply follow the price. However, elite traders—like those mentored at Global Markets Eruditio know that what the price says and what the market momentum does can sometimes tell two different stories.

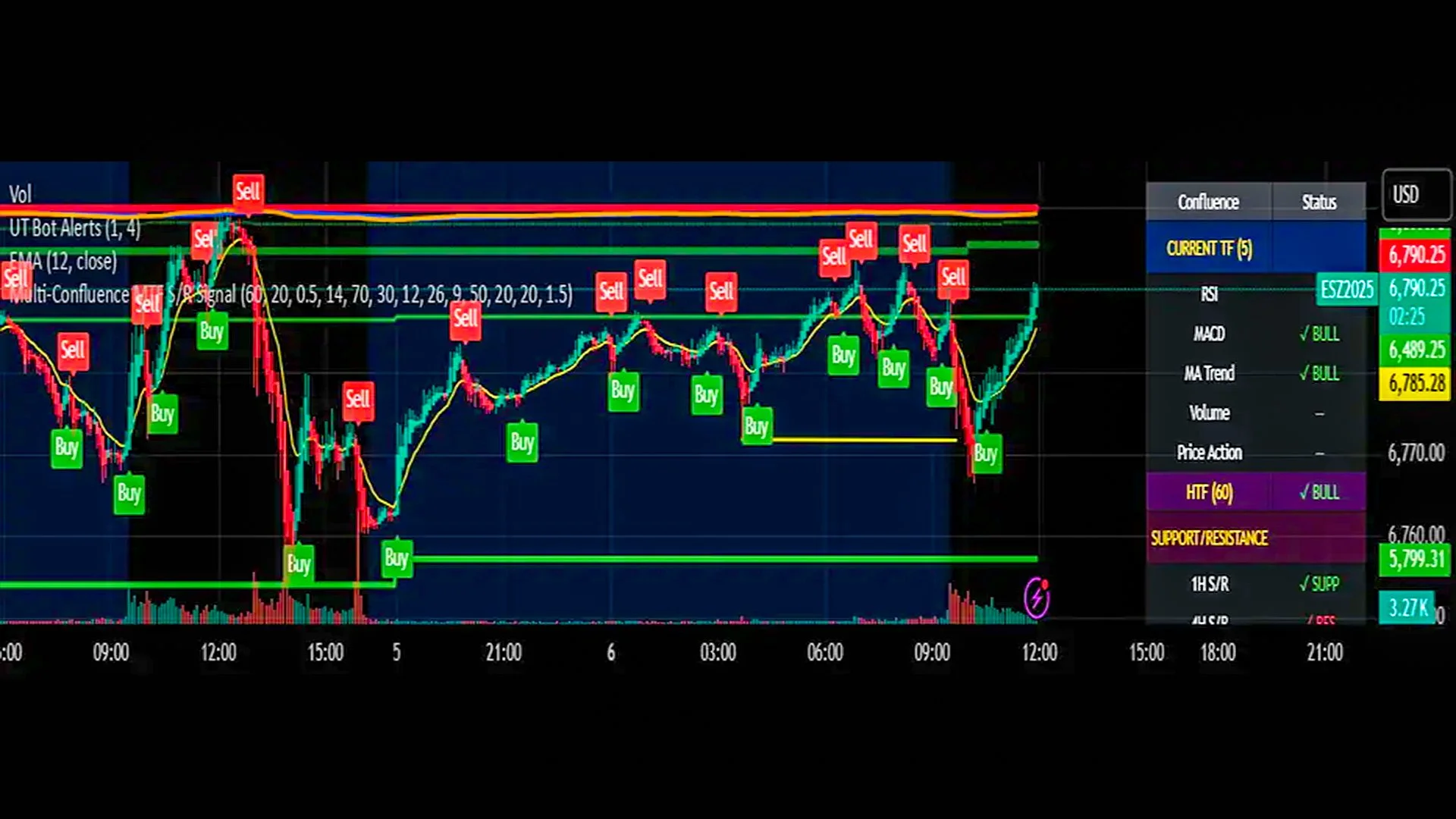

The Power of the "Perfect Storm": Understanding Confluence

In the high-stakes world of currency markets, relying on a single signal is often like trying to navigate a storm with a compass but no map. To truly master the art of market analysis, professional traders turn to a concept known as Confluence.

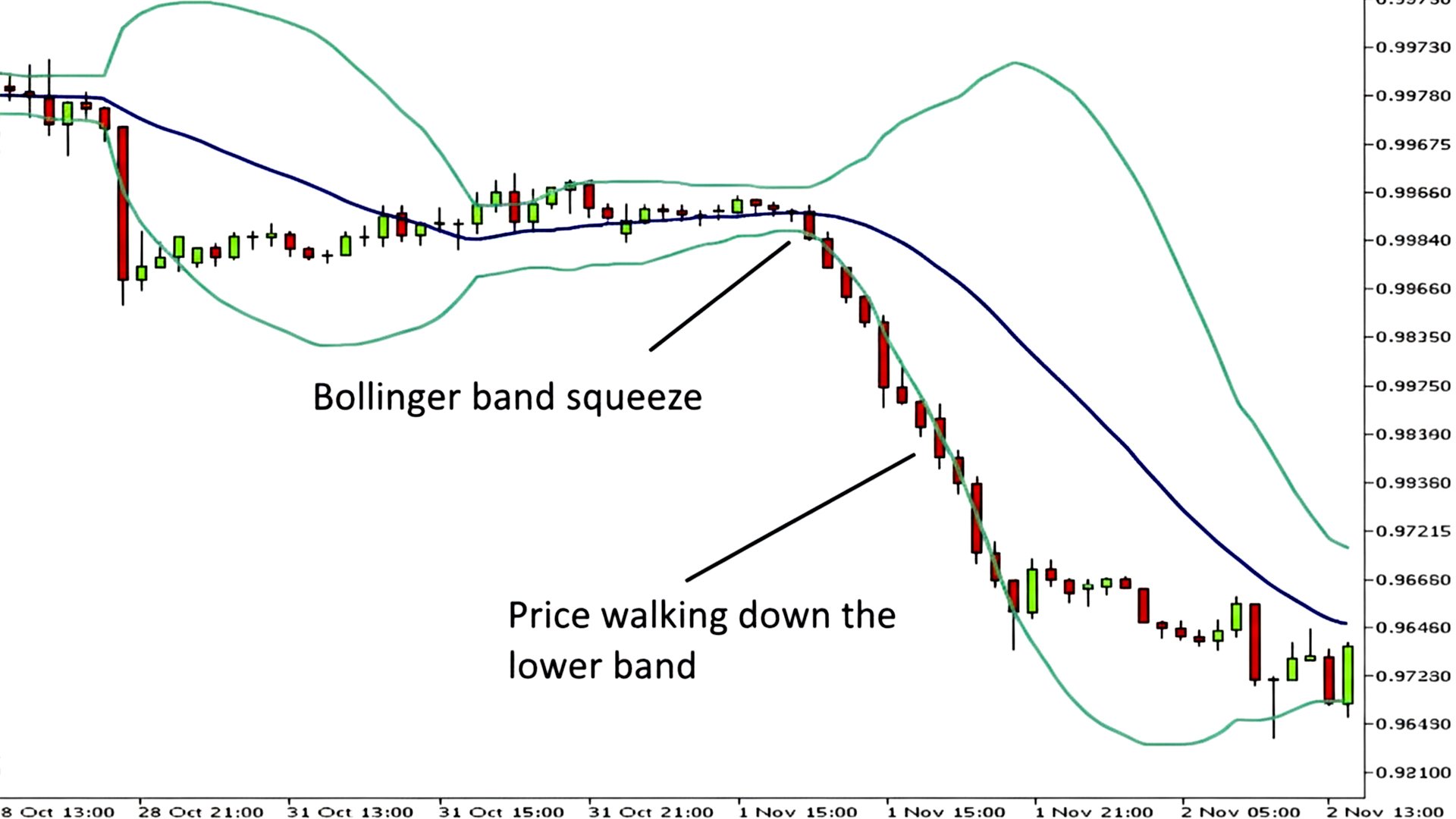

The Bollinger Band Squeeze: How to Predict the Market’s Next Explosive Move

Volatility is the lifeblood of the financial markets, yet it remains the most misunderstood concept for those just starting out in Forex trading. While most traders fear a quiet market, professionals at Global Markets Eruditio know that a period of low volatility is simply the "calm before the storm."

Beyond the Basics: Is Ichimoku Kinko Hyo the Ultimate “One-Look” Trading Edge?

In the fast-paced world of Forex trading, beginners often feel like they are drowning in a sea of jagged lines and flashing numbers.

The Volatility Shield: Why ATR is the Ultimate Stop-Loss Tool for Forex Traders

In the world of Forex Trading, one of the most heartbreaking experiences for a beginner is the "Stop-Out-then-Rally."

The "Institutional Magnet": Why VWAP and Anchored VWAP Are the Ultimate Truth-Tellers in Forex

In the high-stakes world of Forex Trading, most retail traders are taught to look at simple price averages—lines that tell you where the market was.

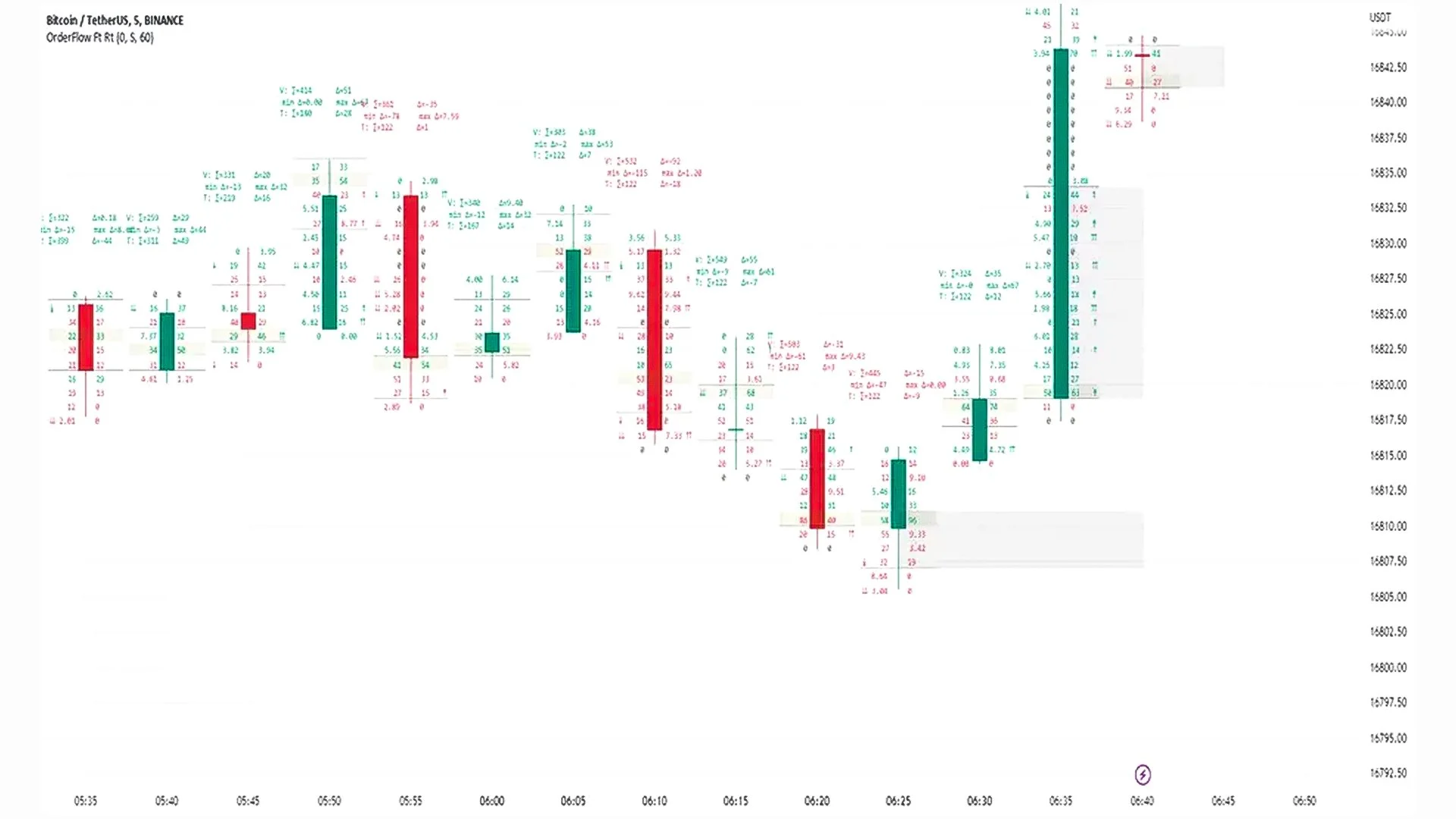

Cracking the Code: How Footprint Charts and Order Flow Reveal the "Smart Money"

In the standard world of Forex Trading, most participants are essentially looking at a map of where the market was. Candlesticks tell you the high, low, open, and close, but they leave out the most critical piece of the puzzle: the actual struggle between buyers and sellers happening inside each bar

Beyond the Candlestick: Mastering Volume and Market Profile in Forex

In the fast-paced world of Forex Trading, most beginners start with traditional vertical volume bars and standard candlesticks. However, professional traders often look "inside" the price action to understand where the real battle between bulls and bears is happening.

The Pulse of the Market: Understanding Price Auction Theory

In the world of trading, many beginners make the mistake of viewing price as a series of random zig-zags on a screen. However, professional traders—including the mentors at Global Markets Eruditio (GME Academy)—view the market through the lens of Price Auction Theory.

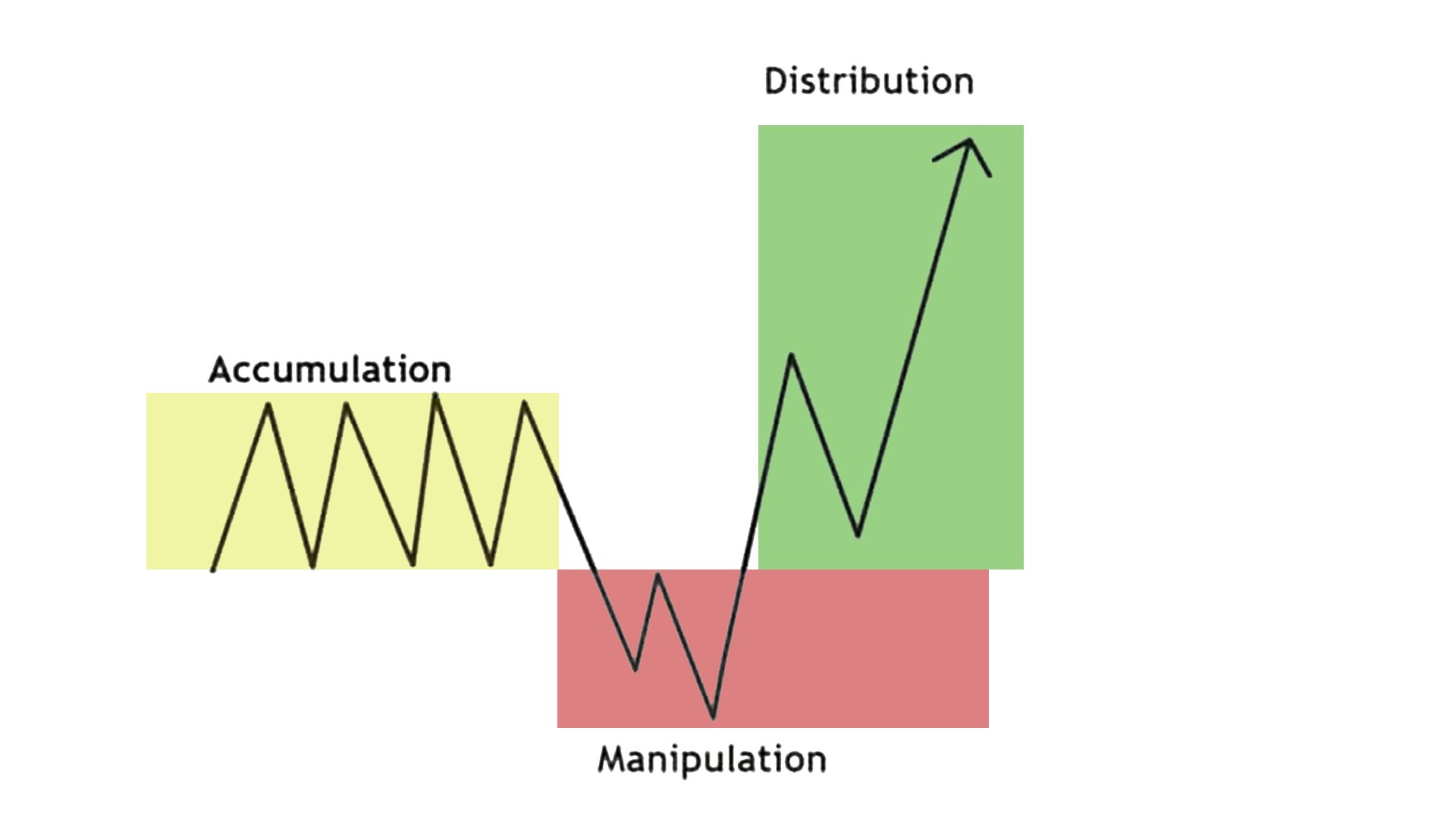

The Silent Engine of the Market: Understanding the AMD Cycle

If you have ever felt like the market "waited" for you to enter a trade just to hit your stop-loss and then move in your original direction, you haven't been cursed—you’ve likely been a victim of the AMD Cycle.

The Great Economic Elasticity: Why the Market “Returns to the Mean”

In the high-speed world of global finance, prices often behave like a stretched rubber band. They may fly to extreme highs during a "bull market" or snap down to terrifying lows during a crash, but eventually, they tend to snap back toward a central average.

Riding the Morning Wave: A Guide to Trading Gaps and Market Open Volatility

The first hour of the trading day is often compared to the start of a wild horse race. For a few frantic minutes, orders that accumulated overnight or over the weekend flood the market, causing price "gaps" and intense volatility.

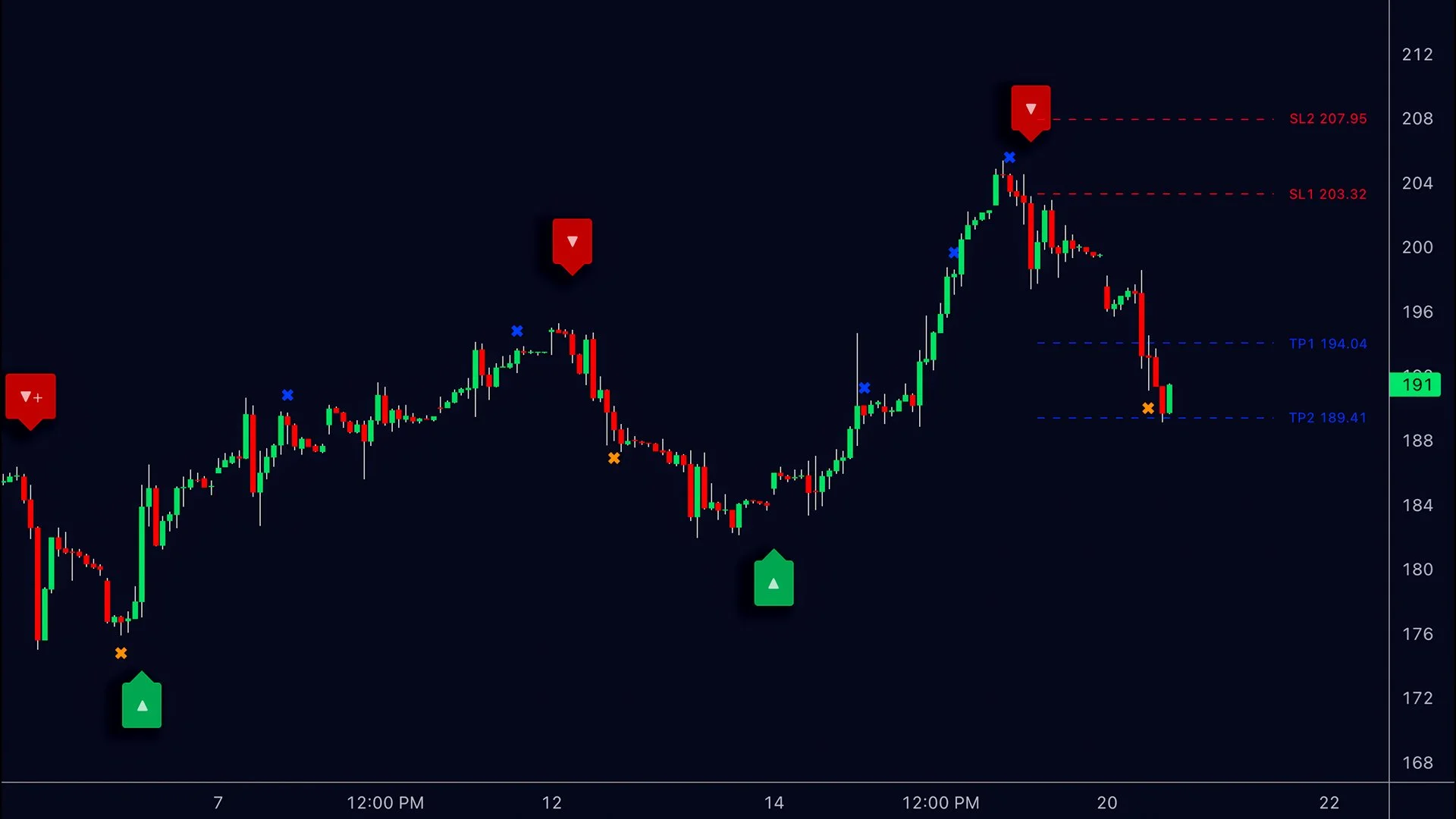

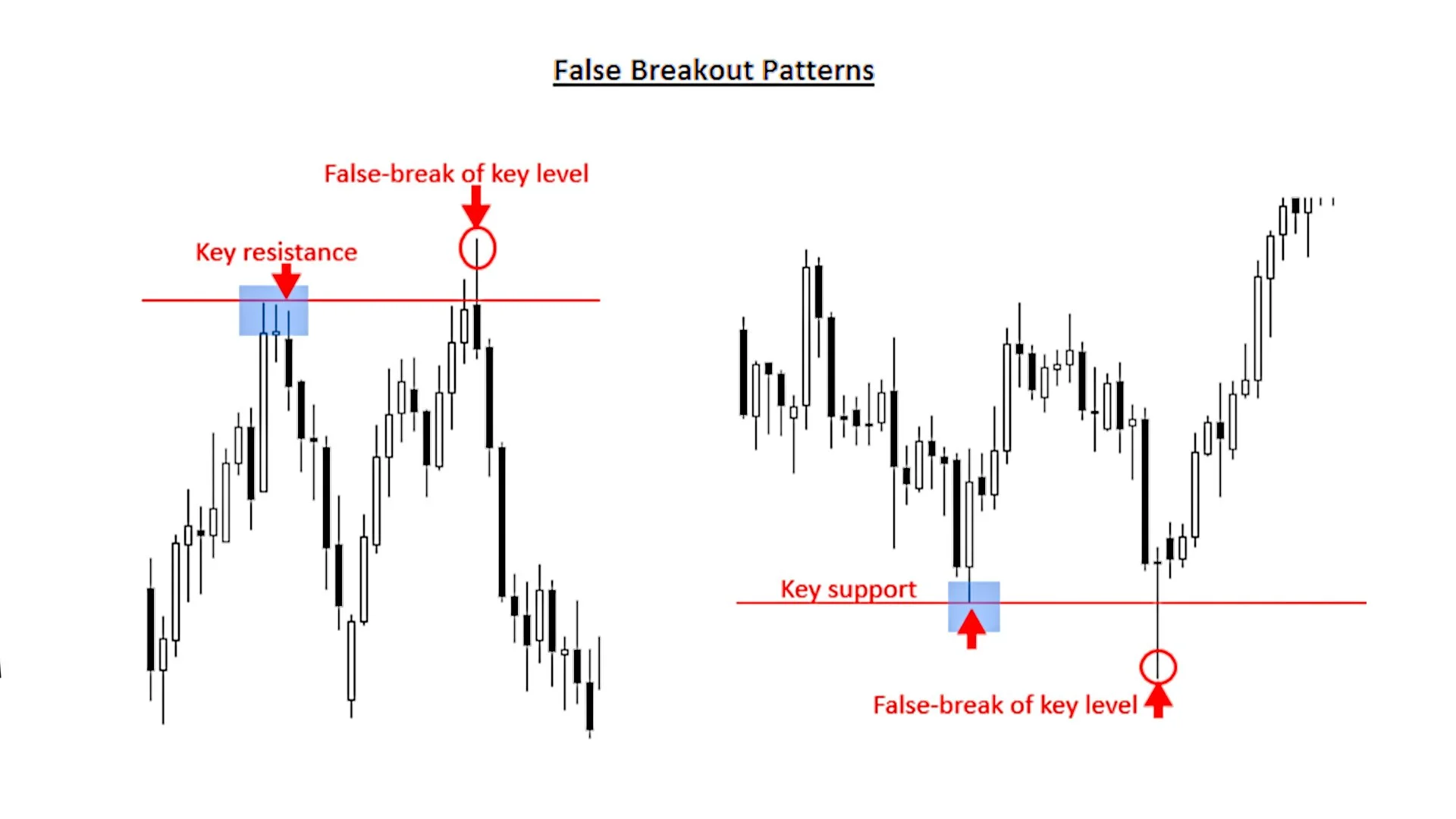

The Great Escape: Master the Art of Spotting True Breakouts Before the "Fakeout" Trap Snaps Shut

Every trader has been there. You’ve spent hours analyzing a consolidation zone on the EUR/USD. The price finally pierces the resistance level with a strong green candle. You enter a "Buy" order, convinced that the "Moon" is the next destination.

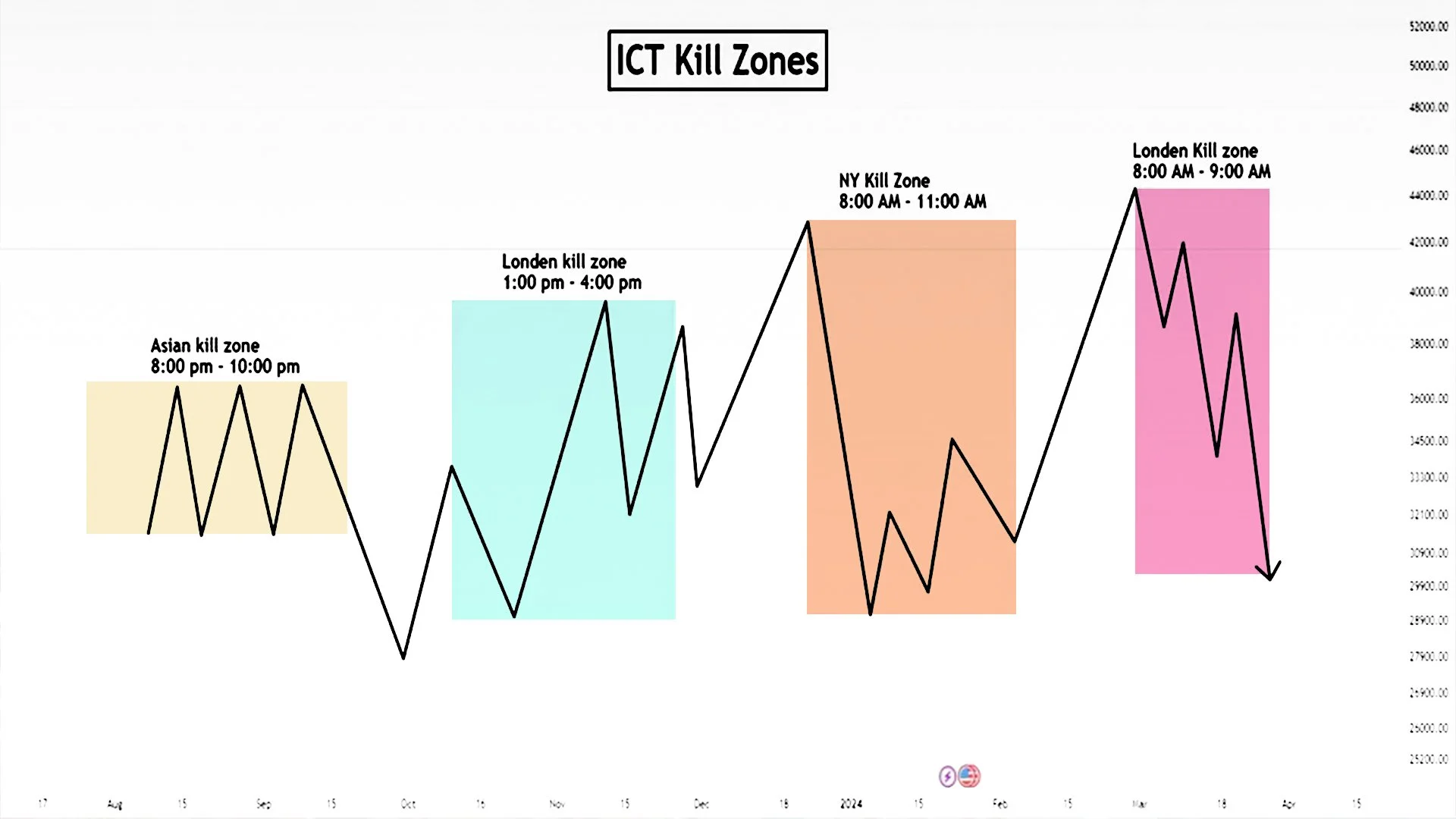

The Golden Hours: Harnessing the Explosive Power of the Asia-London-New York Overlaps

The 24-hour nature of the currency market is often described as a single, endless stream, but professional traders know the truth: it is a series of distinct "liquidity surges."

The Price Magnet: Unlocking the Secret Behind Market Reversals at 1.0000, 50.00, and Other Round Numbers

Why does the EUR/USD often stall at 1.1000? Why does a major stock struggle to break $100.00? This phenomenon, far from random, is a profound psychological principle that governs price action across all liquid markets, including Forex Trading.

Zooming for Precision: Mastering Multiple Time Frame Analysis for Sniper-Like Entries

Successful trading is about probability and precision. Multiple Time Frame Analysis (MTFA), or the "Top-Down Approach," is a fundamental skill that transforms trading from a single-chart gamble into a high-conviction decision-making process.

Market Manipulation or Market Mechanics? Decoding the Fine Line That Separates Illegal Swindles from Sophisticated Trading

Every sudden price spike, deep plunge, or sharp reversal in the Forex market or stock indices raises a perennial question: Is this organic market behavior, or is it a calculated move to mislead traders?

Liquidity Pools: The Smart Money’s Hunting Grounds—Where Price is Programmed to Strike

In the world of Forex Trading, the concept of Liquidity Pools is key to understanding institutional movements. These are not just random clusters of orders; they are predictable price levels—the "Big Money Zones"—where retail traders place their stop-loss orders.